Semler Scientific hires crypto industry veteran, plans to double bitcoin holdings by end of year

Quick Take As of June 4, Semler Scientific (SMLR) holds 4,449 BTC worth approximately $462 million at current prices. Joe Burnett, its new director of Bitcoin strategy, previously served as director of market research at Unchained and was head analyst and product manager at Blockware Solutions.

Semler Scientific announced Thursday the hiring of Joe Burnett as its new director of Bitcoin strategy, as well as a three-year plan to own 105,000 bitcoin.

Using proceeds from equity and debt financings and cash flows from operations, the Nasdaq-listed healthcare tech company plans to hold 10,000 BTC by the end of 2025, 42,000 BTC by year-end 2026, and 105,000 BTC by year-end 2027.

"We are witnessing the global monetization of Bitcoin as a superior form of money," Burnett said in the release . "...Semler Scientific is committed to massively growing its Bitcoin treasury in a highly accretive manner for stockholders, guided by a long-term conviction that Bitcoin is the ultimate long duration asset to hold. We are determined to build one of the largest corporate Bitcoin treasuries in the world."

Burnett previously served as director of market research at Unchained, a Bitcoin-focused financial services company. He has hosted "top macro and Bitcoin thinkers" on various podcasts, the company said in the release. Before Unchained, Burnett was head analyst and product manager at Blockware Solutions.

As of June 4, Semler Scientific holds 4,449 BTC worth approximately $462 million at current prices. The firm is among the top 15 corporate holders of bitcoin, though still well behind industry leader Strategy.

Semler Scientific says it was the second U.S. public company (after Strategy) to adopt "the Bitcoin Standard." There are now nearly 230 firms that have adopted a bitcoin treasury strategy in some form, The Block previously reported .

Semler Scientific first announced its Bitcoin treasury strategy in May 2024 and has achieved approximately 287% BTC Yield, with a $177 million BTC $ Gain through June 3, the company said in a press release.

Semler Scientific's stock trades around $32 per share with a market cap of $375 million, according to The Block's SMLR price data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

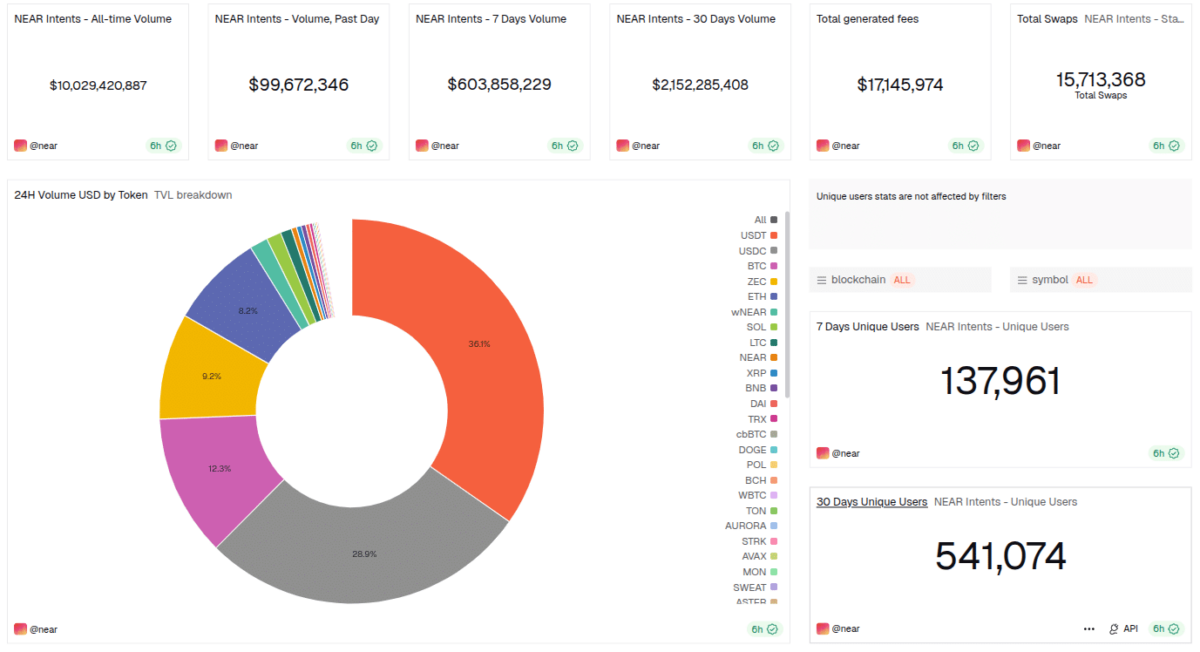

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund