This Could Spark 10x ‘Exponential’ Growth in Ethereum (ETH) Network Fees, Says Investor Tom Lee

2025/06/29 16:00

2025/06/29 16:00Fundstrat’s head of research Tom Lee says one catalyst could trigger an exponential surge in network fees for Ethereum ( ETH ), the second-biggest crypto by market cap.

In a thread on the social media platform X, Lee says the next generation will likely prefer to do their banking with crypto-friendly banks, driving a trend toward Bitcoin ( BTC ) and potentially Ethereum corporate treasuries.

Lee says that banks, credit card issuers, PayPal and other similar companies will hold crypto assets on their balance sheets as working capital.

Therefore, Lee says some companies like Microstrategy (MSTR) and Metaplanet (MTPLF) arguably represent the “high margin” component of future financial architecture.

The investor also says that such a trend would be beneficial for Ethereum given its domination of stablecoins, which are necessary to provide liquidity for crypto assets.

“This is positive for the layer-1 blockchains issuing stablecoins.

Why Ethereum?

– the majority of stablecoins minted on Ethereum

– most of the ‘real world assets’ (RWA) in crypto are on Ethereum, such as stablecoins, tokenized equities, tokenized real estate

Stablecoin fees are 30% of Ethereum ETH network fees today:

Treasury Secretary Scott Bessent recently said >$2 trillion USD market for stablecoins is reasonable

– this is 10X exponential growth in network fees for ETH Ethereum

– other nations may mint stablecoins = upside.”

According to DefiLlama , Ethereum has generated over $20 billion in all-time network fees and has brought in over $128,709 in revenue in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

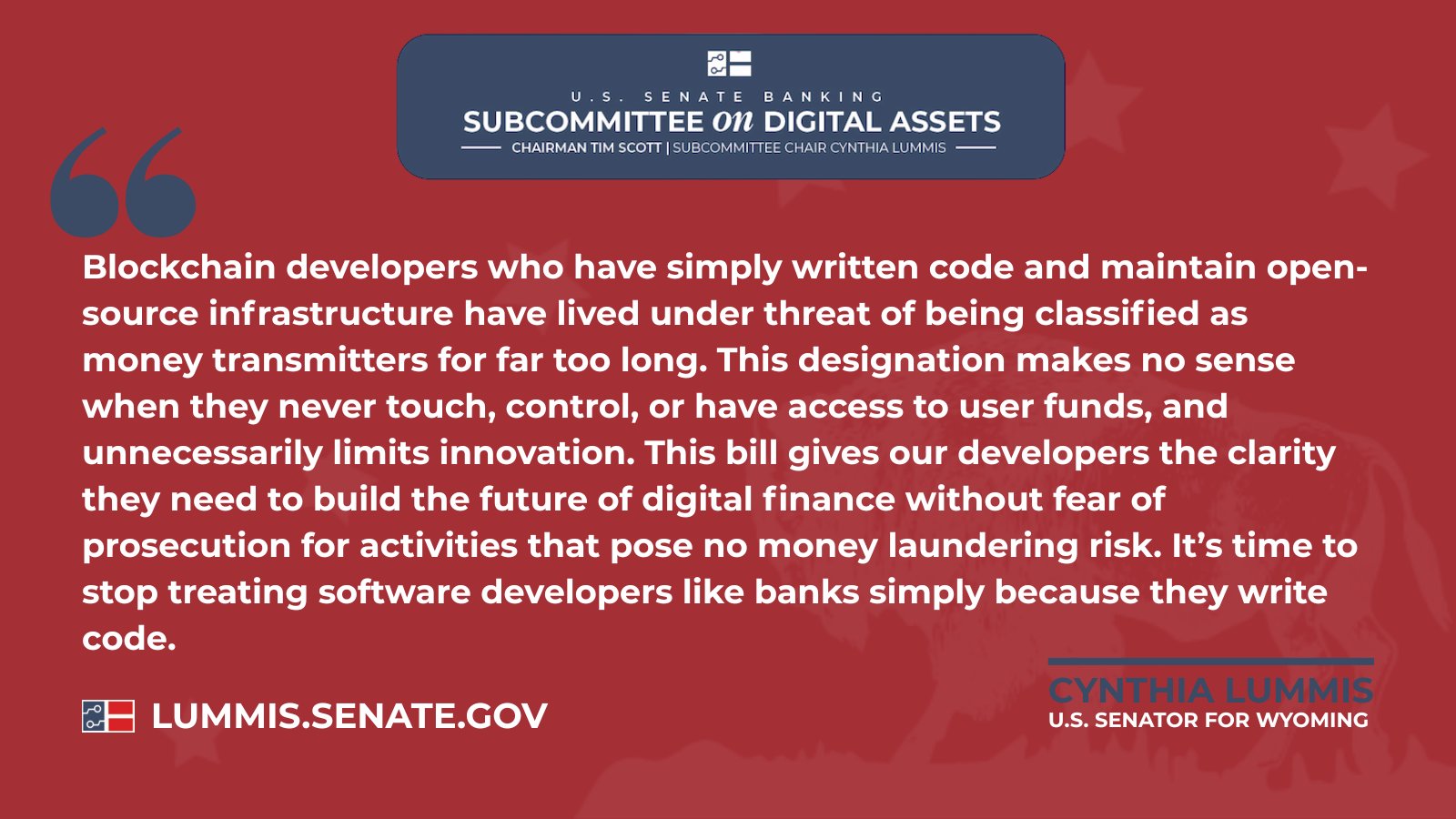

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm