Hashrate Sinks to 8-Month Low—Golden Entry or Looming Risk for Bitcoin Miners?

Bitcoin’s hashrate drop signals pressure on miners but opens profit opportunities with the coming difficulty adjustment. While network security remains intact, macroeconomic uncertainty and miner behavior could shape Bitcoin’s near-term market outlook.

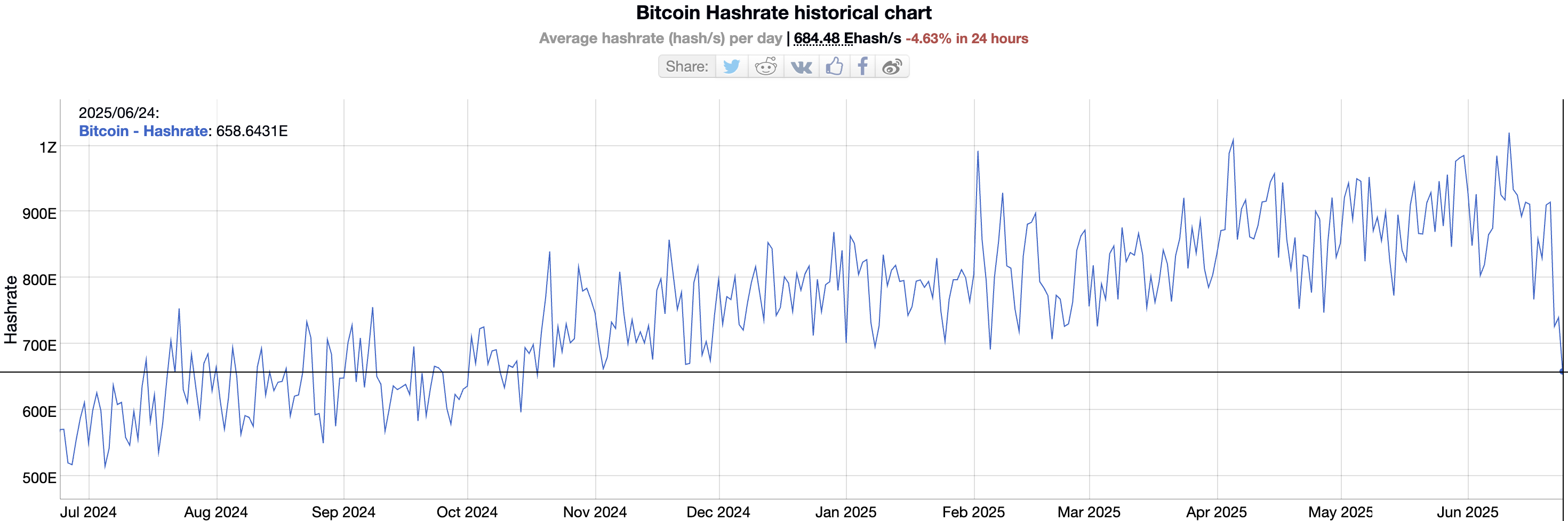

According to data from BitInfoCharts, Bitcoin’s daily average hashrate has dropped to 684.48 EH/s, the lowest since mid-October last year.

This decline, from a peak of 966 EH/s on June 20, 2025, raises a significant question: is this an opportunity or a risk for the cryptocurrency market?

Hashrate has Decreased, but Not to Its Lowest

Although Bitcoin’s current hashrate has fallen to a low level, it is still much higher than the 379.55 EH/s recorded in July 2023. This ensures that the Bitcoin network remains safe to some extent.

Bitcoin hashrate. Source:

BitInfoCharts

Bitcoin hashrate. Source:

BitInfoCharts

The primary cause of this decline could be related to the surge in Bitcoin mining costs, which increased by more than 34% in Q2 2025 when the hashrate hit new highs, as previously reported by BeInCrypto. Higher electricity prices and hardware and maintenance costs have forced many miners to suspend operations to avoid losses.

Additionally, energy-saving programs have contributed to the hashrate reduction, as some mining farms participate in grid load reduction initiatives. Or the war in Iran also contributed to this decline.

“Listen, I know “Hashrate is down because Iran got bombed” is a great meme, but if you actually mine Bitcoin you’re looking at US weather patterns.” X user Rob Waren shared.

The Bitcoin market has maintained remarkable stability despite the current hashrate situation. Bitcoin’s price is currently at $106,000, indicating positive investor sentiment.

Bitcoin ETFs, especially BlackRock with $70 billion in assets under management (AUM), continue reinforcing confidence in Bitcoin as a safe-haven asset, even as the US stock market plummets. This reflects the growing separation between Bitcoin and traditional financial markets.

Bitcoin Mining Difficulty Expected to Decrease by 9.37%

Another critical factor is the upcoming mining difficulty adjustment, scheduled for June 29, 2025. According to CoinWarz, the difficulty will drop from approximately 126.41 T to 114.40 T, a reduction of about 9.37%.

Bitcoin mining difficulty. Source:

CoinWarz

Bitcoin mining difficulty. Source:

CoinWarz

This is an opportunity for miners, as the lower difficulty will increase profits, encouraging them to return to the network. However, if the hashrate does not recover in time, the Bitcoin network could face a slight security risk, although the current 684.48 EH/s level is still sufficient to protect the network from 51% attacks.

The hashrate decline could be a positive signal in the long term, as it weeds out inefficient miners. At the same time, Bitcoin’s stable price at $106,000, combined with the growth of ETFs, indicates that the market still believes in Bitcoin’s potential.

However, risks remain. If the hashrate drops further and the difficulty adjustment does not occur in time, selling pressure from miners could cause Bitcoin’s price to decline. Additionally, macroeconomic factors such as geopolitical tensions and the Fed’s interest rate policies could impact the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Projects Still Lining Up for Listing in This Bear Market

The next potential trading opportunity.

A whale who once made nearly 100 millions in profits shares: Why I no longer trade on HyperLiquid?

A mature financial system would never rely solely on "luck" and "hope" as its final safety net.

DappRadar, another tear of the era

"High value, low payment" is a problem that Web3 tool products have yet to solve.

Bitcoin falls below the 90,000 mark—where is the market headed?

A quick overview of market outlook analyses from traders and industry experts.