Whales are buying up BTC during periods when retail traders express bearish sentiment. Institutions, whales and other large-scale buyers keep shaking down retail, taking signs from social media.

Retail sentiment on BTC goes counter to the inflows of smart money. Based on Sentiment data, social media chatter often signals bearish attitudes among retail buyers.

Santiment tracked messaging across X, Reddit, Telegram, 4Chan, BitcoinTalk, and Farcaster, seeking out the mention of extremely low predictions below $70K, as well as bullish predictions for a rally above $120K. According to Santiment, the peak signal arrived around the time of the April 8 price crash, where retail predicted a fall to $70K. Whales and institutions only accelerated their buying.

Since May, BTC has also exhibited a signal of predominant market takers , indicating a domination of buying demand. For the second time since 2022 market takers have continued buying up coins during a rally, showing peak exuberance. Previous periods of market taker activity happened at lower price ranges, with more conservative accumulation. This time, buyers are still highly active near peak valuations.

Most of the sellers originated from the wallet cohort that held for 3-6 months, based on the hodl waves indicator. Experienced traders often choose a dual strategy of holding and trading to accumulate more BTC. Overall, no holders are pressured to sell, as over 98% of addresses are in profit, and long-term accumulators and miners have a much lower average entry price.

Whales still accumulate at any price range

The latest episode of bearish predictions lasted from June 4 to June 6, when BTC fell to just above $101,000. During that time, bear-posting accelerated, predicting another dip to a lower range.

Despite the temporary price drop, accumulation from whales and large-scale wallets did not skip a beat, with near-peak inflows .

Even during the recent sideways trading around $104,000, crowd sentiment remains bearish, while smart money is bullish on BTC.

Retail traders have often heard the adage of not selling their coins to whales, ETFs or institutions. However, the ability to realize profits at a higher price was appealing to retail and their share of holdings decreased.

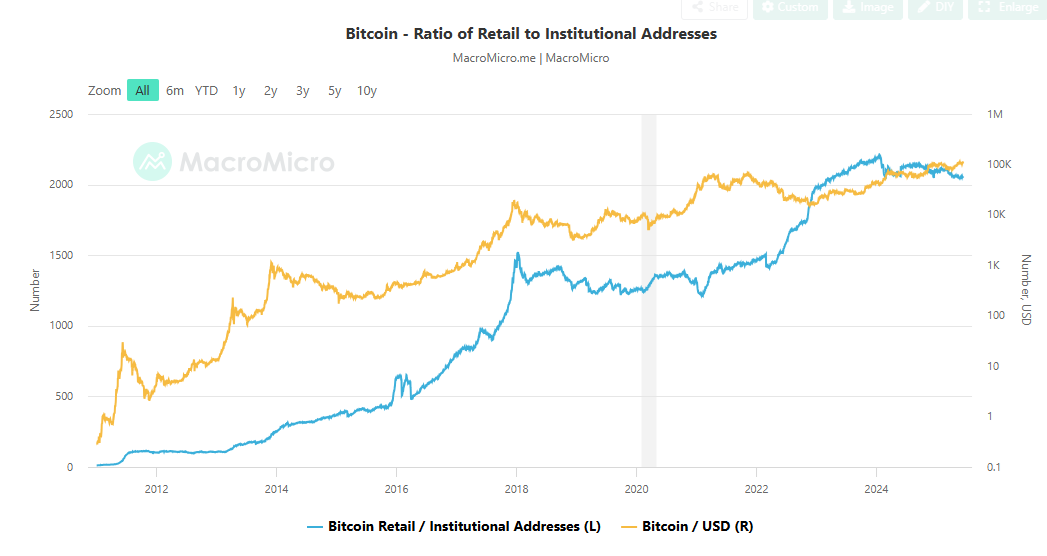

The ratio of retail to whale holdings has been sliding in most of 2025, from 2.1 points to 2.0 points. The ratio has been rising in all of the history of BTC, since institutions only arrived in the past two years.

BTC retail holders gradually declined in 2025, with the balance shifting toward institutions and whale buyers. | Source: MacroMicro

BTC retail holders gradually declined in 2025, with the balance shifting toward institutions and whale buyers. | Source: MacroMicro

The addition of corporate treasuries further added buyers capable of mopping up all newly mined BTC. Institutions and buyers with borrowed funds can afford to risk even near the price top, while retailers are more wary due to crashes from the previous bull cycles.

The current bull cycle also looks different, with a more gradual BTC price expansion. At the same time, the types of investors are shifting, and BTC continues to change hands. Retail traders are also wary of overall demand, as institutional buying and ETF demand have also reversed.

During some of the rallies, whales also sold BTC for profit and re-bought lower. Profit-taking was only slower during the latest rally above $109,000.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot