Dow Jones up 300 points as weak labor market fuels rate cuts bets

Signs of weakness in the labor market are fuelling bets that the Fed might cut interest rates sooner.

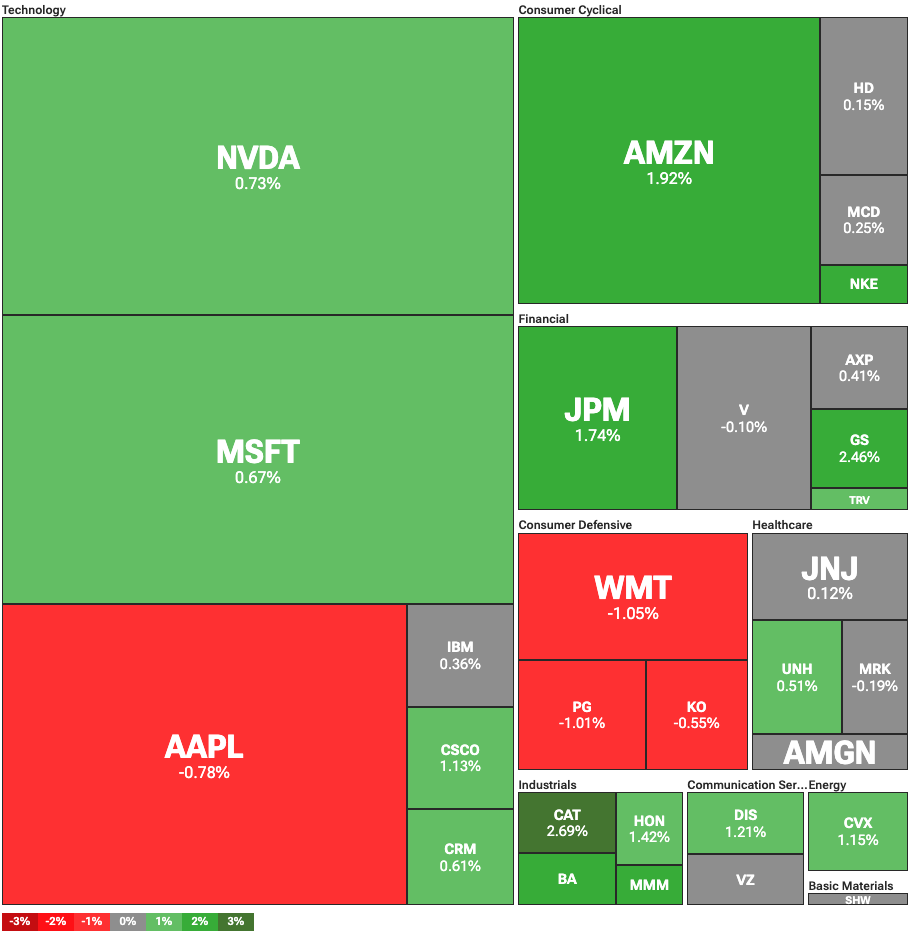

Markets are up, with the S&P 500 near record levels, as traders are betting on rate cuts. On Thursday, June 26, Dow Jones led the market rally, up 343 points, or 0.80%. At the same time, the S&P 500 was up 0.65%, trading at 6,132 points, approaching the February record high of 6,144 points. The tech-heavy Nasdaq was up 0.70%.

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Nvidia continues to rally after reaching an all-time high on Wednesday. The company reclaimed the top spot among all global firms by market cap, surpassing Microsoft at $3.77 trillion. The stock’s surge had also triggered a rally among other semiconductor firms across Asia.

Stock markets have largely absorbed the end of Middle East tensions, and are now looking at the Federal Reserve for cues. In this context, Thursday’s labor market data was seen as a good sign, especially for risk stocks.

The Department of Labor’s survey showed that insured unemployment claims were at 1.974 million. The figure rose by 37,000 from the revised levels of last week. What is more, this was the highest level of insured unemployment since November 2021, at the height of the pandemic.

Fed to finally cut rates?

Weak labor market statistics, while bad for the economy in general, may push the Fed to cut interest rates. This news comes after continued pressure from U.S. President Donald Trump. On Wednesday, Trump stated that he was close to picking a replacement for Fed Chair Jerome Powell.

Trump openly criticized Powell for not cutting interest rates. Still, the President shied away from directly stating that he would replace Powell before the end of his term in 2026. In any case, Powell consistently resisted pressures from the White House, defending the Fed’s independence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Which targets are Wall Street short sellers eyeing? Goldman Sachs reveals the short-selling undercurrents amid the AI wave

Data shows that short selling in the US stock market has reached a five-year high. However, investors are not recklessly challenging AI giants; instead, they are targeting so-called "pseudo-beneficiaries"—companies that have surged on the AI concept but lack core competitiveness.

Aethir establishes DePIN computing leadership with enterprise-level growth: a new generation of computing infrastructure model driven by real revenue

Against the backdrop of surging global demand for AI infrastructure, traditional centralized cloud computing systems are gradually revealing their capacity bottlenecks and efficiency ceilings. With the rapid adoption of large model training, AI inference, and intelligent agent applications, GPUs are evolving from mere “computing resources” to “strategic infrastructure assets.” Amid this structural transformation of the market, Aethir, through its decentralized physical infrastructure network (DePIN) model, has built the industry’s largest and most commercially advanced enterprise-grade GPU computing network, quickly establishing a leading position in the sector. Commercialization breakthroughs in large-scale computing power infrastructure: To date, Aethir has deployed over 435,000 enterprise-grade GPU containers worldwide, supporting the latest NVIDIA hardware architectures such as H100, H200, B200, and B300, delivering a cumulative total of over 1.4 billion hours of real computing services to enterprise clients. In just the third quarter of 2025, Aethir achieved $39.8 million in revenue, pushing the platform’s annual recurring revenue (ARR) past $147 million. Aethir’s growth is driven by genuine enterprise demand—including AI inference services, model training, large AI agent platforms, and production workloads from global game publishers. This revenue structure marks the first time the DePIN sector has seen...

BlackRock’s Massive Bitcoin Sell-Off? Full Analysis of the Truth, Risks, and BTC Trends Through the End of 2025

Bitcoin Miners Turn to AI, but Revenues Lag Behind