Arthapala Transfers 4,120 ETH to Exchange Within an Hour

- Arthapala’s ETH deposits raise selling pressure concerns.

- Potential impact on Ethereum price volatility.

- Community monitors over $200 million ETH transfers.

Arthapala, a suspected staking service provider, deposited 4,120 ETH, approximately $12.2 million, to a centralized exchange in the past hour.

Arthapala’s consistent transfers to exchanges could destabilize ETH prices, impacting market sentiment and liquidity.

Market Movements and Community Response

Arthapala, identified as a suspected staking and validation service provider , has been transferring large amounts of Ethereum to exchanges recently. The activity has prompted market watchfulness due to potential selling intentions exhibited by these movements.

The financial markets are seeing impacts with increased volatility attributed to Arthapala’s actions. On-chain analyst @ai_9684xtpa has reported that the address moved 118,907 ETH since June, indicating significant market movements.

“In the past hour, this address deposited another 4,120 ETH, valued at approximately $12.196 million, into an exchange. This activity is part of a larger trend observed since June 11, 2025, with the address having allegedly moved a total of 118,907 ETH, worth $202 million, for potential selling.”

The Ethereum community, focused on market stability, views these actions as potential selling pressure, which could lead to broader effects on the crypto market. No statements have been issued by regulatory authorities or influential market leaders on these developments.

Analysts note that sustained large-scale ETH outflows could lead to increased regulatory scrutiny. The historical precedent suggests similar sell-offs have previously caused market shake-ups, impacting not only Ethereum but also decentralized finance platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

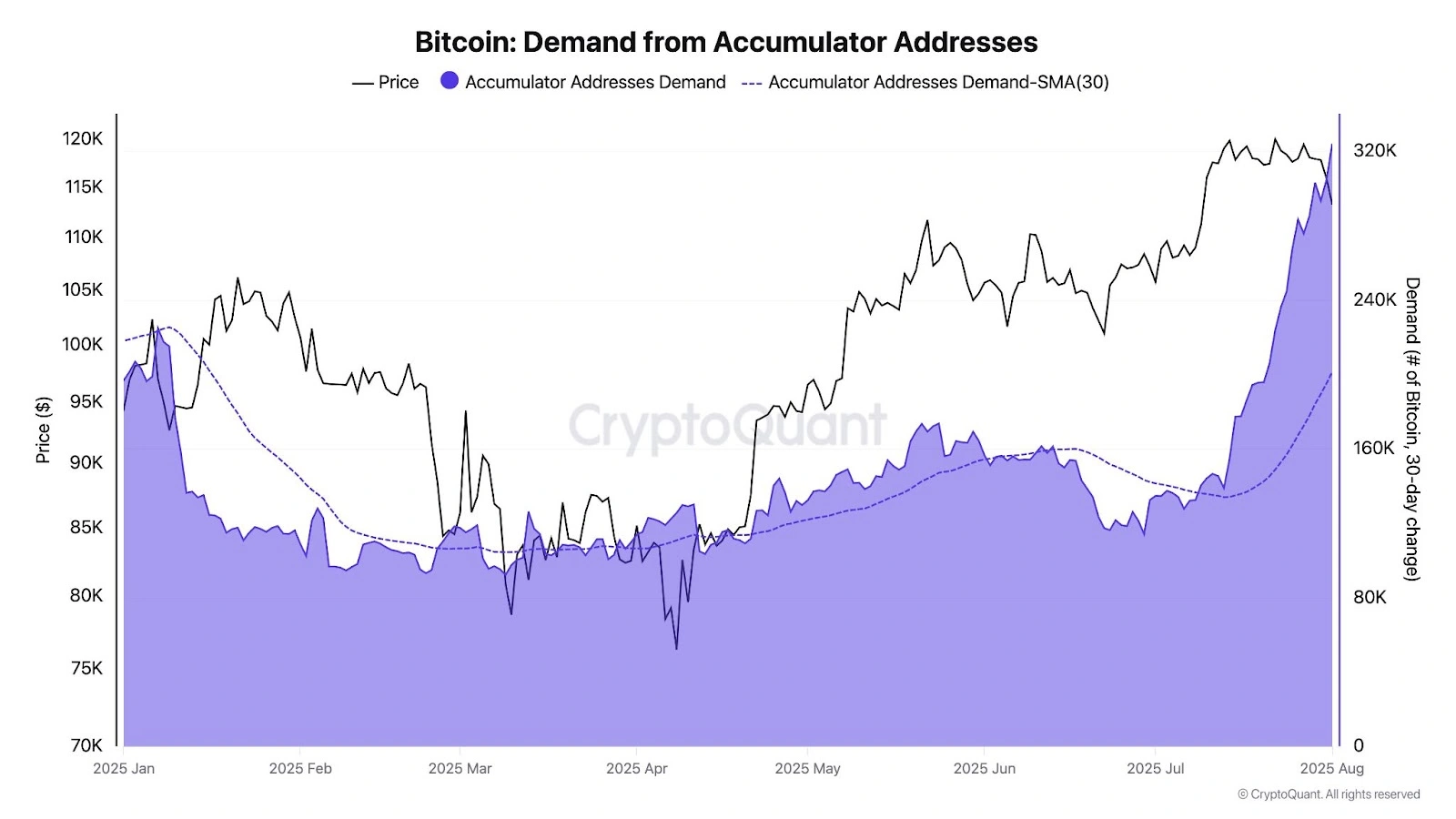

Bitcoin is still in a good place, but short-term holders might be a problem

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

SEC Appeals in Ripple XRP Case Nears Deadline

H100 Group Expands Bitcoin Holdings with $2.2M Funding