TRX $4 Billion Demand Zone Indicates Where Tron Price is Headed

Tron’s price may correct from recent gains, but the strong demand zone around $0.276 provides support. A breakout above $0.286 could signal further gains.

Tron (TRX) has experienced a strong price rise, reaching a 5-month high. However, the recent bullish momentum appears to be losing steam, signaling the potential for a price correction.

While the asset has performed well, there are signs that TRX could be overvalued in the short term, which may prompt a pullback.

Tron Is Overvalued

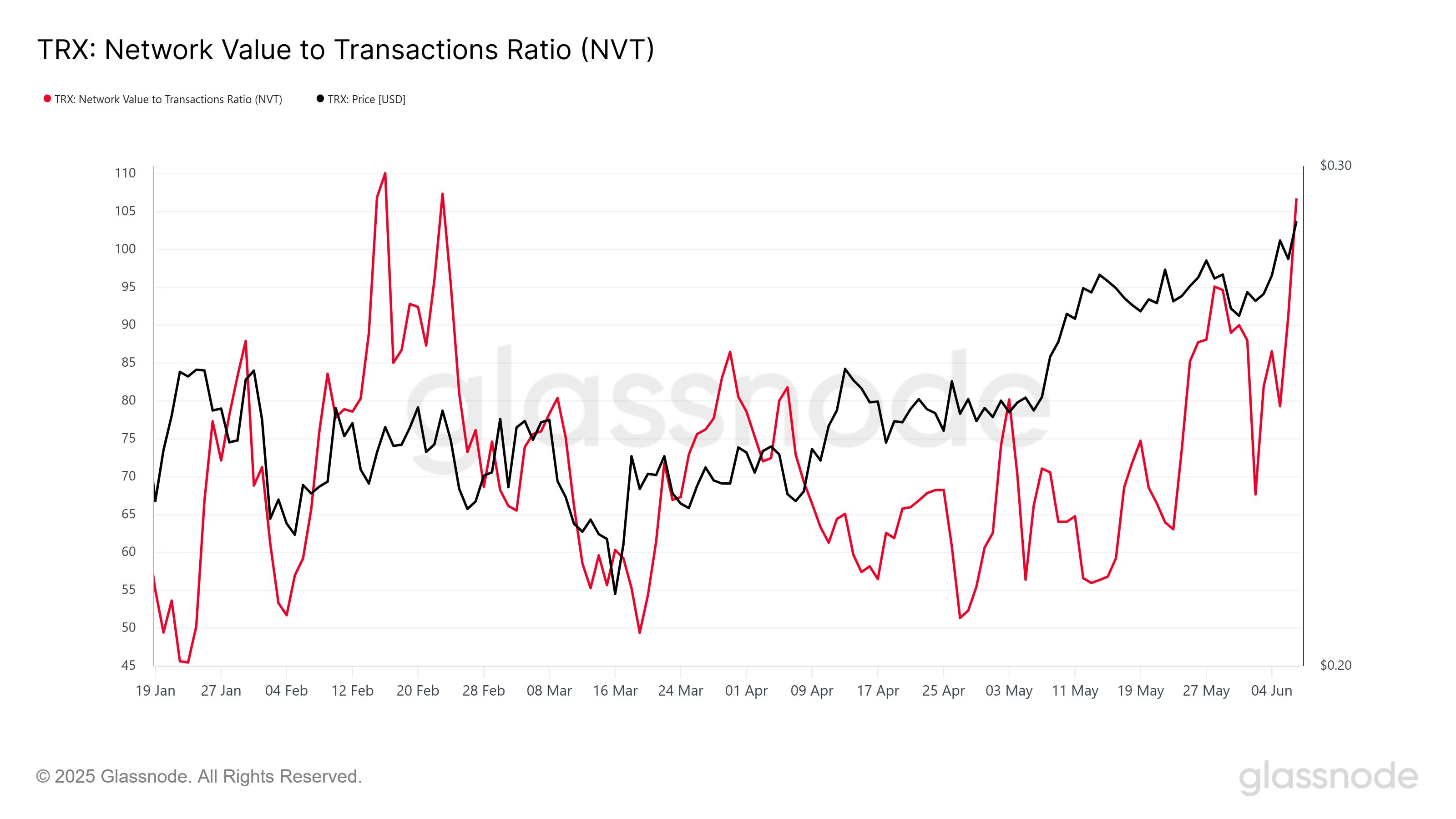

The Network Value to Transactions (NVT) ratio for Tron has spiked, reaching its highest level in a month and a half. NVT measures the ratio between a network’s market value and its transaction volume.

A rising NVT often signals that the market value of an asset is outpacing its transactional activity, suggesting overvaluation. In the case of TRX, this increase in NVT is a potential red flag.

With the NVT ratio rising, TRX could face downward pressure as investors adjust their expectations. The token’s overvaluation could lead to a sell-off, especially if market sentiment shifts toward caution.

As a result, a price correction seems likely, especially if the broader cryptocurrency market experiences a cooling-off period.

TRX NVT Ratio. Source:

Glassnode

TRX NVT Ratio. Source:

Glassnode

Despite the concerns about overvaluation, the overall macro momentum for TRX may not lead to a sharp correction. The IntoTheBlock’s IOMAP indicator shows a strong demand zone between $0.268 and $0.276, where around 13.89 billion TRX, worth nearly $4 billion, was purchased.

