Bitcoin Reacts As CPI Shows Inflation Rose to 2.7% in June

Bitcoin saw a slight rise following June's CPI print, showing 2.7% inflation. With markets anticipating rate changes and tariff effects, focus now shifts to Fed policy.

The US Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI), showing inflation cooled in June. Crypto markets reacted in the aftermath, amid a growing influence of US economic signals on Bitcoin (BTC).

Focus now shifts to the wave of Federal Reserve (Fed) speakers on the schedule today. Their statements are expected to provide a window into the policy outlook ahead of the July 30 FOMC meeting.

Inflation Rose To 2.7% in June, US CPI Print Shows

According to the BLS, inflation rose at an annual rate of 2.7% in June, above economists’ expectations ahead of the data print.

CPI 0.3% MoM, Exp. 0.3%CPI 2.7% YoY, Exp. 2.6%CPI Core 0.2% MoM, Exp. 0.3%CPI Core 2.9% YoY, Exp. 2.9%

— zerohedge (@zerohedge) July 15, 2025

Ahead of the CPI print, consensus expected the headline to rise by 0.3% month-over-month (MoM), and accelerate to 2.6% Year-over-Year (YoY).

“ABOVE expectations for the first time in 5 months,” analyst Quinten noted.

It marks an extension of the May US CPI inflation reading, which showed consumer prices increased 2.4% annually.

Therefore, headline CPI inflation continues to rise for the second consecutive month, and analysts expect the Fed pause to continue.

“In just 2 months, CPI inflation in the US has risen from 2.3% to 2.7%. Critics will blame tariffs, and praisers will blame base effects. Regardless, the Fed will not cut interest rates this month,” wrote The Kobeissi Letter.

In the immediate aftermath, Bitcoin price recorded a modest surge, trading for $117,138 as of this writing.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

Ahead of the CPI price, markets had started de-risking, with Bitcoin sliding from its $123,000 high. BTC had slipped to the $116,900 range in the hours leading to the CPI print.

The otherwise muted reaction likely stems from traders and investors already pricing in this impact amid calls and expectations of rising inflation last month.

Bitcoin and Gold knew this was coming months ago.

— The Kobeissi Letter (@KobeissiLetter) July 15, 2025

The same sentiment was reflected among altcoins, with high-fundamental projects flashing red on Crypto Bubbles.

Probably de-risking ahead of the CPI print. pic.twitter.com/mHn9IDJDZr

— Kyledoops (@kyledoops) July 15, 2025

Meanwhile, analysts say geopolitical tension between Israel and Iran may have contributed to US inflation in June. This comes amid the perceived impact on oil prices after Iran constrained the Strait of Hormuz.

“It is expected to be higher than last month due to an increase in OIL price. The big question is whether it goes even higher than the expectations. The recent comment by Bessent seems like foreshadowing and bracing for a higher number. This could stir things up, and DXY appears to be moving a bit,” wrote Daan Crypto Trades.

Experts Blame Trump’s Tariffs, Will Fed Cut Interest Rates?

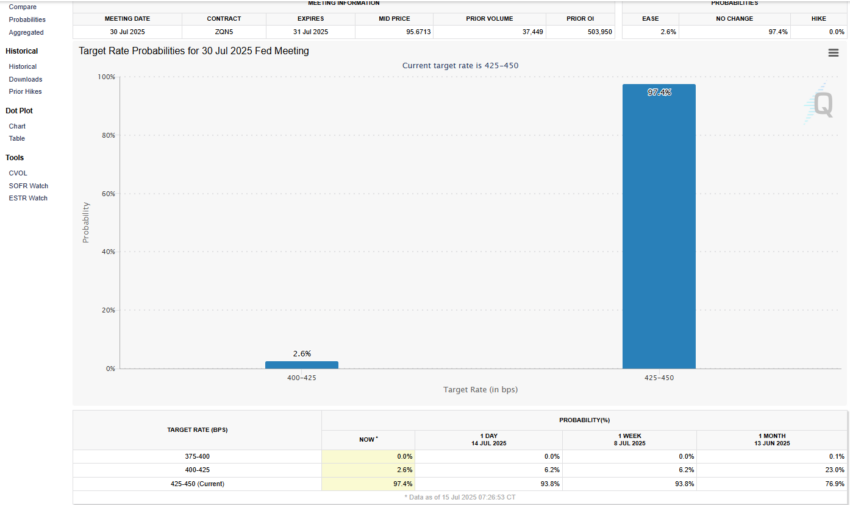

Before the June CPI print, the CME FedWatch Tool showed interest bettors predicting a 95.3% chance the Fed would keep interest rates unchanged between 4.25% and 4.50% versus a 4.7% chance of cutting rates to the 4.00% to 4.25% range.

This has since changed, with the FedWatch Tool showing a 97.4% probability the Fed will still keep interest rates paused.

Fed interest rate cut probabilities. Source:

Fed interest rate cut probabilities. Source:

The next FOMC meeting is due on July 30, just over two weeks out.

Economists saw it coming elsewhere, ascribing the rise of US inflation to Trump’s trade policies.

Like Fed chair Jerome Powell, private-sector forecasters anticipated inflation turning higher over the summer, an outlook drawn from businesses passing on Trump’s tariffs to consumers.

“We expect to see over the summer some higher readings,” Powell said during a July 1 conference.

Firms are running out of options after trying to shield customers from tariffs for a while. Previously, some went as far as stocking up on inventories in advance, while others actively absorbed part of the higher costs at the expense of lower margins.

They can do so no longer, with consumers now bearing the brunt.

“You’re still in an environment where businesses used a broad array of strategies to mitigate the effect of duties,” Bloomberg reported, citing EY-Parthenon Chief Economist Gregory Daco.

In hindsight, the minutes of the Fed’s June policy meeting, released last week, accentuate the rising inflation outlook.

As BeInCrypto reported, officials were divided on the potential impact of tariffs on US inflation and, by extension, their course of monetary policy.

Notwithstanding, the next CPI print is always the most important after the last one, and today’s inflation reading is no different.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OracleX Global Public Beta: Restructuring Prediction Market Incentive Mechanisms with "Proof of Behavior Contribution"

OracleX is a decentralized prediction platform based on the POC protocol. It addresses pain points in the prediction market through a dual-token model and a contribution reward mechanism, aiming to build a collective intelligence decision-making ecosystem. Summary generated by Mars AI The content of this summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Bitcoin is not "digital gold"—it is the global base currency of the AI era

The article refutes the argument that bitcoin will be replaced, highlighting bitcoin's unique value as a protocol layer, including its network effects, immutability, and potential as a global settlement layer. It also explores new opportunities for bitcoin in the AI era. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?