$5.23 Billion Floods Into Bitcoin Spot ETFs in May | ETF News

Bitcoin ETFs attracted over $5 billion in May amid BTC’s record rally to $111,068, reflecting strong institutional interest despite cautious short-term sentiment.

Bitcoin exchange-traded funds (ETFs) saw a significant surge in demand throughout May, with total net inflows exceeding $5 billion.

This marks an over 70% increase from April’s figures and reflects a sharp rise in institutional interest as the king coin soared to a new all-time high.

BTC ETF Inflows Surge 76% in May

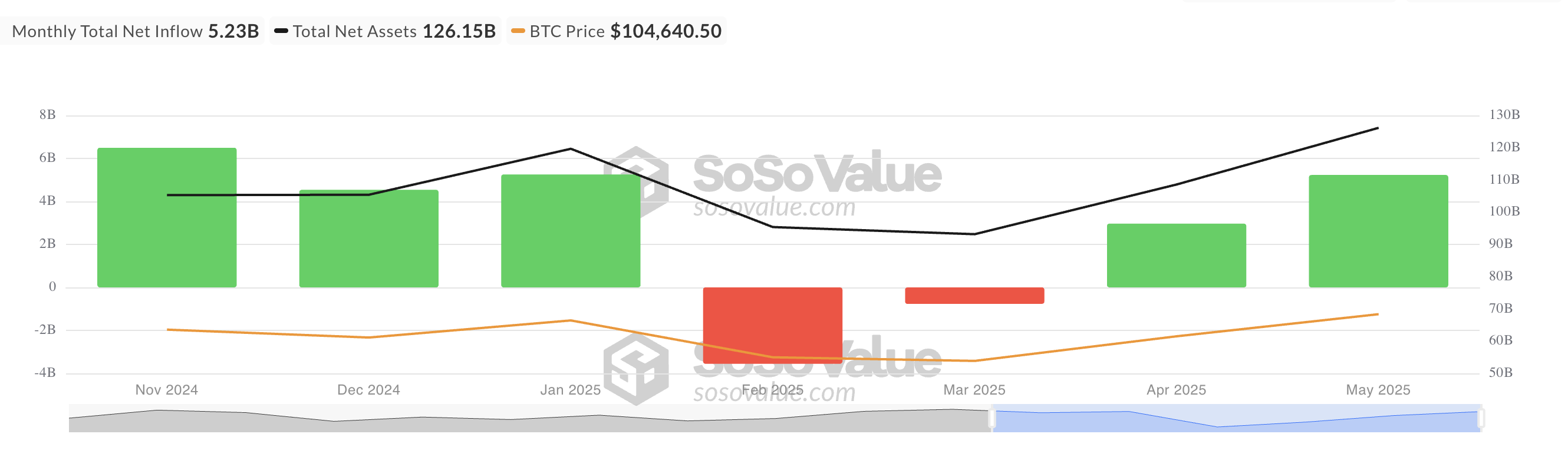

According to data from SosoValue, BTC ETFs saw a resurgence in demand in May, with net inflows totaling $5.23 billion. This marked a 76% surge from April’s $2.97 billion figure and represented the largest monthly influx since January.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

The surge in demand coincided with BTC’s rally to a new all-time high of $111,968 during the month under review. This milestone, driven by sustained retail momentum and growing interest from institutional players, injected fresh optimism into the broader market.

So, as the price of BTC climbed, ETF products became an increasingly attractive vehicle for large investors seeking exposure to digital assets.

Sustained institutional participation like this often brings price stability and reduced volatility, potentially setting the stage for further BTC rallies in June.

