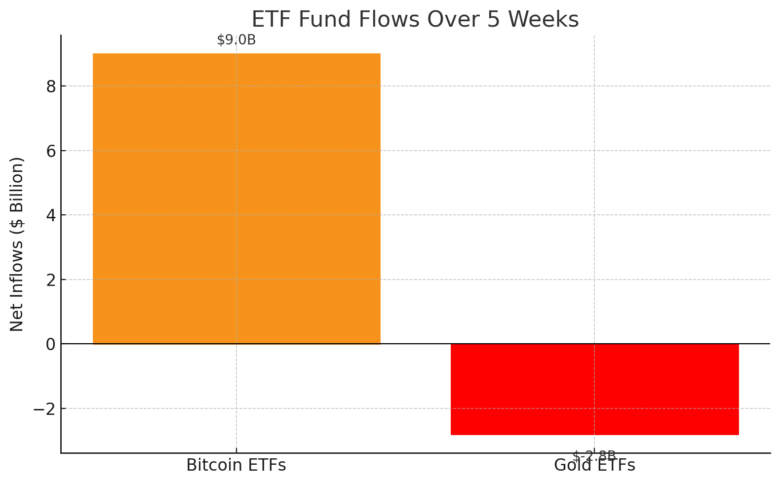

Over the last five weeks, Bitcoin ETFs in the U.S. have pulled in over $9 billion, led by BlackRock’s iShares Bitcoin Trust (IBIT), while gold-backed funds lost more than $2.8 billion over the same period.

This switch is happening due to the fact that investors are looking for safer places to invest their money, especially since the issue of U.S. inflation and government debt keeps rising. On May 22 alone, Bitcoin ETF saw around $432 million inflow, its highest so far this week

BTC ETF Inflow and Outflow | Source: Farside Investor

BTC ETF Inflow and Outflow | Source: Farside Investor

Bitcoin recently hit an all-time high of $111,970 on May 22nd after getting boosted by optimism around the new stablecoin bill and the U.S.& China tariff war.

At the time of writing, Bitcoin is trading at $105,293.46. This is down 1.35% in the last 24 hours but still up more than 55% over the past year, according to CoinMarketCap. Meanwhile, Gold is still up more than 25% this year, and currently trades at $3,310 per ounce, which is $190 down from its record high.

Bitcoin ETF and Gold ETF Inflow/Outflow Chart | Source: x.com/BTC_Archive

Bitcoin ETF and Gold ETF Inflow/Outflow Chart | Source: x.com/BTC_Archive

Analysts believe Bitcoin’s appeal is rising due to financial uncertainty. According to Christopher Wood, the Global Head of Equity Strategy at Jefferies “ “I remain bullish on both gold and Bitcoin. They remain the best hedges on currency debasement in the G7 world.” However, some critics still Bitcoin’s price swing is too risky to be considered a true safe haven.

In a statement, Geoff Kendrick of Standard Chartered said Bitcoin’s edge comes from being decentralized and helpful during both private and public sector shocks. “Bitcoin is more effective against financial system risks due to its decentralized nature.” he said.

He also noted that it can act as a hedge against both private-sector failures, like the collapse of Silicon Valley Bank in 2023, and public-sector concerns, such as deficits and threats to Federal Reserve independence.

Schiff Stays Silent on Bitcoin ETFs But Continues BTC Critic

Although Peter Schiff, a gold advocate, has continued to publicly criticize Bitcoin, he has notably stopped commenting on BTC ETFs because of their performance. Still, he believes gold’s long history and its physical value make it a haven.

Meanwhile, this new development adds more fuel to the heated argument between Michael Saylor, the Chairman of Strategy (formerly MicroStrategy), and Bitcoin critic Peter Schiff. Saylor, known in the crypto space for converting Strategy, which was recently rebranded from Strategy into a Bitcoin holding firm, repeatedly declared BTC as the world’s superior store of value.

However, Schiff doesn’t agree with this, he insists that gold remains the safest. In a recent post , he even criticized the media “Most of the so-called experts who regularly appear on CNBC don’t understand gold or Bitcoin. When it comes to investment, CNBC really is the blind leading the blind.”