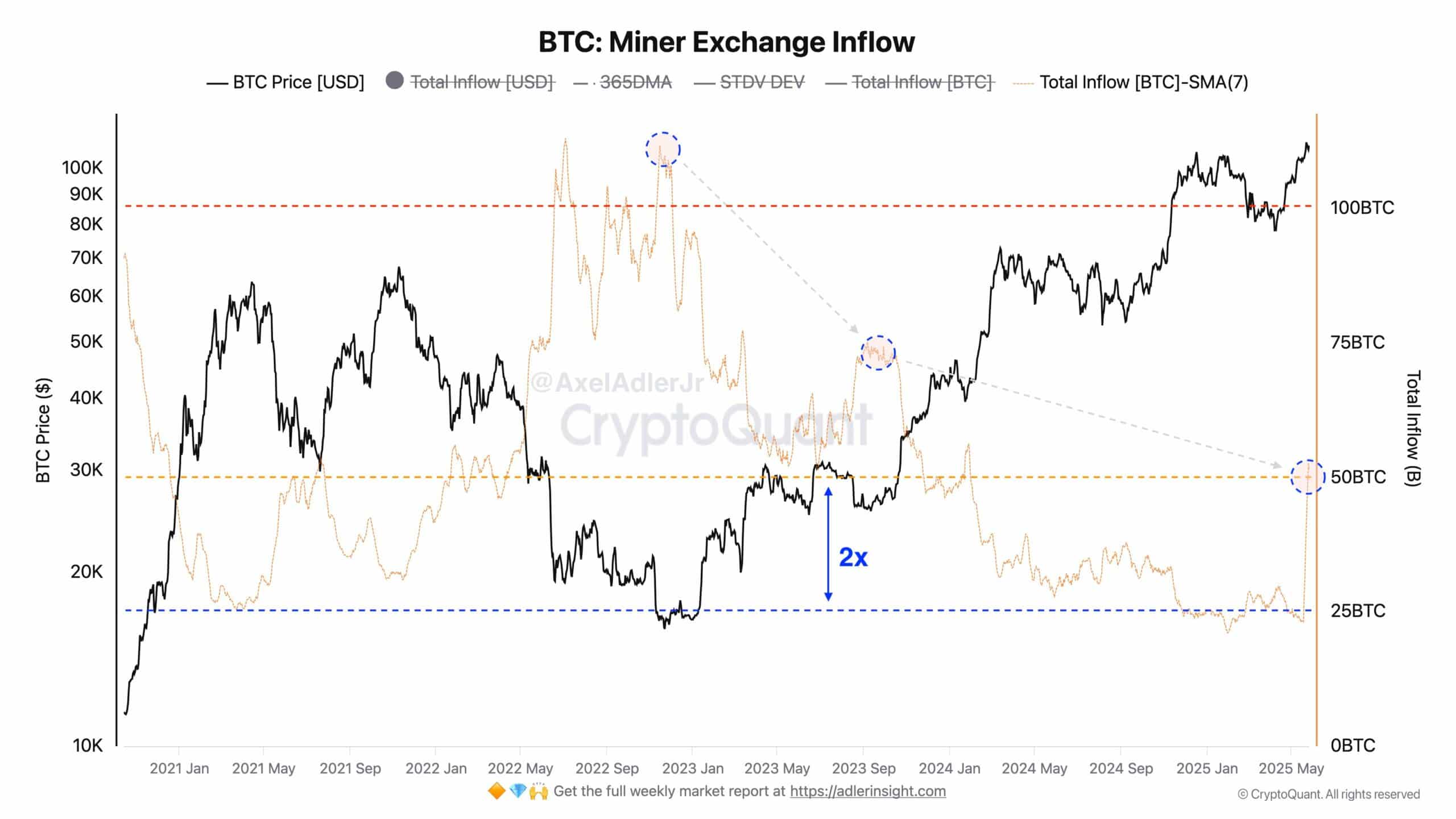

Bitcoin miners’ exchange inflows have surged to an average of 50 BTC per day, reflecting both the cryptocurrency’s recent rally and strategic selling behavior.

-

After hitting an all-time high (ATH), Bitcoin miners have doubled their outflows, signaling increased selling activity.

-

Despite the uptick in sales, the overall market appears to be effectively absorbing this selling pressure.

This article delves into Bitcoin miners’ recent selling trends and market impacts, highlighting crucial insights amid the cryptocurrency’s soaring prices.

Miners’ Selling Behavior and Market Response

Bitcoin’s recent surge to an ATH has brought notable changes to the miners’ selling patterns. As prices reached unprecedented heights, miners capitalized on these opportunities, resulting in a significant spike in exchange inflows. With inflows increasing to 50 BTC per day, this represents a 100% increase from the previous average. Interestingly, despite the rise in outflows, market indicators suggest a surprising resilience, absorbing the additional selling pressure.

