Tether to End USDT Support on Five Blockchains by September

- Tether to end USDT on five blockchains, including Omni and Algorand, by September 1, 2025.

- Focus shifts to Layer 2 and active chains with stronger user and developer engagement.

- USDT remains the largest stablecoin with a market cap approaching $170 billion.

Tether, the largest issuer of stablecoins, has announced that it will cease USDT redemption and freeze tokens on five legacy blockchains. The support for Omni Layer, Bitcoin Cash SLP, Kusama, EOS, and Algorand will end on September 1, 2025. This step follows the company’s larger interest in streamlining its infrastructure and focusing more on networks that are more actively in use.

Sharing insights about the shift, Paolo Ardoino, CEO of Tether, stated that the move enables the firm to concentrate on platforms offering more scalability, developer engagement, and community participation. Further, he pointed out that a sharp drop in USDT usage across these five blockchains over recent years had led to the decision to sunset support.

The review considered data on blockchain applications, feedback from infrastructure partners, and market demand. Tether stated that legacy networks, such as the Omni Layer, which previously had a key role in its early growth, no longer align with the firm’s strategic focus. Additionally, USDT balances on the affected blockchains are low compared to global token developments. Nonetheless, Omni Layer holds approximately $82.9 million USDT, while the total values of Kusama, SLP, EOS, and Algorand are under $6 million.

Focus Shifts to Layer 2 Networks and Active Chains

Tether emphasized that this change will allow it to allocate technical and operational resources to more relevant blockchain ecosystems. The company plans to collaborate with DeFi-native and interoperable blockchains that are seeing increased activity from users and developers.

Ardoino confirmed the firm’s direction aligns with broader ecosystem changes. “As the digital asset ecosystem evolves, Tether remains committed to adapting alongside it,” he said. Furthermore, the company aims to strengthen support for Layer 2 solutions like the Lightning Network to meet users’ demands for fast and low-cost transactions.

Tether has been planning to phase out support of these blockchains over time. In August 2023, the company ceased minting new USDT on Omni Layer, Kusama, and Bitcoin Cash SLP. This was followed by a pause in the minting operations on EOS and Algorand in June 2024.

The stablecoin issuer advised that customers with assets on these blockchains redeem or request reissuance on a supported network. Non-customers may transfer their USDT via third-party service providers according to their terms.

Despite the end of support, the transition is expected to be smooth. The Algorand Foundation stated that users on its network should not experience disruption noting that customers were given a one-year timeline for redemption. DefiLlama data indicates that Circle’s USDC has surpassed USDT as the leading stablecoin on Algorand.

Stablecoin dominance on Algorand Source: DefiLlama

Related: EU’s MiCA Authorizes 53 Crypto Firms; Binance, Tether Left Out

USDT Dominance Unshaken Despite Blockchain Exit

Furthermore, Tether’s decision reflects an ongoing trend in the industry toward mergers and optimization of operations. As stablecoin competition intensifies, providers are focusing on performance, developer activity, and cross-chain utility. Removing underused blockchain integrations gives firms like Tether more agility to respond to network shifts and user preferences.

Currently, USDT is the largest stablecoin by market cap. According to CoinMarketCap’s latest data, its supply is nearing $170 billion. Tether reaffirmed its commitment to expanding its presence on chains that support broader use, faster settlement, and more reliable infrastructure.

Although the announcement represents the end of support for some early blockchain integrations, Tether’s refocus on Layer 2 and high-activity networks indicates a longer-term realignment. The sunsetting of these chains as part of the support allows the company to adapt to the next phase of growth in the digital asset infrastructure.

