VanEck Solana ETF Gets DTCC Listing as Approval Comes Close

- VanEck’s Solana ETF was listed under VSOL on the DTCC site as a prelaunch fund.

- Analysts believe the SEC could approve Solana ETFs within the next few months.

- More asset managers are now joining the race to offer Solana-based ETF products.

VanEck’s proposed spot Solana ETF has officially appeared on the Depository Trust and Clearing Corporation (DTCC) website under the ticker VSOL. This inclusion, while not an approval, suggests growing readiness for potential Securities and Exchange Commission (SEC) clearance. The ETF appears in the DTCC’s “active and pre-launch” category, indicating it awaits regulatory approval before becoming tradable.

Source:

DTCC

Source:

DTCC

DTCC clarified that the fund cannot be created or redeemed until the SEC issues a formal approval. The listing aligns with recent analysts’ expectations that Solana-based exchange-traded funds may soon receive SEC approval.

Regulatory Hurdles Remain for Spot Solana ETF

Despite the DTCC listing, the SEC has not approved any spot Solana ETFs to date. The fund’s appearance among pre-launch listings does not guarantee approval, but it does indicate progress. Historically, the SEC has been slow to approve crypto ETFs beyond Bitcoin and Ethereum.

Besides VanEck’s VSOL, DTCC had earlier listed Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2x Solana ETF (SOLT), which focus on Solana futures. These are currently marked as redeemable, suggesting a different regulatory track. Still, the CME’s upcoming Solana futures launch supports momentum for broader acceptance.

Moreover, Seyffart and Balchunas noted that the SEC has begun working with issuers to refine S-1 filings. This cooperation may signal a more lenient stance toward crypto ETFs beyond Bitcoin and Ethereum.

Institutional Interest and Broader Implications

Solana’s rise in developer activity and market performance has caught the attention of institutional players. The blockchain, known for fast and low-cost transactions, continues to gain traction as an alternative to Ethereum.

CoinShares, Franklin Templeton, and Bitwise are placing Solana ETF products on the market. Some are considering staking options within ETF structures. These efforts reflect increased investor demand for multiple cryptocurrency platforms.

DTCC’s inclusion of VSOL represents a significant milestone in institutional recognition of crypto assets. As a central player in the U.S. financial infrastructure, DTCC’s involvement lends credibility to the growing acceptance of digital assets. The organization has previously explored tokenized collateral solutions and is reportedly developing plans for a stablecoin initiative.

Related: Solana ETF Filings Updated as SEC Review Enters Key Stage

With Bitcoin and Ethereum ETFs already approved, the spotlight now turns to Solana. Could it be the next crypto asset to enter the regulated ETF space? As momentum builds, industry watchers remain focused on what the SEC’s next move will be. A DTCC listing of VanEck’s VSOL could be a game-changing milestone for the broader admission of altcoins in the U.S. ETF space.

The post VanEck Solana ETF Gets DTCC Listing as Approval Comes Close appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

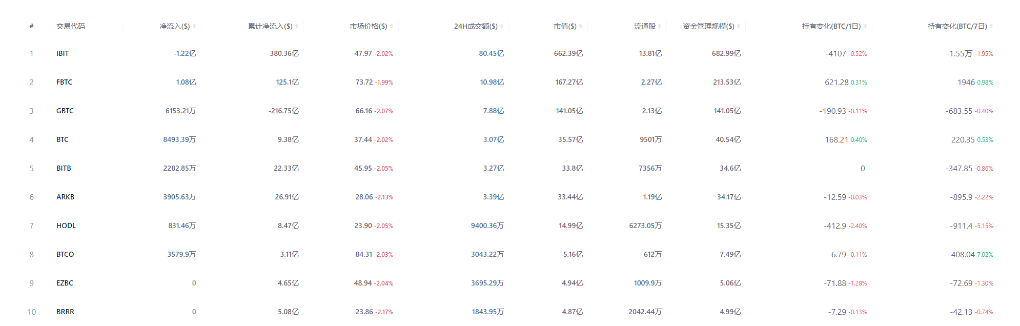

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?