Bitcoin ETFs Heat Up With $386 Million Inflows After Price Spike | ETF News

Bitcoin ETFs experienced a significant $386 million inflow after BTC broke through the $105,000 resistance. This marks a shift toward renewed bullish sentiment across spot and derivatives markets.

Bitcoin exchange-traded funds (ETFs) saw strong demand yesterday, with total net inflows exceeding $350 million. This followed BTC’s breakout past the $105,000 resistance level to close above the $110,000 price.

With strengthening bullish pressure, the leading coin is poised to continue its rally, further fueling the demand for ETF products.

BTC ETFs See $386 Million Inflows as Investor Confidence Returns

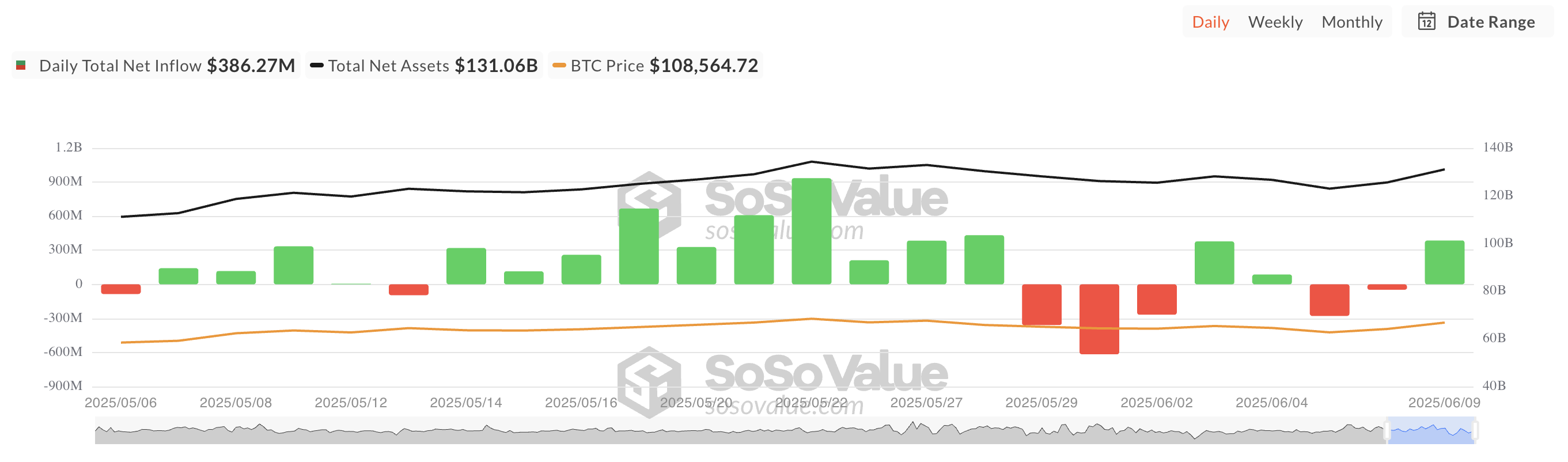

On Monday, BTC spot ETFs recorded net inflows of $386.27 million. This capital inflow marked a significant shift in market sentiment following last week’s decline.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

These inflows reversed the previous week’s trend of net outflows, as BTC’s lackluster performance and waning investor confidence had dragged down demand. The surge followed BTC’s breakout above the $105,000 resistance level, with the asset closing at $110,263 during yesterday’s trading session.

As a result, renewed optimism spread across the market, driving heightened activity in ETF trading as well. On Monday, Fidelity’s CBOE-listed FBTC fund led the charge, posting the largest single-day net inflow among all US BTC ETF issuers.