The post Tether to End USDT Support on Five Blockchains by September appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

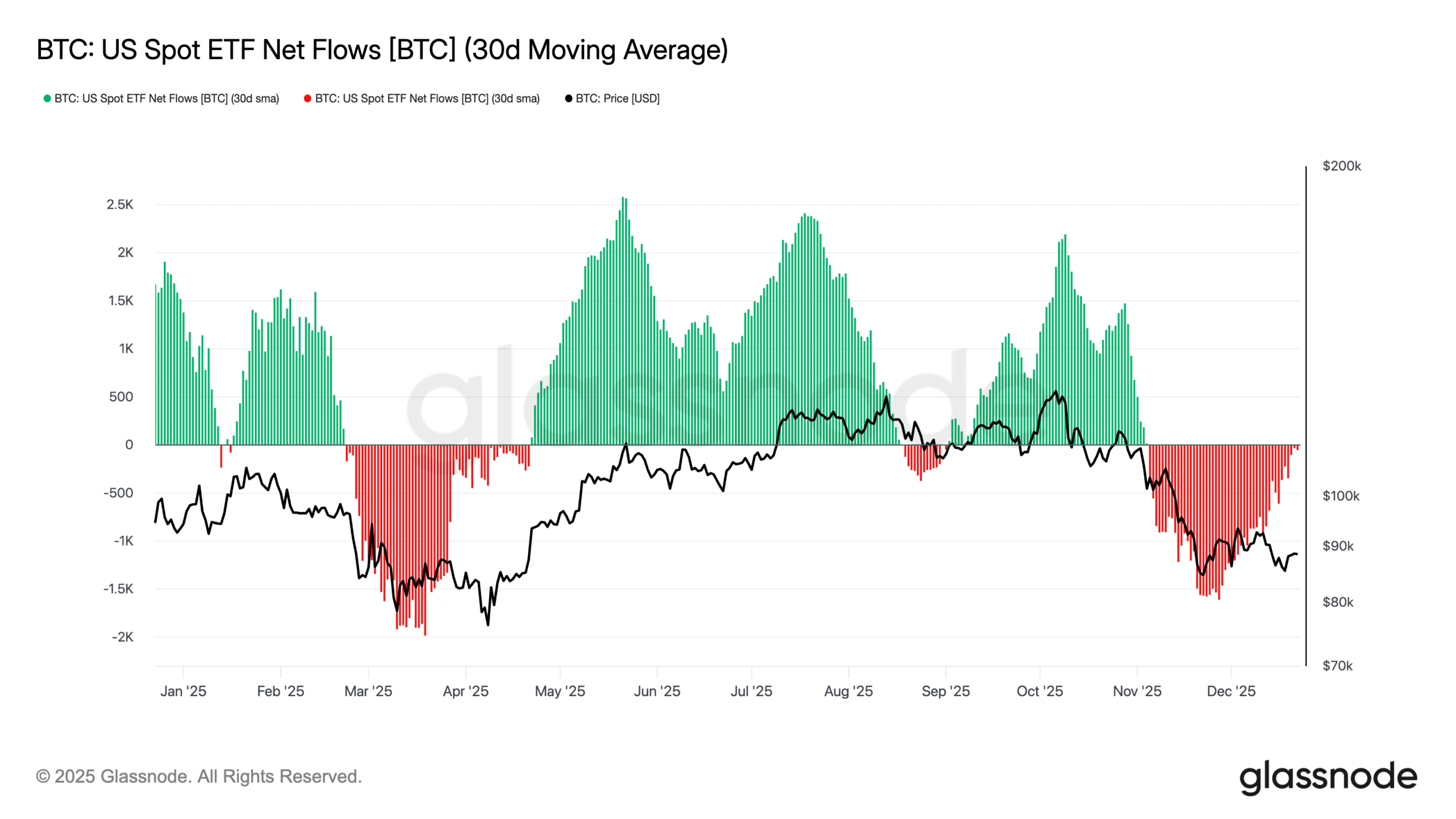

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens

Zoox issues software recall over lane crossings

The Biggest Bitcoin and Crypto Treasury Plays of 2025

Why Can’t Bitcoin Experience Massive Rallies Anymore? Anthony Pompliano Says the “Wild Era” Is Over and Explains Why