BTC Market Sees Mixed Signals

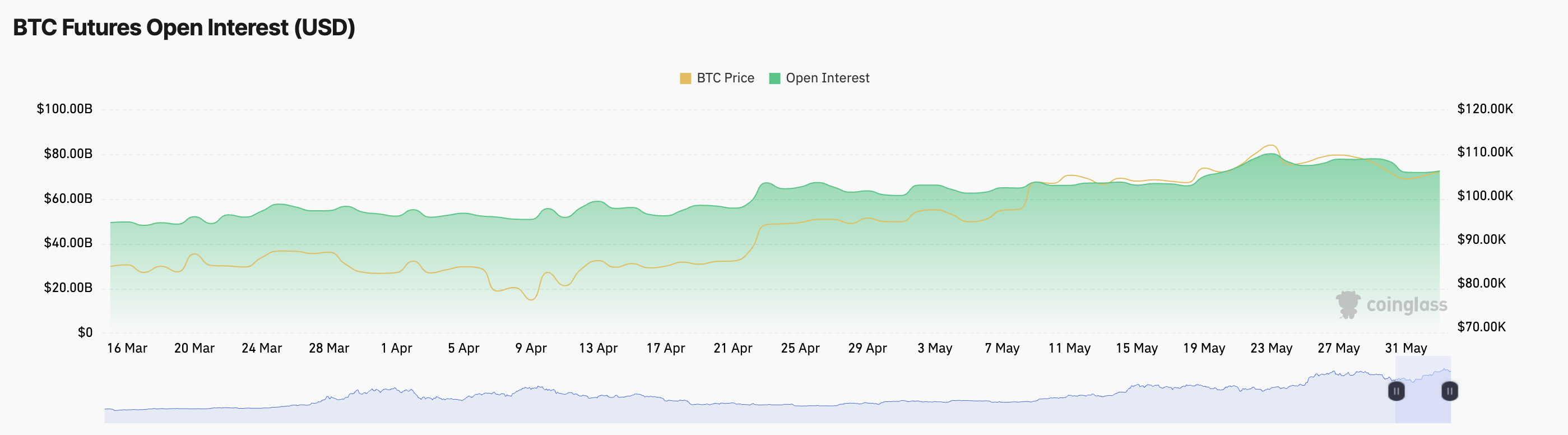

Amid today’s slight rebound in trading activity, BTC is up by a modest 1% and currently trades at $105,216. Its rising futures open interest confirms the surge in the demand for the king coin. This stands at $72.47 billion at press time, climbing 1% over the past day.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of active derivative contracts, such as futures or options, that have not been settled. A rise in open interest indicates increased market participation and capital inflows.

This signals a gradually strengthening momentum in the BTC market and shows conviction in its price trend.

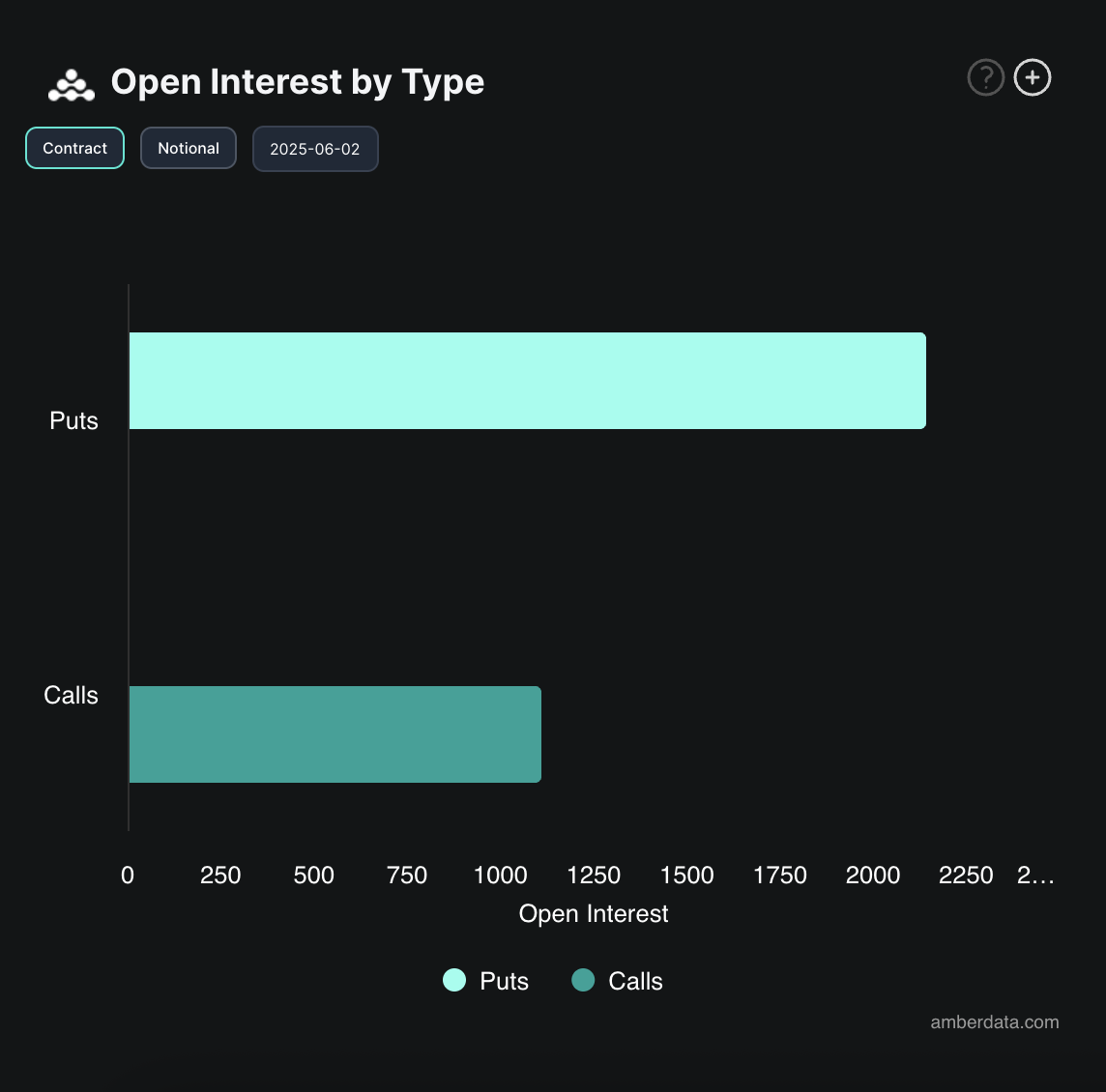

However, readings from the coin’s options market show signs of bearish hedging. According to Deribit, today is marked by a significant demand for put contracts, indicating that many traders are preparing for potential downside, even as the underlying asset trends higher.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

This highlights a split in market sentiment: strong long-term fundamentals overshadowed by lingering short-term uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services