Bitcoin faces key support test at $108k amid $211m in liquidations: analysts

Bitunix analysts have highlighted the latest data on crypto liquidations near the $108,000 support zone, warning that more liquidations could follow if Bitcoin breaks below this level.

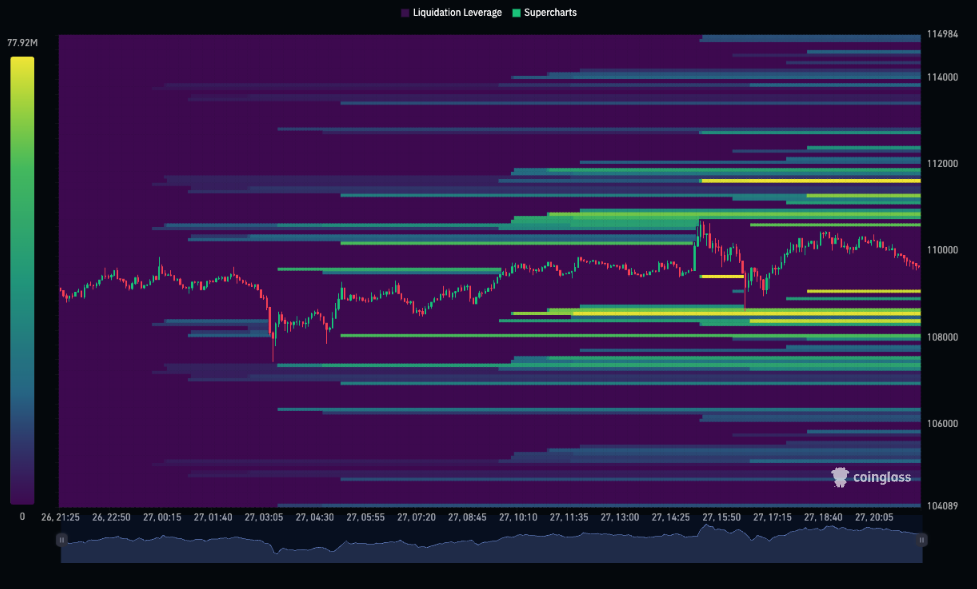

Bitcoin’s (BTC) recent volatility has created a notable liquidation pocket, analysts at crypto exchange Bitunix told crypto.news. On Tuesday, May 27, total crypto liquidations reached $211 million, with a clear bias toward long positions. Specifically, $131 million in longs were liquidated, compared to $79.84 million in short positions.

Bitunix analysts interpret this imbalance as evidence of a long-side wipeout during Bitcoin’s recent dip to $108,000. As a result, they caution against entering overly aggressive long positions while BTC trades near this key support.

“Short-term attention should be paid to the effect of support at $108,500–$109,000, and it is not recommended to chase higher. Analysts advise observing whether the $110,800–$112,000 pressure band is effectively broken before considering further positions,” Bitunix wrote.

Bitcoin’s price suggests caution in the short term: Bitunix

According to Bitunix, the liquidation heat map reveals a concentrated cluster of liquidations around the $108,000 level, signaling that this zone may serve as a key liquidity support area, where buyers tend to step in.

Binance BTC/USDT liquidation heat map | Source: Coinglass

Binance BTC/USDT liquidation heat map | Source: Coinglass

However, Bitunix analysts still believe that traders should exercise caution. Specifically, a drop below the $108,000 zone could lead to more liquidations, which could trigger further breakdown of its price.

“A drop below $108,000 could trigger a new round of liquidations. Traders are advised to exercise strict risk control as the market could weaken again if capital inflows do not resume,” Bitunix.

Despite short-term risks, there are signs that Bitcoin’s long-term outlook is strong. A May 25 report by UTXO’s Guillaume Girard and Will Owens showcases that Bitcoin’s institutional demand is currently outpacing the supply. Effectively, buyers are entering the market faster than miners can mint Bitcoins, which could escalate in the coming years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services