Dow Jones down, Nasdaq gains while S&P 500 nears record highs

Tech stocks were led slightly higher as the S&P 500 approached record levels following the Israel–Iran ceasefire.

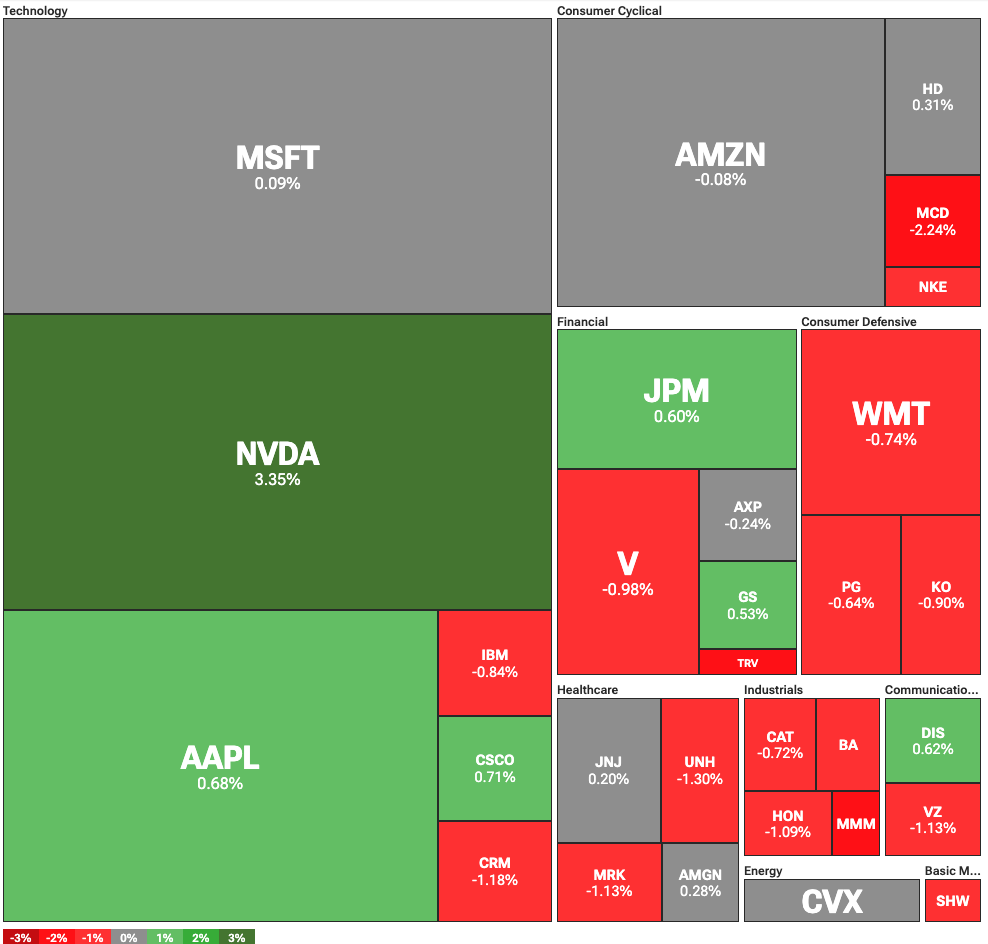

Major U.S. stock indices were mixed as the S&P 500 approached its all-time high. On Wednesday, June 25, the Dow Jones was down 151.95 points, or 0.35%, while the tech-focused Nasdaq gained 0.24%. The S&P 500 was mostly flat, trading at 6,090 points, close to its February all-time high of 6,144.

Stocks are stabilizing after a major rally earlier this week on the Iran–Israel ceasefire. Just days ago, tensions had threatened to escalate into a broader regional war, with the U.S. facing another potential Middle East entanglement.

Now, markets are adjusting back to their normal dynamics. Crude oil prices also rose 2% to $65 per barrel after dropping from the monthly highs reached during the conflict. On the other hand, tech stocks are gaining as traders see signs of potential rate cuts this year.

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Nvidia near ATH, Trump looking for Powell’s replacement

In particular, Nvidia had strong gains , rising 3.4% to $152.93. This puts it on track to surpass its intraday all-time high of $153.13, last seen in January. The rally also pushed Nvidia’s market cap to $3.71 trillion, surpassing Microsoft’s $3.65 trillion.

The rally was likely fueled by Bank of America’s guidance on the stock, which identified it as the leader in AI chips. Moreover, Nvidia and the broader AI sector could benefit from the easier monetary policy that U.S. President Donald Trump is advocating.

After months of pressuring Federal Reserve Chair Jerome Powell, Trump stated that he is actively seeking a replacement. The President said he is now down to 3 or 4 candidates to replace Powell as Fed Chair. Trump did not say whether he would fire Powell before his term officially ends in May 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.

Elon Musk at the Center of an Unprecedented Showdown with the EU

Stablecoin Payments: Stripe’s Tempo Blockchain Launches Public Testnet