Analyzing Profitability and Miner Sentiment

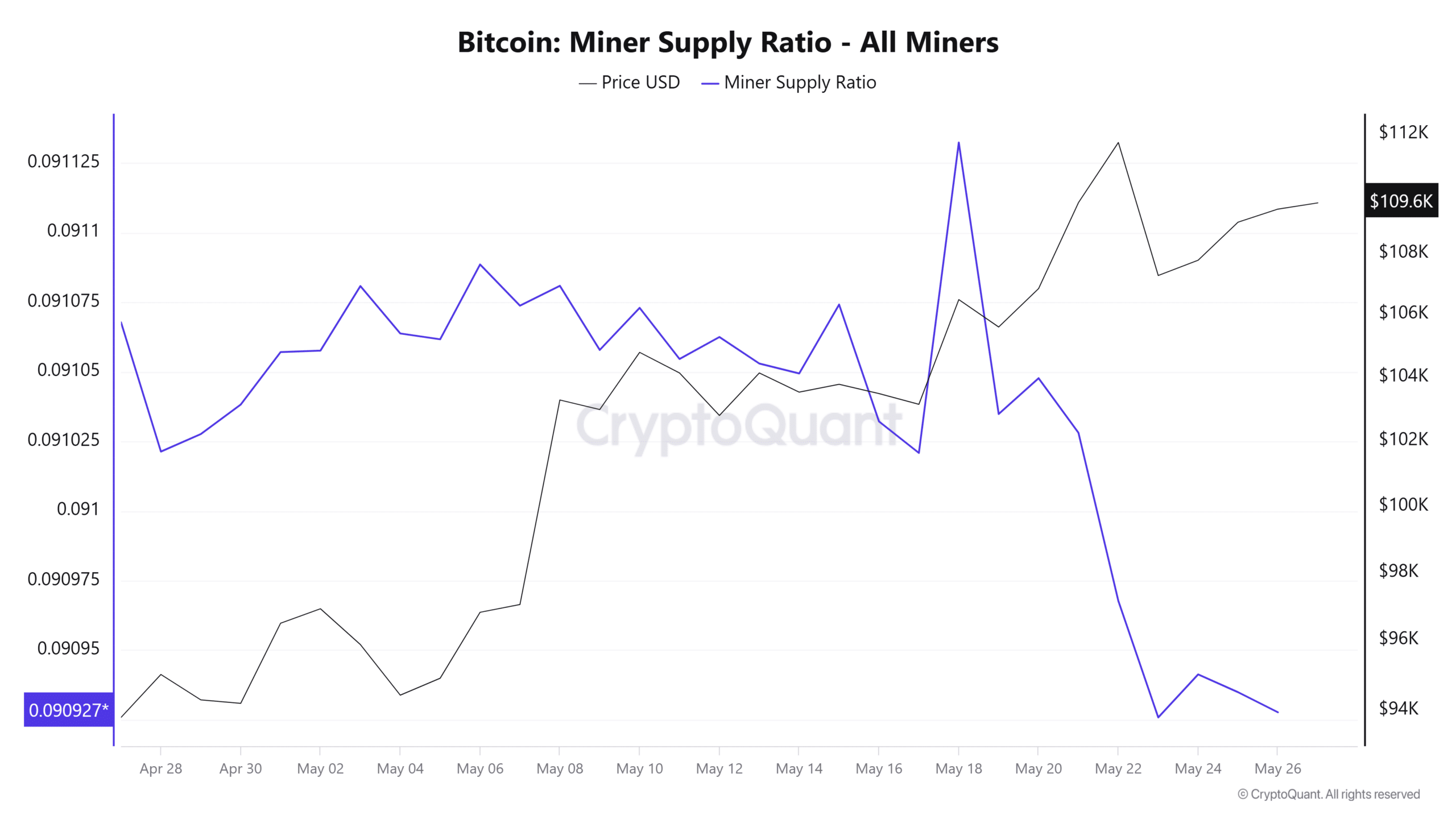

Miners tend to increase sales when profit margins are favorable. Recent analysis by CryptoQuant’s Axel Adler indicates that miners began accelerating sales following Bitcoin’s ascent to $110,000, driven by improved profitability ratios. This behavior reflects a broader trend among miners to capture profits while maintaining control over the majority of their mined BTC. As Bitcoin’s miner supply ratio has steadily decreased to 0.090, it signals confidence in the market’s bullish outlook.

Source: CryptoQuant

The Historical Perspective on Miner Inflows

Current miner inflows, while considerably increased, still lag behind previous peaks. Historical data shows that during past cycles, miner exchange inflows have reached highs of around 100 BTC per day. Thus, the current rate is still approximately 50% lower than these historical benchmarks. This both highlights the cautious selling strategy of miners and suggests they are not in a panic selling state.

Source: CryptoQuant

Market Dynamics Amid Selling Pressure

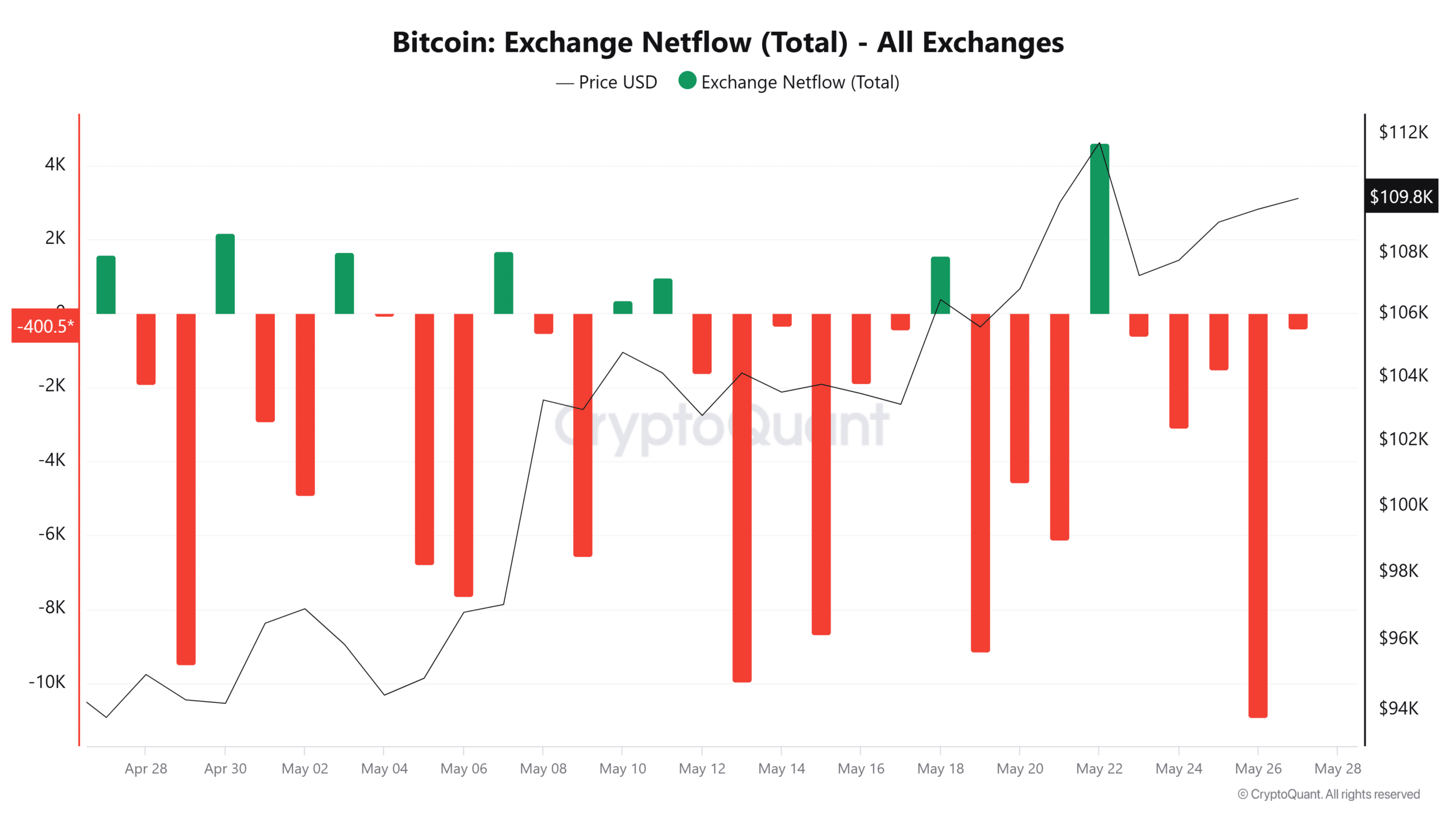

Amid the uptick in miner selling, the overall market sentiment remains positive. While miners have substantially increased sales, observers note that this activity does not equate to aggressive market destabilization. The market has been able to absorb these inflows without significant disruption. For context, Bitcoin’s exchange netflows have primarily remained negative, indicating a strong buyer presence despite miners’ selling.

Source: CryptoQuant

Conclusion

In conclusion, while Bitcoin miners have ramped up their selling, the market’s capacity to absorb this activity suggests stability rather than panic. Current netflows indicate a healthy trading environment, and barring a significant increase in miner sales, Bitcoin could continue to stabilize and potentially regain its upward trajectory. The indicators suggest that if mining flows do not escalate dramatically, Bitcoin may be on a path to reclaim its previous highs.