US Banks See $70,600,000,000 in Profits in First Quarter As Non-Interest Income Jumps: FDIC

The US banking industry saw a rise in profits in the first quarter of the year driven by a jump in non-interest income, according to new government numbers.

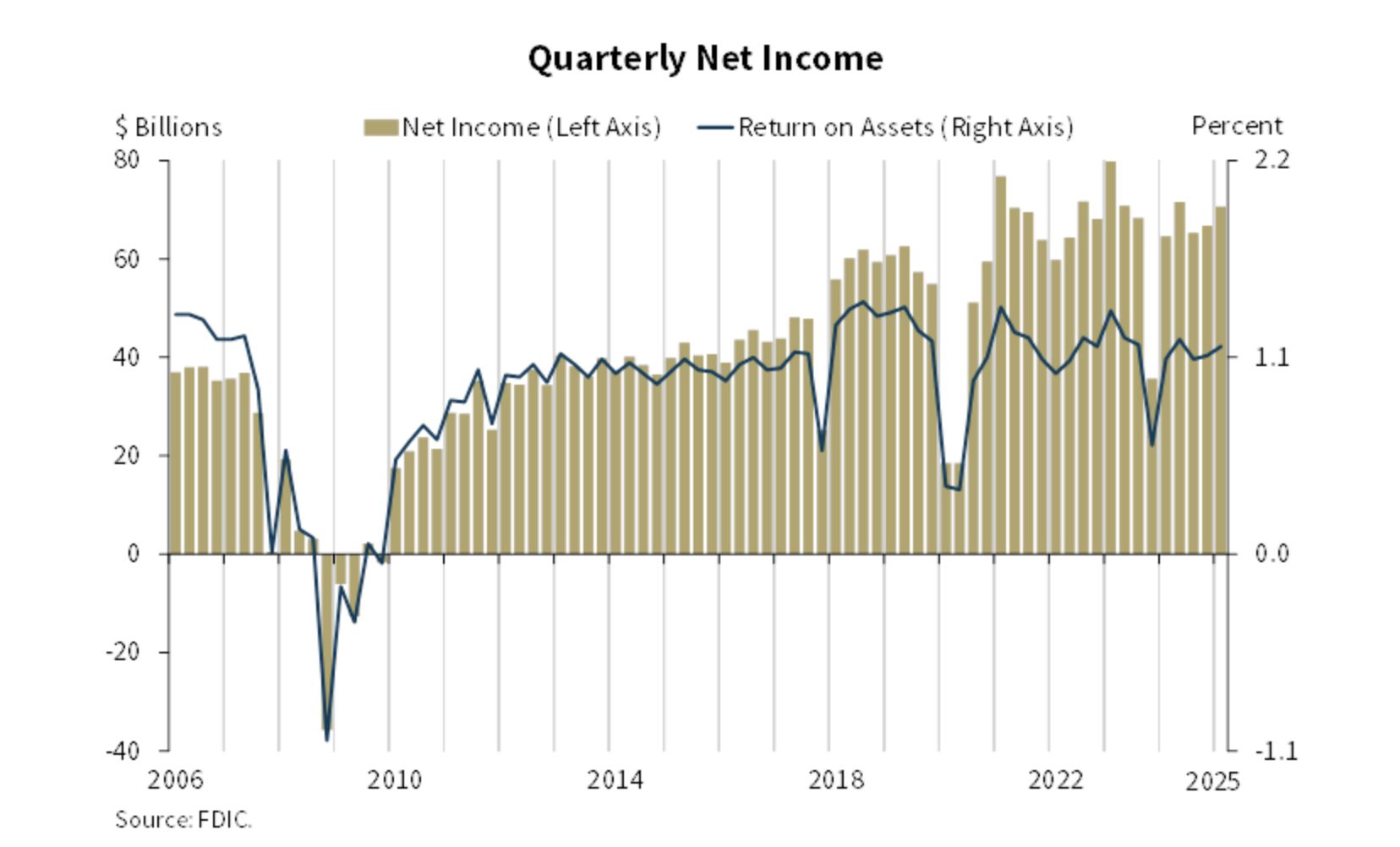

In an announcement from the Federal Deposit Insurance Corporation (FDIC), the agency says that financial institutions in the US reported a return of 1.16% and net income of $70.6 billion.

The FDIC says the rise in income was a jump of $3.8 billion, or 5.8%, from the previous quarter.

Source: FDIC

Source: FDIC

Says FDIC Acting Chairman Travis Hill,

“With strong capital and liquidity levels to support lending and protect against potential losses, the banking industry continued to support the country’s needs for financial services while navigating the challenges presented by economic uncertainty, elevated inflation and interest rates, tighter credit, and elevated unrealized losses.”

Earlier this month, market intelligence giant S&P Global reported that the top four US banks have seen their assets grow in the past three months by a whopping $681.71 billion.

S&P Global says that the combined assets of JPMorgan Chase, Bank of America, Citibank and Wells Fargo ballooned by 5.9%, or $681.71 billion, in the first quarter of the year.

The massive asset growth is in stark contrast to “a 2.9% contraction in the previous quarter.”

“JPMorgan Chase & Co., the biggest US bank at $4.358 trillion in total assets as of March 31, reported an increase of $355.04 billion in assets in the first quarter. That marked the third-highest sequential increase among the nation’s 50 largest banks at 8.9%.

Citigroup Inc. posted the second-highest sequential growth at 9.3%, or an increase of $218.57 billion in assets.

Bank of America Corp. reported asset growth of 2.7% from the prior quarter, while Wells Fargo & Co.’s assets increased 1.1% in the same period.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services