-

Cardano (ADA) is currently facing significant resistance at $0.66, with bearish indicators signaling potential price declines amid growing investor skepticism.

-

The Chaikin Money Flow shows active outflows, while the MVRV Long/Short Difference suggests a shift in profit-taking dynamics between short-term and long-term holders.

-

According to COINOTAG analysis, overcoming the $0.66 resistance is crucial for ADA to regain momentum and target higher price levels like $0.70 and $0.74.

Cardano (ADA) struggles to surpass $0.66 resistance amid bearish Chaikin Money Flow and investor skepticism, risking a decline to $0.60 if support fails.

Investor Sentiment and Chaikin Money Flow Indicate Bearish Pressure on Cardano

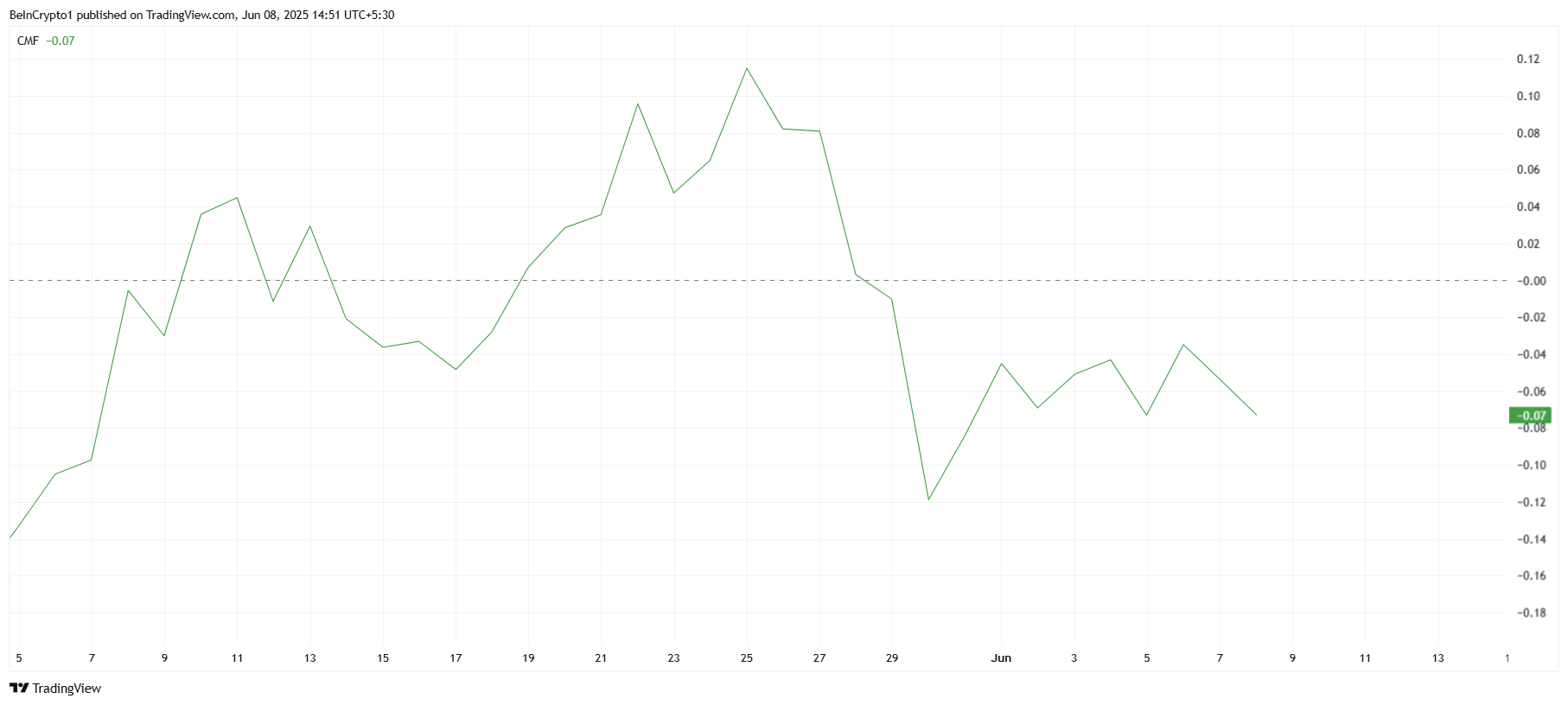

Cardano’s price action near the $0.65 mark is accompanied by a bearish Chaikin Money Flow (CMF) reading, which remains below zero, signaling persistent outflows from ADA holders. This metric is a reliable indicator of capital movement, and its negative stance reflects a growing lack of confidence among investors. The sustained selling pressure suggests that many market participants are reducing their exposure to Cardano, potentially due to broader market volatility and uncertainty about ADA’s near-term prospects.