BTC Futures and Options Flash Bullish as Price Holds Above $109,000

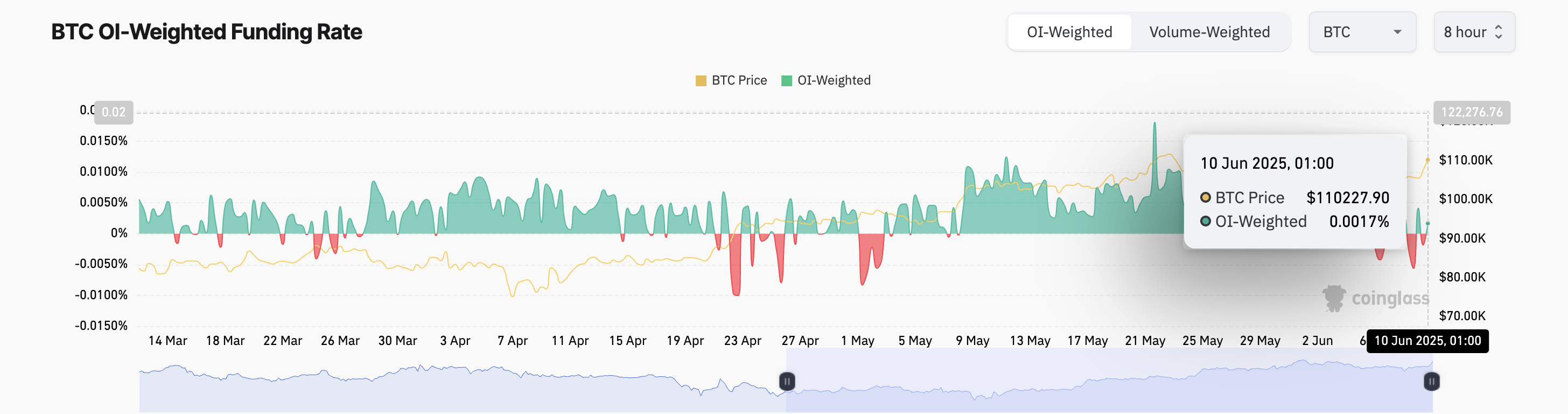

BTC trades at $110,227 at press time, up 4% over the past day. The coin’s funding rate has flipped back into positive territory on the derivatives front, signaling a shift toward bullish market positioning. It currently stands at 0.0017%.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep prices aligned with the spot market.

When its value is positive, it indicates bullish sentiment and a higher demand for longs. It means that traders holding long BTC positions pay those holding short positions, a trend that could drive the coin’s value upward in the near term.

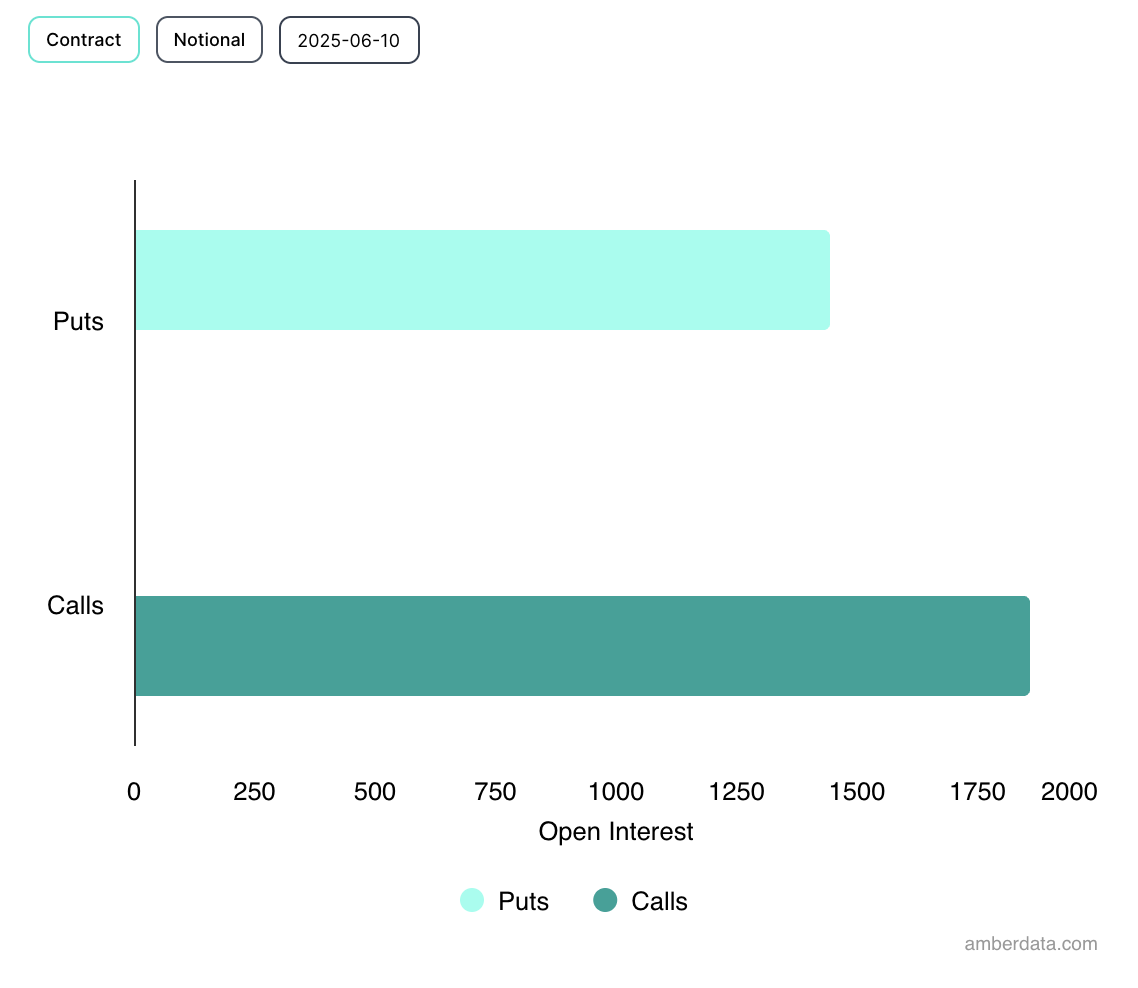

Furthermore, traders are buying BTC call options today, signaling growing bullish sentiment on the asset’s future price.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

Therefore, the combination of institutional inflows, rising price momentum, and a return to positive sentiment in derivatives suggests that the market may be entering a renewed accumulation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services