Bitcoin’s price movement to a new all-time high of $112,052 on Wednesday has made some investors re-evaluate their positions, with analysts warning that underexposed traders could be caught off guard if the rally continues. 10x Research analysts believe Bitcoin’s latest breakout could extend deep into the third quarter, reaching a price target of as high as $133,000.

According to Markus Thielen, head of research at 10x Research, the firm’s Bitcoin trend model flipped bullish on June 29. The model now places a 60% probability of BTC continuing its upward market price move over the next two months.

Thielen’s analysis mentions a potential 20% gain during this period, which would see Bitcoin tread upwards to $130,000 at current prices.

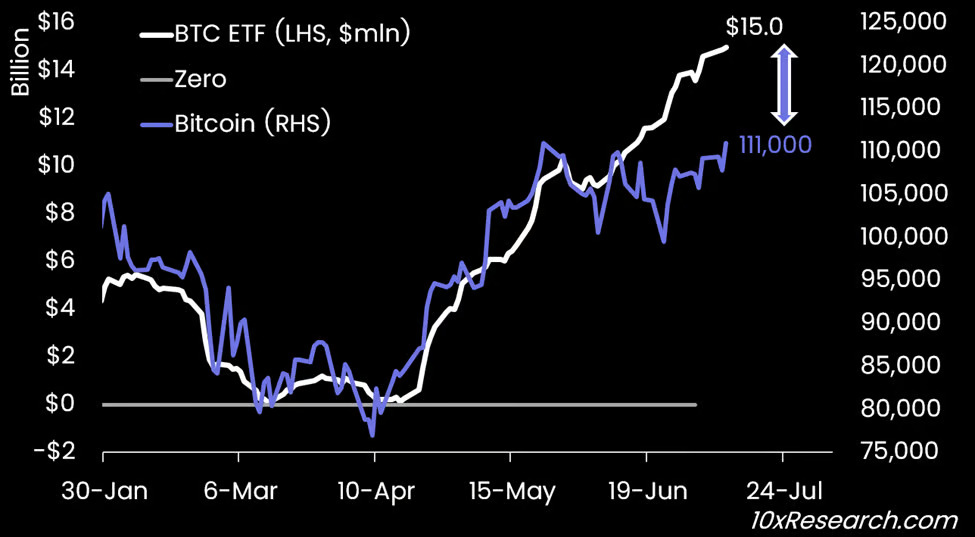

“Bitcoin is breaking out, fueled by relentless ETF demand and a series of policy catalysts on the horizon,” Thielen wrote in a market update released Wednesday. He reiterated that many traders are underpositioned following the previous month’s option expiry, leading to a “significant exposure roll-off.”

“We remain constructive,” he jotted down, explaining that current trading signals support the continuation of this bullish trend.

Call option buying: Traders eyeing an upside move

According to the 10x Research head, Bitcoin traders are now predominantly buying calls, which could mean there is a sentiment of being “underexposed to further upside.” Market participants may be racing to catch up with Bitcoin’s rally rather than driving it through spot buying.

He also explained that the current market bull run will likely extend into September, especially if upcoming macroeconomic events become favorable.

Bitcoin ETF flows – $15 billion net buying since mid-April. Source: 10xResearch

Bitcoin ETF flows – $15 billion net buying since mid-April. Source: 10xResearch

In the US Consumer Price Index (CPI) report scheduled for release on July 15, economists expect a “benign” CPI print to push people towards buying positions.

The third quarter hasn’t always been Bitcoin’s most favorable time of the year, with an average return of just 5.84% since 2013, according to data from CoinGlass. Still, Thielen is confident this year could be an exception, citing US pro-crypto policy changes and green ETF flows.

“Traders on the sidelines risk missing the move that could define this quarter,” he concluded.

ETF inflows show bulls in control

Even during weeks of consolidation, there was approximately $15 billion in silent accumulation through the US-based spot Bitcoin ETFs . On Wednesday alone, these ETFs attracted $215.7 million in inflows, according to data from Farside Investors.

Traders previously sitting on the sidelines are seemingly being forced to re-enter the market, potentially at much higher prices.

10x Research revealed that it has entered a long position in Bitcoin at $104,000, hedged with a $115,000 call option. The core position is up by $7,000, but the option has only gained $450 because of the market’s reduced implied volatility and time decay.

Still, Thielen said the trade was performing as expected and will soon transition into a higher trading range.

Ethereum ETFs on a market run

Ethereum surged over 5% on Wednesday, outperforming Bitcoin, Ripple, and Solana. The rally was accompanied by record trading activity in BlackRock’s spot ether ETF, ETHA, listed on Nasdaq.

More than 43 million shares of ETHA changed hands on Wednesday, the highest daily volume since the fund’s debut a year ago. According to Yahoo Finance, that figure nearly doubled the previous day’s volume of 24 million.

TradingView data also shows that ETHA’s 30-day average trading volume is up by 18.83 million shares, up from 12.97 million in the first week of June.

Investor interest has translated into robust capital inflows, with over $1.2 billion added to the fund since June. On Tuesday alone, net inflows reached $159 million, the largest single-day total since June 11, based on SoSoValue data.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites