U.S. Secret Service team has recovered nearly $400 million in crypto from criminals: Bloomberg

Quick Take The U.S. Secret Service’s Global Investigative Operations Center team has recovered $400 million in digital assets from criminals over the past decade, Bloomberg reported on Saturday. Much of the recovered assets sits in a single cold-storage wallet, according to the report. The Secret Service team, alongside federal authorities from the FBI and the U.S. Attorney’s Office, filed to seize $225 million in crypto in June, the largest seizure in the team’s history.

The Secret Service, best known for its work in providing protection to American political leaders, has also become a significant crime-fighter in the crypto sphere.

In addition to the widely-publicized seizure of $225 million in crypto last month, following a massive investigation that also involved the FBI and the U.S. Attorney's Office, the Secret Service's Global Investigative Operations Center (GIOC) has recovered an additional $175 million in digital assets from criminals over the past decade, according to a recent report from Bloomberg illuminating the team's efforts, citing confidential sources.

Bloomberg also reported that much of the recovered funds, totaling around $400 million, "sits in a single cold-storage wallet." The recovery effort harkens back to the department's original mandate, as an agency of the U.S. Treasury department combating an earlier form of financial scheme: counterfeiting money.

In addition to the seizures, the GIOC has conducted free, week-long training sessions in more than 60 countries to inform local law enforcement officials on how to identify and prevent crypto-based scams and crimes.

“Sometimes after just a week-long training, they can be like, ‘Wow, we didn’t even realize that this is occurring in our country,’” Kali Smith, the lawyer leading the department's cryptocurrency strategy, told Bloomberg.

Coinbase previously detailed its work aiding the Secret Service in tracking funds, and Tether, back in December, 2023, said it onboarded the FBI and the Secret Service to the company's platform to better assist in asset freezing and seizing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

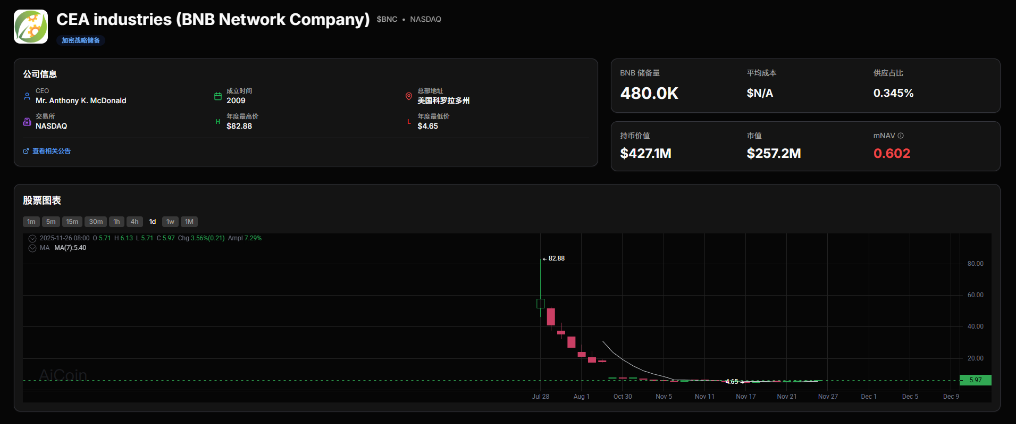

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage