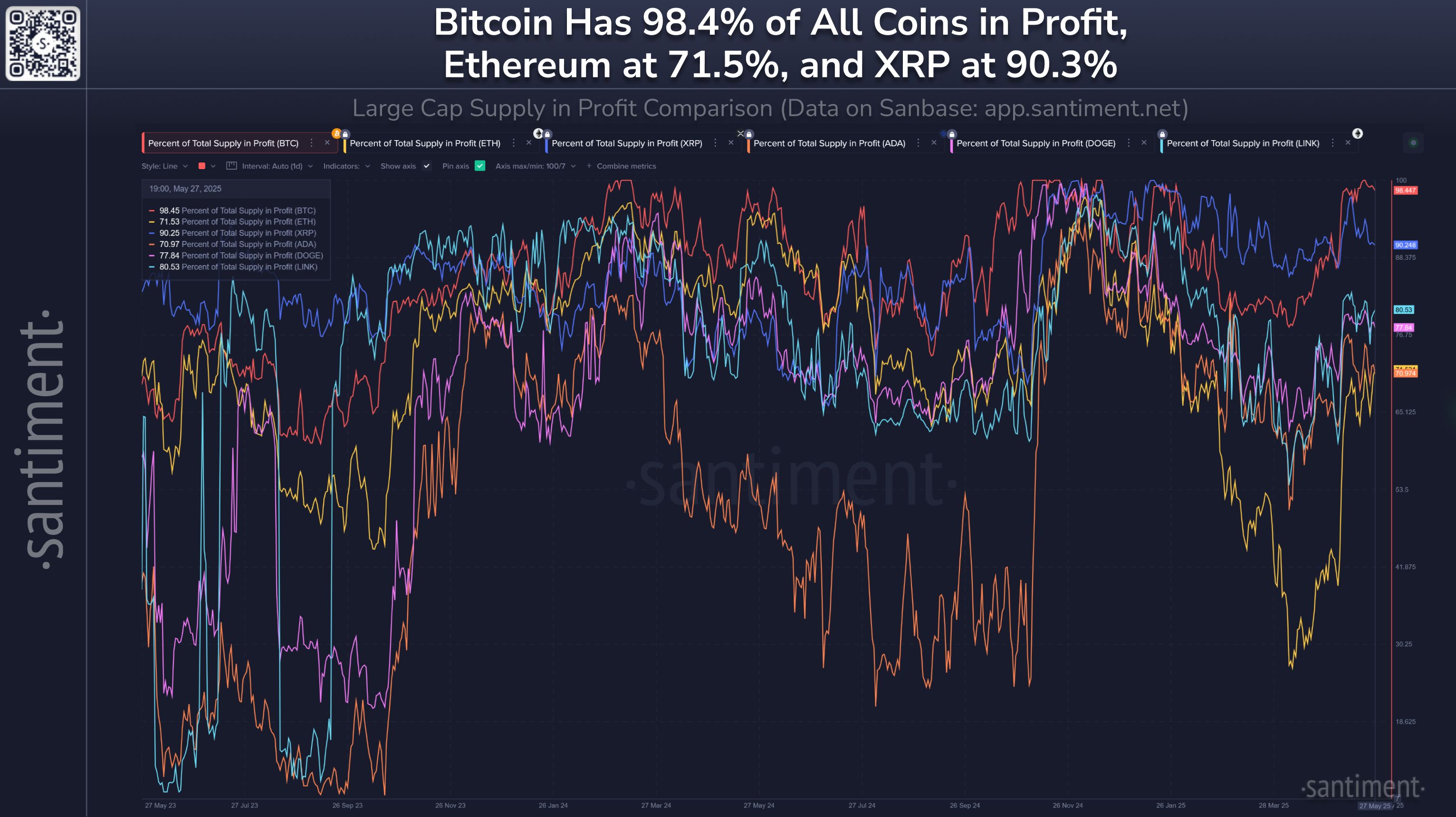

Bitcoin's Recent All-Time High Understandably Shows Nearly All Coins in Profit Compared to Other Top Caps

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!

Bitget Trading Club Championship (Phase 20)—Up to 2400 BGB per user, plus a RHEA pool and Mystery Boxes

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— enjoy up to 8% APR and share 30,000 USDT!