Moreover, the CMF’s bearish trend highlights the critical nature of the $0.66 resistance level. Failure to break above this threshold could exacerbate selling pressure, pushing prices lower. This dynamic underscores the importance of monitoring capital flows as a key determinant of Cardano’s price trajectory in the coming weeks.

Market Value to Realized Value (MVRV) Signals Shift in Holder Behavior

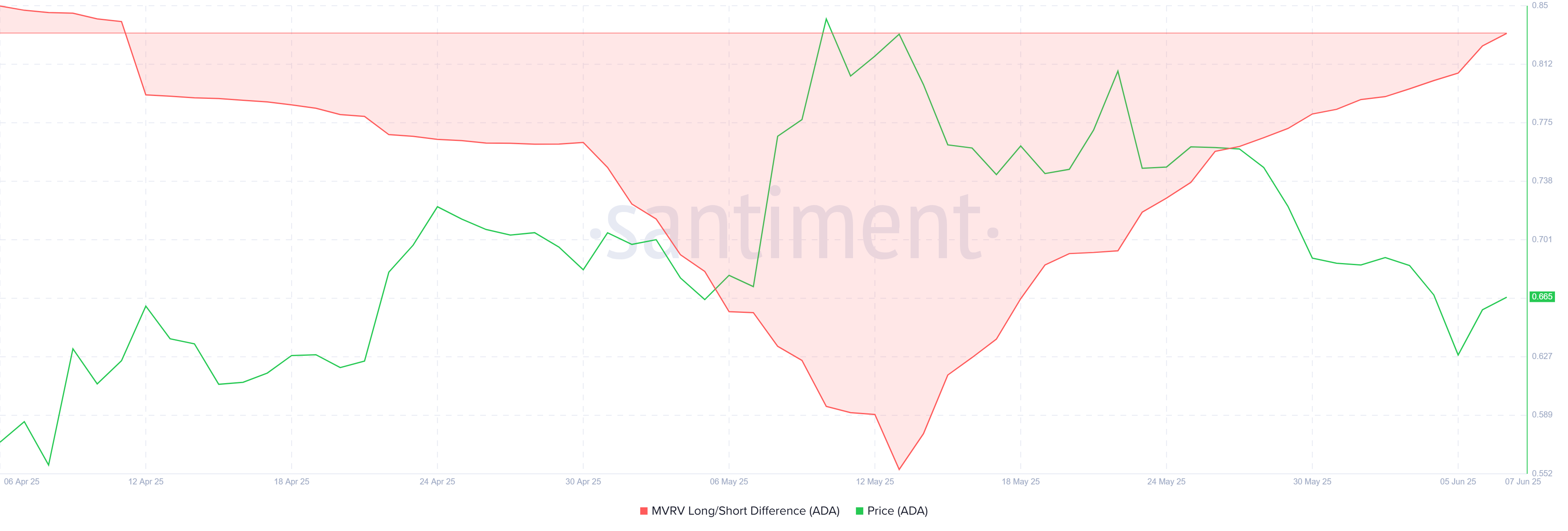

Complementing the CMF data, the MVRV Long/Short Difference metric reveals an interesting shift in profit distribution between short-term holders (STHs) and long-term holders (LTHs). Currently, profits appear to be migrating from STHs to LTHs, indicating that long-term investors are maintaining their positions despite market headwinds. This behavior is often interpreted as a sign of underlying confidence among committed holders, which could provide a stabilizing effect on ADA’s price.

However, this positive signal is tempered by the risk that if long-term holders begin to capitulate under sustained market pressure, it could trigger a significant sell-off. Such a scenario would likely intensify downward momentum, further challenging Cardano’s ability to sustain its price levels.

