-

Bitcoin experiences a modest 2% decline to $104,970, yet on-chain analytics indicate this dip might be a short-lived correction.

-

A significant liquidity cluster near $103,000 acts as a robust support level, mitigating further downside risks in the market.

-

Geopolitical tensions, particularly between Israel and Iran, remain a critical factor influencing Bitcoin’s near-term price trajectory, with potential for either recovery or deeper declines.

Bitcoin dips 2% amid geopolitical tensions but strong liquidity support near $103K suggests potential rebound; on-chain data reveals cautious optimism in BTC market.

BTC Bulls Hold the Line with Strong Liquidity Support

Bitcoin’s recent price action shows resilience despite a 2% pullback, largely due to a concentrated liquidity cluster forming around the $103,000 level. This cluster, highlighted by BTC’s liquidation heatmap, indicates a significant accumulation of buy orders poised to absorb selling pressure if prices approach this zone.

Liquidation heatmaps serve as crucial tools for traders, pinpointing price levels where leveraged positions are vulnerable to liquidation. The dense liquidity near $103,221 suggests that many market participants anticipate a price floor here, reinforcing the notion that Bitcoin is unlikely to breach this support easily.

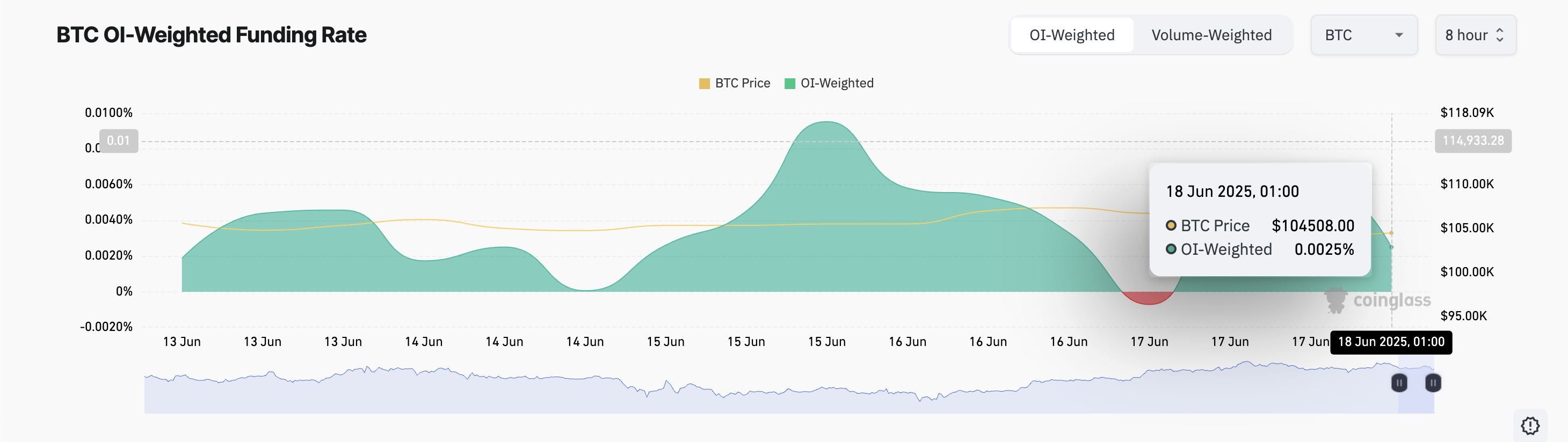

Adding to this optimistic outlook is Bitcoin’s positive funding rate, currently at 0.0025%, which reflects a market preference for long positions. This funding rate, a mechanism balancing perpetual futures prices with spot prices, indicates traders are willing to pay a premium to maintain bullish exposure.

Such a funding rate underscores a cautiously optimistic sentiment among futures traders, suggesting that despite the recent dip, confidence in Bitcoin’s upward potential remains intact.

$106,000 or Bust? Bitcoin’s Price Outlook Amid Rising Global Tensions

While on-chain data points to solid support, Bitcoin’s price remains vulnerable to external macroeconomic and geopolitical factors. The escalating conflict between Israel and Iran introduces uncertainty that could disrupt bullish momentum.

If geopolitical tensions intensify, Bitcoin may test the liquidity cluster near $103,061. Failure to hold this level could trigger a sharper decline toward $101,610, exposing BTC to increased downside risk.

Conversely, a de-escalation in global tensions or positive market catalysts could restore confidence, enabling Bitcoin to rebound and challenge the resistance near $106,548. This scenario aligns with the broader bullish narrative supported by on-chain indicators and funding rates.

Market Sentiment and Trading Volume Dynamics

Trading volumes have shown signs of contraction amid the recent price decline, reflecting a cautious stance among investors. Lower volumes often signal uncertainty, which can exacerbate price volatility in either direction.

However, the presence of strong liquidity zones and positive funding rates suggests that institutional and retail participants are strategically positioning themselves for a potential recovery, awaiting clearer market signals before committing further capital.

Conclusion

Bitcoin’s current 2% dip to around $104,970 appears to be a temporary correction supported by a robust liquidity cluster near $103,000 and a positive funding rate that signals underlying bullish sentiment. Nevertheless, the cryptocurrency’s short-term trajectory remains sensitive to geopolitical developments, particularly the escalating tensions between Israel and Iran. Traders should monitor these external factors closely, as they will likely dictate whether Bitcoin consolidates above key support levels or faces deeper declines. Maintaining a balanced perspective and leveraging on-chain data can provide valuable insights for navigating this volatile environment.