Near Protocol faces pivotal vote to slash token inflation by half

A new proposal from HOT Protocol, a decentralized group operating on the NEAR Protocol, has called for a significant reduction in the AI crypto project‘s token inflation rate.

On June 24, the decentralized organization submitted a plan to slash NEAR’s annual inflation rate from 5% to 2.5%. The proposal aims to enhance the long-term sustainability of the crypto project’s token and realign incentives across the network.

According to the proposal, the current 5% inflation rate has become a liability, harming NEAR’s competitiveness by “causing unnecessary token supply growth and dilution.”

HOT protocol explained that NEAR’s inflation rate was designed with the assumption that fee burns from high transaction volumes would offset much of the supply growth. In practice, however, only 0.1% of the token supply was burned over the past year.

As a result, the full inflation rate continues to inflate the circulating supply by over 60 million NEAR annually, outpacing actual network growth and user activity.

To counter this, the new proposal suggests reducing the staking yield from 9% to 4.5%, which could make NEAR-based DeFi offerings more competitive.

While this might lead some validators to exit, it also opens space for new demand-generating features, including transaction fee revenue from Intent-based models.

The DAO highlighted the importance of its proposal, stating:

“Reducing NEAR’s inflation is an urgent priority. Every additional month of the status quo means millions of new NEAR entering circulation, which is not only dilutive but also unnecessary given the low fee burn. High inflation without high usage is unsustainable.”

Community support

The proposal has drawn strong backing from the NEAR ecosystem, with many industry players expressing support.

Illia Polosukhin, co-founder of NEAR Protocol, endorsed the plan, saying it better positions NEAR as a potential store of value in emerging AI-focused environments.

He also highlighted the need to reduce the reliance on staking as the primary source of yield, a dynamic that has limited DeFi innovation on NEAR so far.

Avichal Garg, the co-founder of Electric Capital, echoed similar views, while adding:

“[I am a] big fan of this for the NEAR ecosystem. The future of crypto [is] lower emissions, fee switches to drive revenue to tokenholders, and [rewarding] long-term holders via more revenue.”

Meanwhile, the proposal is currently undergoing a validator vote and requires a two-thirds majority to pass. As of press time, 13.36% of the required 66.67% threshold has been secured.

If approved, implementation is expected by Q3 2025, pending a smooth technical rollout and final community validation.

The post Near Protocol faces pivotal vote to slash token inflation by half appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PI Price Analysis: PI Holds $0.20 Support After Triangle Breakdown—What’s Next?

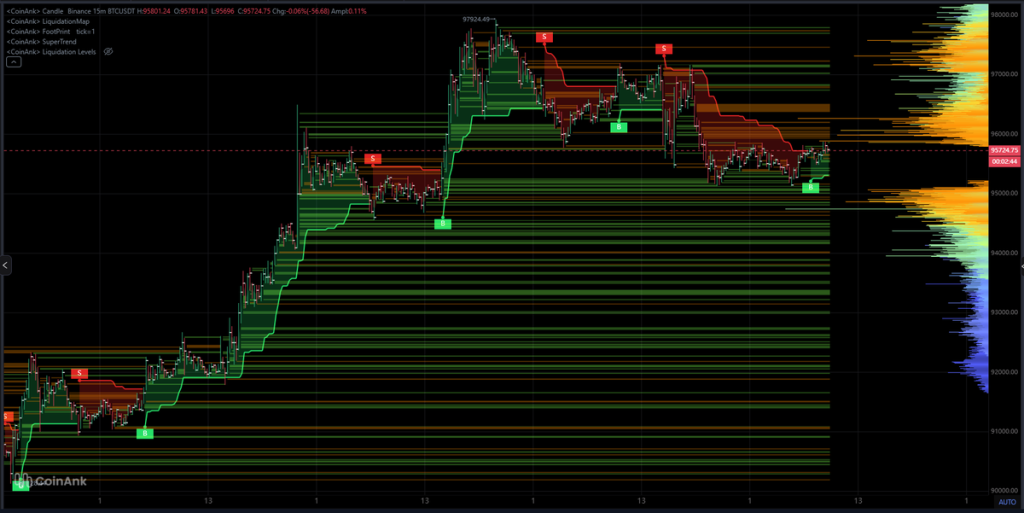

Bitcoin Trend Cools After Spike to $98K: Key BTC Price Levels to Watch Over the Next 48 Hours

Ethereum Price Hits a Key Zone vs. Bitcoin—Is an Altcoin Rotation Finally Starting?

XRP News: Ripple Says RLUSD Volumes Could Move From Ethereum to XRP Ledger