Cardano CMF. Source: TradingView

Cardano MVRV Long/Short Difference. Source: Santiment

Price Resistance at $0.66: A Pivotal Point for ADA’s Short-Term Outlook

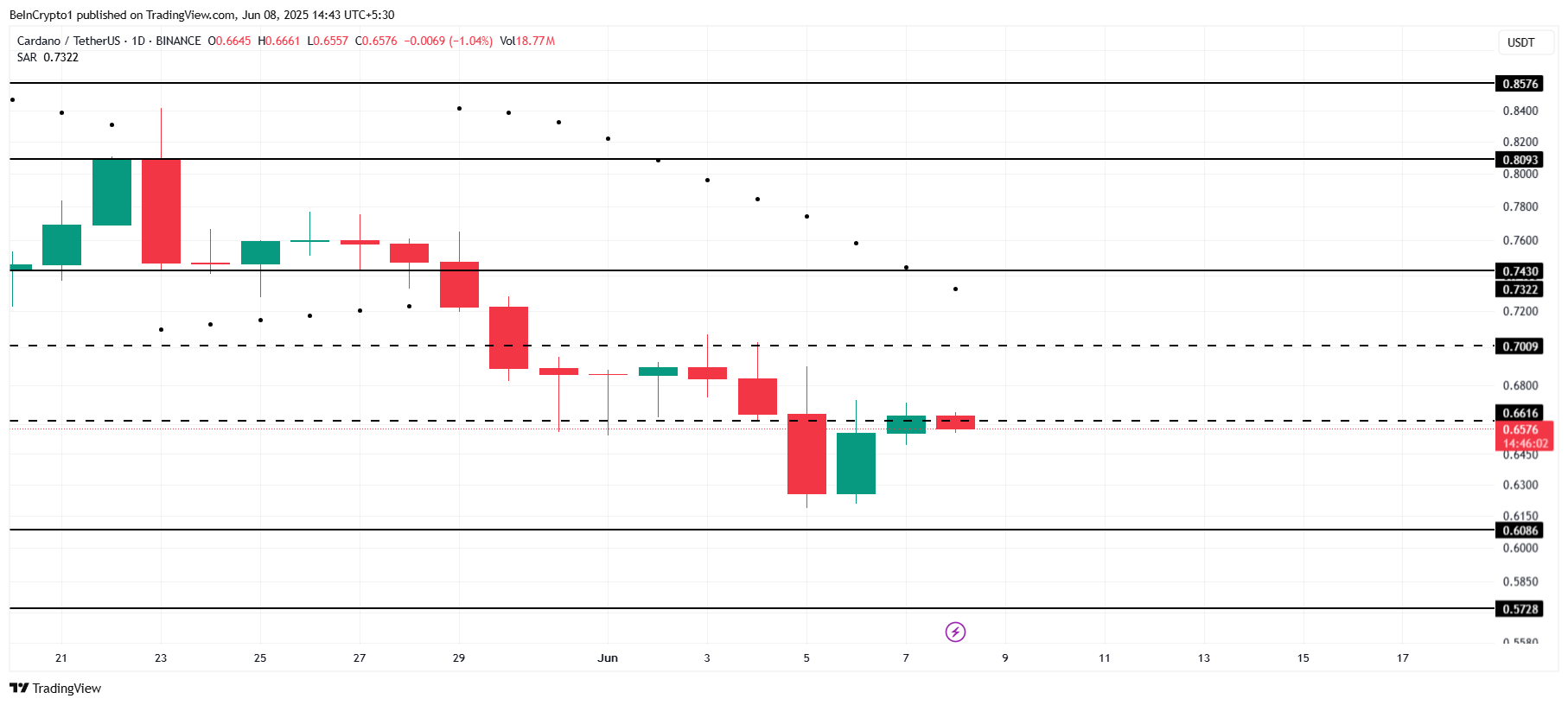

Cardano’s current trading range is tightly bound by the critical resistance at $0.66. This level represents a key battleground between bullish attempts to regain upward momentum and bearish forces aiming to push prices lower. Technical indicators, such as the Parabolic SAR positioned above the candlesticks, reinforce the prevailing bearish sentiment, suggesting that ADA lacks the immediate strength to break through resistance.

If ADA fails to hold above $0.66, the next significant support level to watch is $0.60. A breach below this point could signal an extended correction phase, potentially inviting further downside risk. Traders and investors should closely monitor volume and momentum indicators to gauge the sustainability of any price movements near these levels.

Potential Upside: Breaking Resistance Could Restore Confidence

Conversely, a successful breakout above $0.66 could mark a turning point for Cardano. Surpassing this resistance would likely attract renewed buying interest, propelling ADA toward the $0.70 mark. Should momentum continue, a further advance to $0.74 is plausible, effectively reversing the current bearish outlook.

This scenario would not only validate the resilience of long-term holders but also signal a potential shift in market sentiment. Investors are advised to watch for confirmation signals such as increased volume and sustained price action above resistance to capitalize on possible upward trends.

Cardano Price Analysis. Source: TradingView

Conclusion

Cardano’s near-term price action is at a critical juncture, with the $0.66 resistance level serving as a decisive factor in determining its trajectory. Bearish signals from the Chaikin Money Flow and Parabolic SAR highlight ongoing selling pressure and investor skepticism. However, the MVRV Long/Short Difference suggests that long-term holders remain engaged, offering a potential buffer against further declines.

For ADA to regain upward momentum, it must decisively break through the $0.66 resistance and sustain gains above this level. Failure to do so could lead to a deeper correction toward $0.60. Market participants should remain vigilant, leveraging technical indicators and volume trends to inform their strategies in this volatile environment.