-

Bitcoin’s recent $8 billion decline raises questions about potential recovery amidst macro challenges and bear market pressures.

-

Despite this setback, signs of accumulation emerge, indicating that traders may not be entirely abandoning their bullish outlook.

-

According to COINOTAG, “The volatility in Bitcoin is a testament to the market’s sensitivity to macroeconomic influences.”

Bitcoin faces a critical moment as it navigates an $8B decline, with macroeconomic pressures weighing heavily on market sentiment.

Understanding Bitcoin’s Current Market Struggles

Bitcoin’s recent price action has been marked by a notable and alarming trend: five consecutive downward candles. This linear drop raises questions about the market’s overall sentiment.

On May 27th, Bitcoin (BTC) reached a peak of $110,000 before bears instigated a swift sell-off, dampening bullish enthusiasm. What exacerbates this situation is the backdrop of heightened trade tensions.

As highlighted in recent analyses, retail investors are shifting their cash back towards safer assets, steering away from crypto investments amid increasing uncertainty.

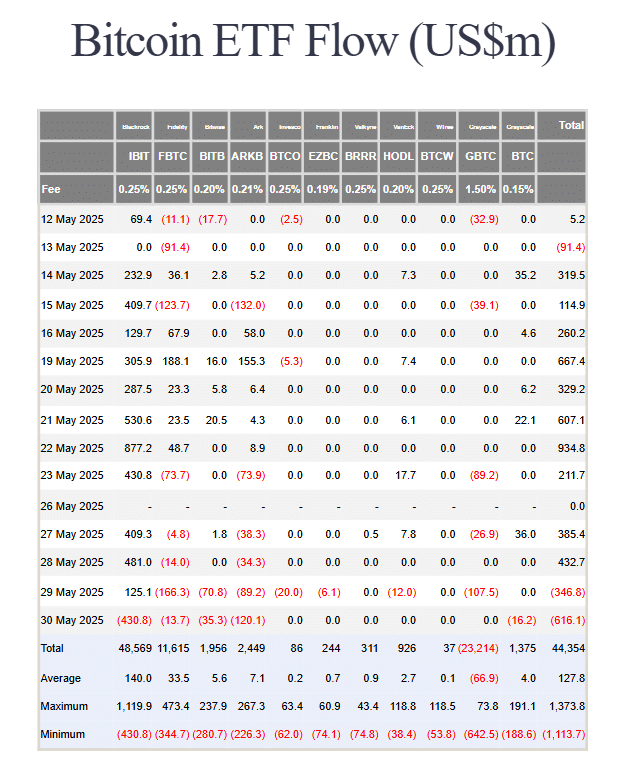

Moreover, institutional players are also showing signs of retreat. BlackRock’s recent sell-off of 4,100 BTC broke its streak of inflows, signaling broader caution within the investment community.

Source: Farside Investors

The bear market appears to be gaining traction; funding rates on Bybit turned negative for the first time in almost a month, indicating increased bearish sentiment. The concern is palpable: will Bitcoin’s linear decline lead to a deeper distribution, or is it simply a liquidity squeeze?

Opportunities for the Bulls Amid Market Challenges

Despite the bearish noise, the situation is not entirely bleak for Bitcoin bulls. On May 29th, an outflow of 8,175 BTC from spot wallets indicated strong accumulation sentiment, as opposed to hasty panic selling.

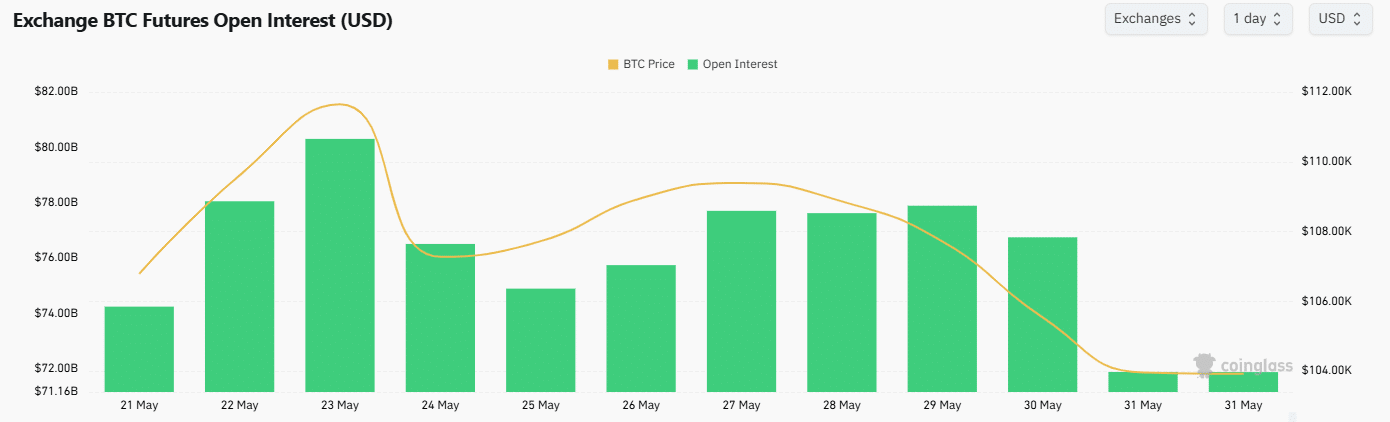

Add to this the fact that Bitcoin’s Open Interest (OI) hit a record $80 billion in late May, aligning with the cryptocurrency’s peak price. A subsequent reduction in OI to around $71.86 billion within seven days reflects a significant contraction of $8 billion, suggesting a recalibration rather than a complete capitulation.

Source: CoinGlass

This controlled decline presents a paradox; it implies that despite the prevailing bearish environment, there remains a chance for the bulls to reposition themselves. Currently, this atmosphere appears less like panic and more akin to a reset, potentially setting the stage for a rebound if future economic conditions stabilize.

Conclusion

In summary, Bitcoin’s recent trends reveal a complex interplay of investor sentiment influenced by external economic factors. With significant capital shifts and a cautious approach from both retail and institutional investors, the market remains on the cusp of potential recovery. Should bulls seize this brief window, we may witness a strengthening trend as the macroeconomic clouds begin to clear.