Research Report|Huma Finance Project Overview & $HUMA Valuation Analysis

I. Project Introduction

II. Key Highlights

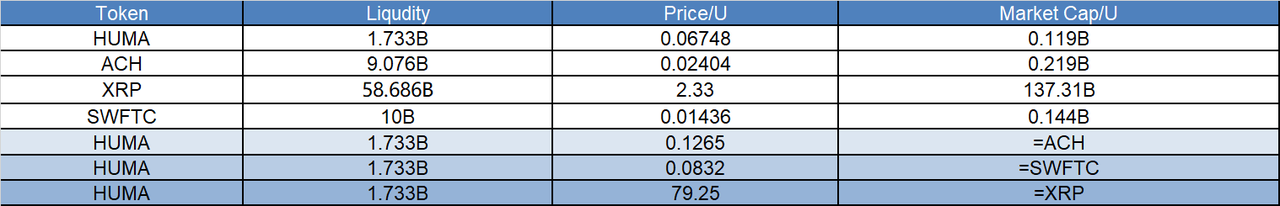

III. Valuation Outlook

IV. Tokenomics

Total Supply: 10,000,000,000 $HUMA

Circulating Supply: 1,733,333,333 $HUMA

-

Liquidity Ecosystem Incentives (31%): Rewards LPs and ecosystem partners, with quarterly unlocks to balance liquidity and inflation.

-

Investors (20.6%): Seed and Series A investors with 12-month lockups and 3-year linear vesting for long-term alignment.

-

Team Advisors (19.3%): Incentives for the core team and strategic advisors, with the same vesting as investors.

-

Protocol Treasury (11.1%): Strategic reserves for future development, grants, partnerships, and liquidity management.

-

Marketing Community Incentives (12.97%): Community growth, airdrops, developer grants, and event campaigns.

-

CEX Listing Marketing (7%): Funds allocated to exchange listings and global outreach.

-

Presale (2%): Early infrastructure supporters and strategic partners.

-

Future Airdrops (5%): Reserved for future ecosystem expansion and new user onboarding.

-

Market Making On-Chain Liquidity (4%): Initial DEX/CEX liquidity provisioning and market support.

-

Strategic Partnerships (0.5%): Allocated to large institutions and key protocol alliances.

-

Protocol Governance: Stake to participate in protocol decisions, parameter updates, and ecosystem proposals.

-

Liquidity Mining Rewards: Incentivize LPs, partners, and developers to stimulate network activity.

-

Ecosystem Growth: Support user acquisition, developer engagement, and platform integrations.

-

Fee Capture Value Accrual: Future implementation of protocol revenue sharing via staking and buybacks.

-

Utility Access: Priority access to new pools, advanced features, analytics, and faster withdrawals.

V. Team Fundraising

-

Seed Round

-

Date: February 23, 2023

-

Raised: $8.3 million

-

Investors: Race Capital, Distributed Global, ParaFi Capital, Robot Ventures, Circle Ventures, Folius Ventures

-

-

Strategic Round

-

Date: September 11, 2024

-

Raised: $38 million

-

Investors: Distributed Global, ParaFi Capital, HashKey Capital, Robot Ventures, Fenbushi Capital, Folius Ventures, Circle Ventures, Race Capital, Blockchain Founders Fund, Hard Yaka, Anagram, Stellar Development Foundation, 500 Emerging Europe, Santiago Roel Santos, TIBAS Ventures

-

VI. Risk Factors

-

Off-Chain Dependency of Collateral Huma relies on real-world receivables, wages, and invoices as underlying assets. These require off-chain data syncing and manual/automated verification, which poses risks in terms of authenticity, completeness, and enforceability that cannot be fully verified on-chain.

-

Increasing Competition in PayFi As the PayFi sector rapidly evolves, Huma may face competition in terms of product similarity and yield compression. Failure to maintain its innovation, compliance edge, risk controls, and institutional support could lead to user and liquidity attrition, affecting platform growth.

VII. Official Links

-

Website: https://huma.finance

-

Twitter: https://x.com/humafinance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.