Ethereum-based stablecoin adoption hits fresh all-time high with over 750,000 unique weekly users — a new all-time high

2025/06/24 16:00

2025/06/24 16:00

Ethereum stablecoin senders have surged to a new all-time high, exceeding 750,000 unique weekly users across major stablecoins including USDT, USDC, BUSD, and DAI.

This milestone represents the culmination of what appears to be "stablecoin season," characterized by heightened institutional attention and, more importantly, substantial user adoption. The steady upward trajectory throughout 2024 and into 2025 suggests that stablecoin usage has moved beyond speculative interest into genuine, utility-driven adoption.

The current stablecoin landscape on Ethereum remains dominated by two major players, though the competitive dynamics are beginning to shift. USDT has maintained its position as the largest stablecoin by market capitalization, with $73 billion in supply on Ethereum, while USDC holds $41 billion. Together both tokens account for the majority of the approximately $134 billion total stablecoin market on the network.

Other stablecoins collectively represent around $20 billion in supply, indicating that new entrants have room to capture a meaningful market share despite the dominance of established players.

The growing user base is driving increased competition among stablecoin issuers as they seek to differentiate their offerings. As the market matures, companies are likely to compete more aggressively for users by offering lower transaction fees, enhanced yield opportunities, and incentives for potential holders. This competitive pressure could benefit end users through improved services and reduced costs, while also spurring innovation in stablecoin design and functionality.

The sustained growth in stablecoin usage reflects broader trends toward digital dollar adoption and crypto-enabled financial services. As more traditional financial institutions and payment processors integrate stablecoin infrastructure, adoption may accelerate further, establishing stablecoins as critical infrastructure for digital commerce.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

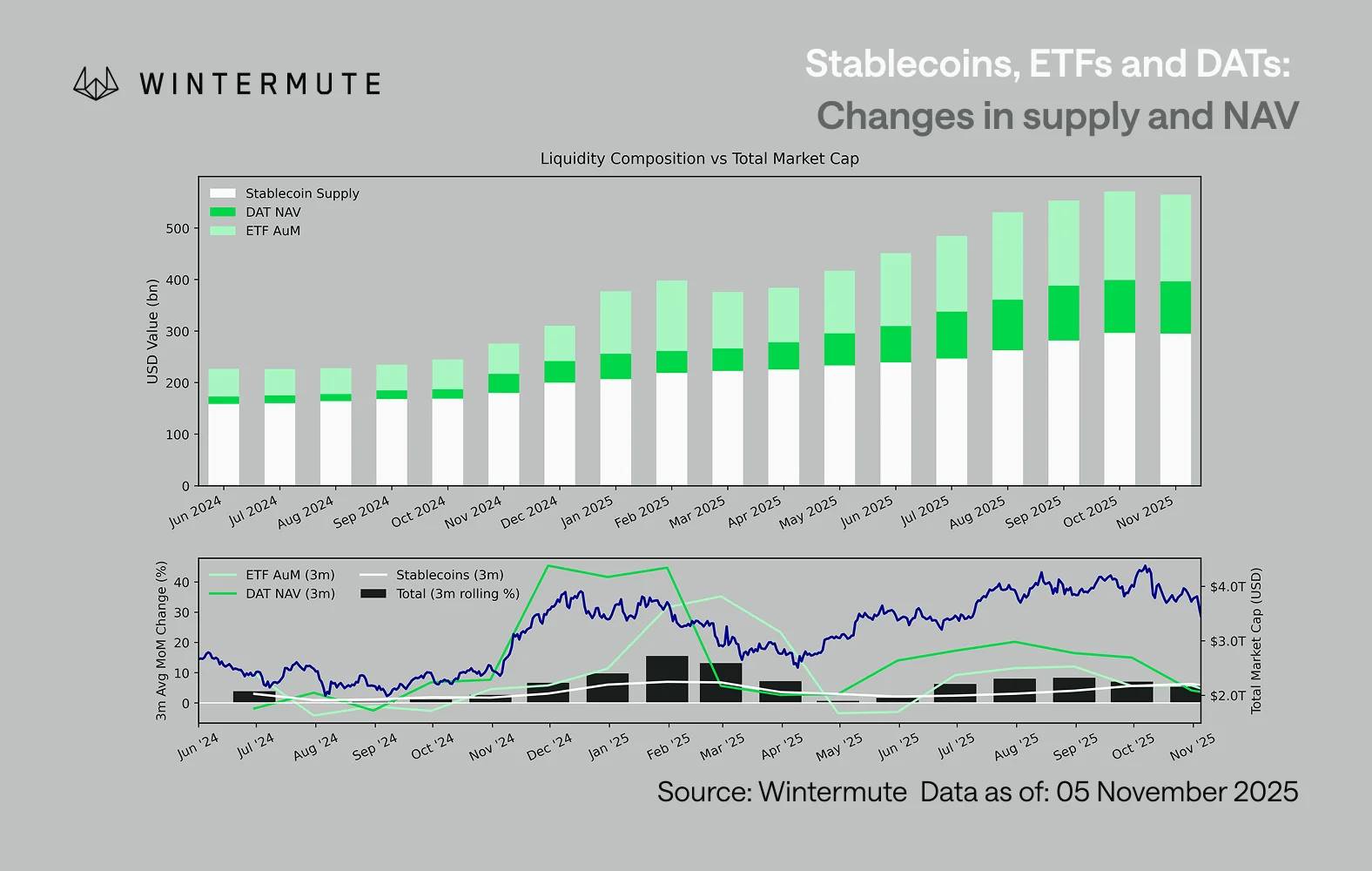

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.

Crypto: Balancer publishes a preliminary report on the hack that targeted it