Grayscale Files Confidential IPO Plans with SEC

- Grayscale’s IPO aims for 2025, involving confidential SEC filing.

- Bitcoin and Ethereum closely impacted.

- Market anticipates increased capital and crypto adoption.

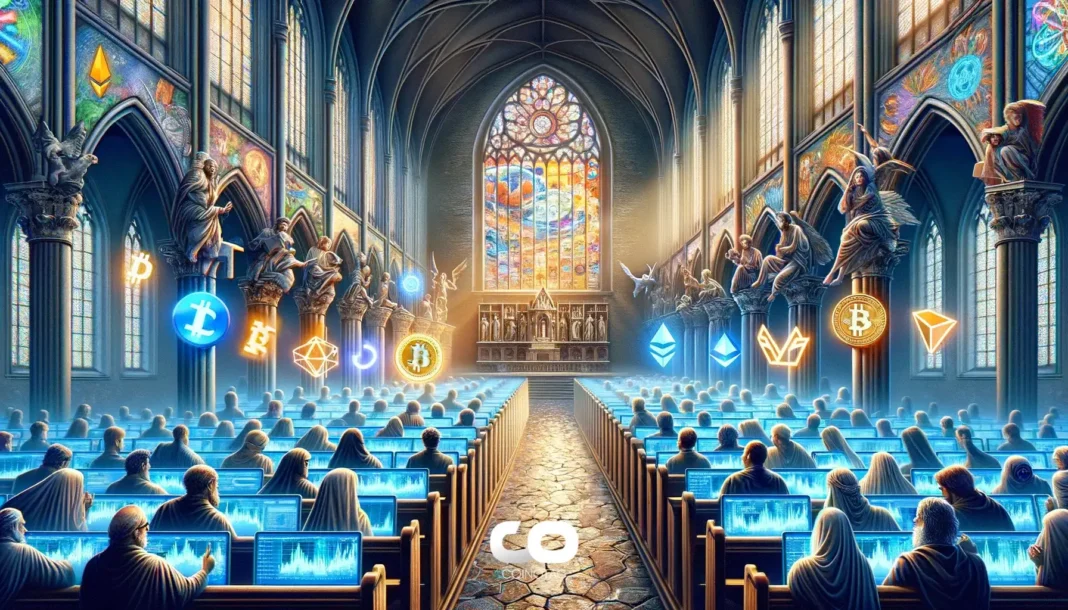

The event is pivotal in the digital asset space, potentially mainstreaming crypto finance and influencing regulatory perspectives.

Main Content

Grayscale’s IPO Plans

Grayscale Investments’ confidential filing with the SEC suggests an initial public offering (IPO) as early as 2025, reflecting ambition for broader market engagement. This follows its successful transition to ETF products.

The firm is led by CEO Michael Sonnenshein, who has overseen significant legal victories and transformations. No official comment has been made by executives due to SEC regulations on confidential filings.

Market Impact

The IPO may influence the digital asset market by providing access to new capital and partnerships. Both Bitcoin and Ethereum, integral to Grayscale’s offerings, could see immediate market impacts.

The move aligns with regulatory shifts, especially following Grayscale’s victory in securing the first spot Bitcoin ETF approval. This sets a precedent for cryptocurrency firms pursuing public listings.

Industry Reaction

The crypto community is closely monitoring potential movements and industry advancements resulting from Grayscale’s public ambitions. Institutional interest is expected to rise due to favorable regulatory signals and market receptivity.

Industry analysts foresee a significant impact on the crypto sector’s financial landscape. Historical IPO successes, such as Circle’s, exhibit high investor demand and set benchmarks for digital asset enterprises entering public markets.

“The current market environment offers a ‘golden window of opportunity’ for crypto firms to go public, citing strong investor receptivity.” — Jay Ritter, Professor, University of Florida

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GameSquare Raises $70M for Ethereum Expansion

300% DOGE price rally expected if this key price level is reclaimed

ETHBTC Builds Toward 0.03400 Breakout as Price Presses Into 0.02680 Resistance