This substantial accumulation zone provides a buffer for TRX, as investors who buy at these levels are unlikely to sell without a profit.

The demand zone is crucial because it represents a price floor that may prevent TRX from falling too far. As the market has demonstrated interest in this price range, the chances of TRX dropping below $0.276 in the short term are reduced.

If TRX does experience a correction, it is expected to find solid support within this zone, keeping the price above the critical $0.276 level.

Tron IOMAP. Source:

IntoTheBlock

Tron IOMAP. Source:

IntoTheBlock

Will TRX Price Take A Dip?

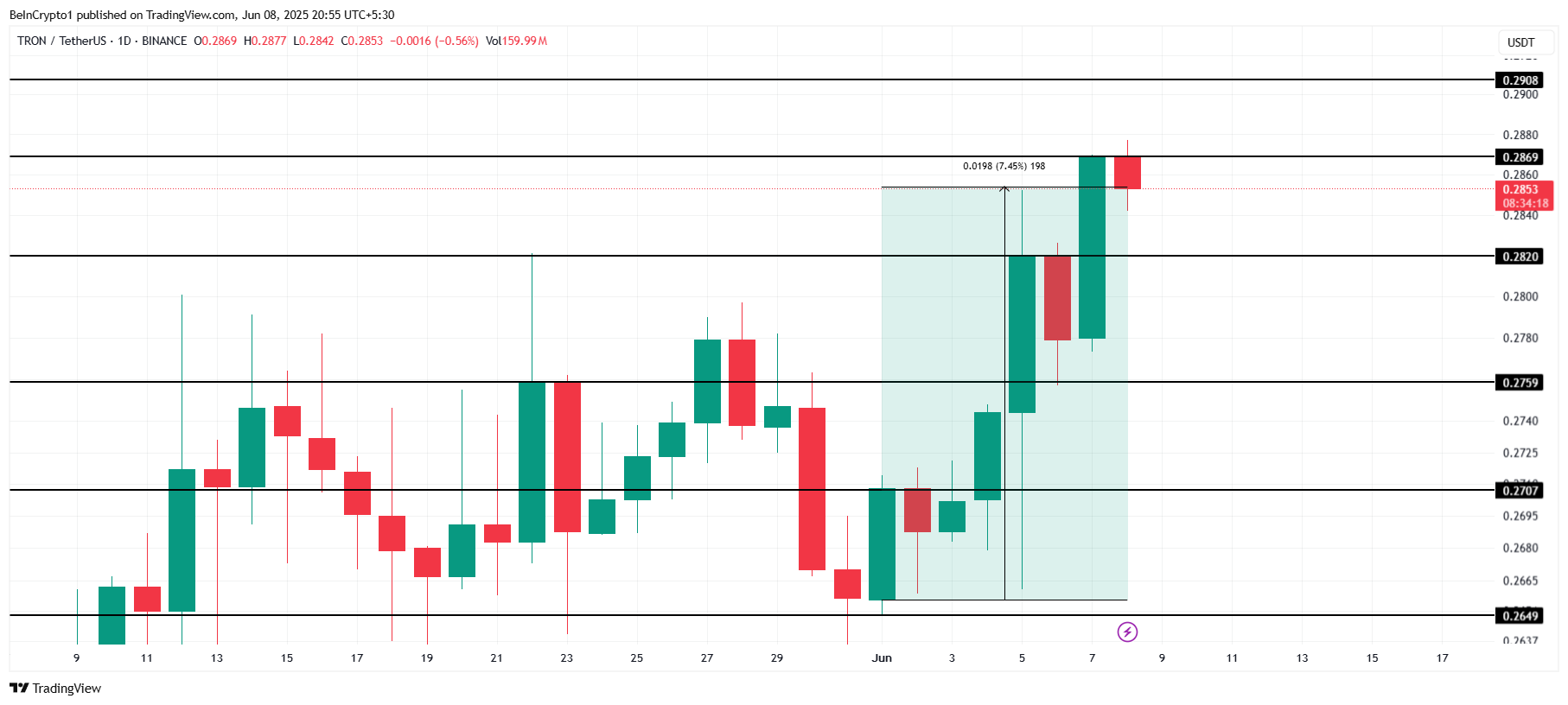

TRX has gained 7.45% over the past week, trading at $0.285 at the time of writing. It is currently facing resistance at $0.286, which has proven to be a challenging level to break. Given the recent rise in price, the token is nearing a critical point.

If TRX fails to breach the $0.286 resistance, it could face a pullback as investors take profits.

Should the overvalued condition trigger a price decline, TRX could drop below $0.282 and head toward the $0.275 support level. A fall below this level is unlikely due to the strong demand zone around $0.268 to $0.276, which should provide support for the price. The correction is expected to be moderate, with the demand zone preventing a more severe decline.

Tron Price Analysis. Source:

TradingView

Tron Price Analysis. Source:

TradingView

On the other hand, if the broader market remains bullish, TRX may push past the $0.286 resistance level. A successful breach of this barrier could see TRX move toward $0.290. This would invalidate the bearish outlook and set the stage for further price appreciation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030