Meta says No to Bitcoin Reserves Despite Mounting Institutional Adoption

Meta's decision mirrors similar rejections at other tech giants, signaling that Big Tech remains cautious despite rising institutional interest in Bitcoin.

Meta Platforms, the parent company of Facebook and Instagram, has voted overwhelmingly against a proposal to diversify its corporate treasury into Bitcoin.

This signals that Big Tech remains cautious about adopting the top cryptocurrencies despite rising corporate interest.

Meta Shuts Door on Bitcoin Treasury Move

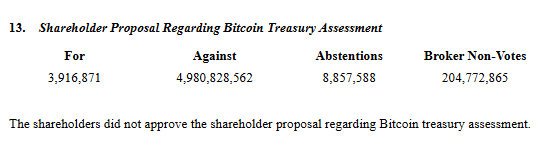

According to documents shared on X, the shareholder motion received just 3.9 million votes in favor, while more than 4.9 billion opposed it. Another 8.9 million shares abstained, and 205 million were broker non-votes.

Meta Shareholders Vote on Bitcoin Treasury Move. Source:

X/Phoenix

Meta Shareholders Vote on Bitcoin Treasury Move. Source:

X/Phoenix

This vote follows the proposal of Ethan Peck, a Mata Shareholder, earlier this year.

Peck had called on Meta to convert a portion of its cash and bond reserves into Bitcoin, citing growing institutional adoption and the asset’s potential to outperform traditional financial instruments.

However, Meta’s board rejected the proposal even before the vote, stating that the company already has robust treasury management practices.

The board maintained that there was no compelling reason to consider Bitcoin, though it did not entirely dismiss digital assets as a concept.

“While we are not opining on the merits of cryptocurrency investments compared to other assets, we believe the requested assessment is unnecessary given our existing processes to manage our corporate treasury,” Meta’s board stated.

Still, Meta hasn’t ruled out blockchain technology entirely. The company has reportedly held early-stage discussions with crypto infrastructure firms about a potential stablecoin integration to support global payments.

Meanwhile, the vote ends months of speculation that Meta might follow in the footsteps of companies like Strategy, which has aggressively accumulated Bitcoin as a reserve asset.

The Facebook’s parent company decision also mirrors recent shareholder rejections at Amazon and Microsoft, both of which declined similar proposals.

Some of the speculation surrounding Meta stemmed from CEO Mark Zuckerberg’s ties to crypto culture, including the fact that one of his goats is named Bitcoin.

Notably, market analysts had floated the idea that Meta could lead a new wave of tech firms embracing digital assets.

“If a Meta or Microsoft adds BTC to its balance sheet, it will arguably have a bigger impact than all the smaller companies doing it. Kinda like when Tom Hanks got COVID, which made it feel real even though the cases had already been mounting,” Bloomberg ETF analyst Eric Balchunas explained.

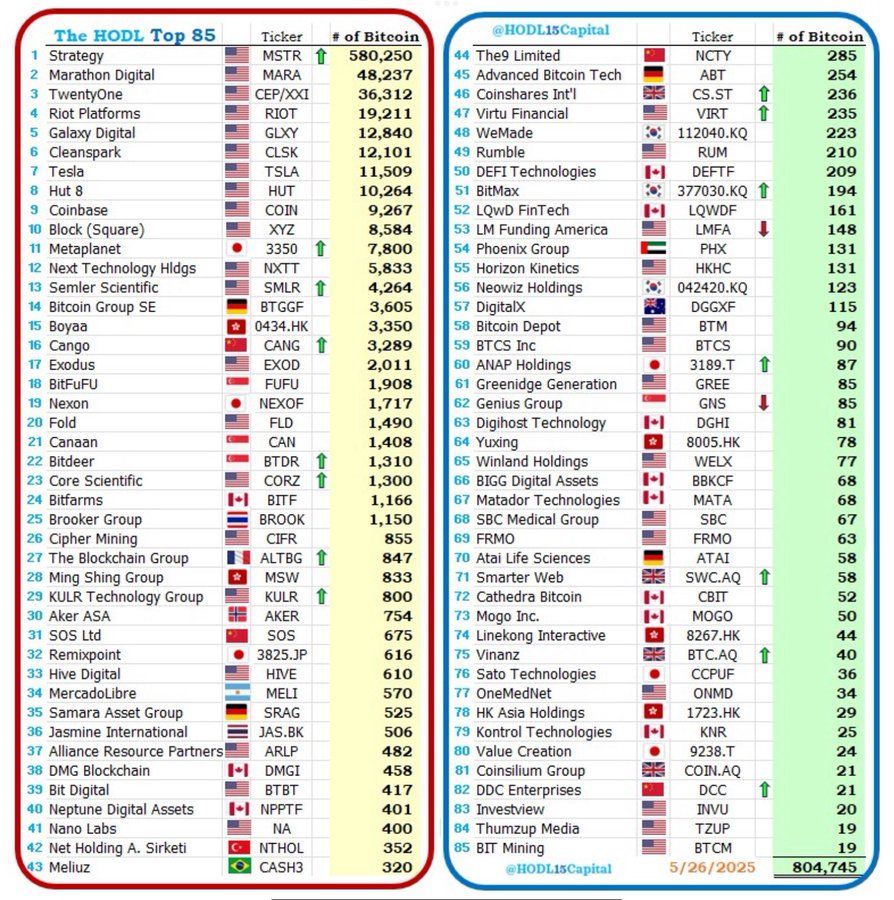

Bitcoin Top 85 Corporate Holders. Source:

Hodl15Capital.

Bitcoin Top 85 Corporate Holders. Source:

Hodl15Capital.

As of May 2025, more than 85 public companies collectively hold over 804,000 BTC, according to Hodl15Capital. Strategy leads the pack with more than 580,000 BTC under its control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Unlikely To Hit $100K By Year-end, Say Prediction Markets

Rare Funding Rate Event Stuns XRP Market

Revealed: The $500M Gamble of a Bitcoin OG’s Massive Leveraged Positions

Unlock Billions: Anza’s Bold Plan to Slash Solana Account Creation Fees by 90%