Bitcoin Worth $590 Billion Faces Risks of a Quantum Attack

Bitcoin developers have introduced a radical proposal to protect the network from a potential quantum computing attack. The draft plan could freeze roughly 25% of the total Bitcoin supply if users fail to upgrade. This would mean around $593 billion worth of BTC remains vulnerable to a quantum attack. Bitcoin Developers’ Radical Plan To Prepare … <a href="https://beincrypto.com/biticoin-quantum-computing-risk-59-billion-freeze/">Continued</a>

Bitcoin developers have introduced a radical proposal to protect the network from a potential quantum computing attack. The draft plan could freeze roughly 25% of the total Bitcoin supply if users fail to upgrade.

This would mean around $593 billion worth of BTC remains vulnerable to a quantum attack.

Bitcoin Developers’ Radical Plan To Prepare for Quantum Computing Era

The proposal, titled “Post Quantum Migration and Legacy Signature Sunset”, was submitted on July 14 by popular contributors including Jameson Lopp.

It outlines a multi-phase strategy to transition Bitcoin to quantum-resistant cryptography and sunset legacy signature types like ECDSA and Schnorr.

In the plan, the developers argue that quantum computers could break these cryptographic schemes in the next five to ten years. Some say Q-day can arrive as early as 2027.

If that happens, any wallet that has ever exposed its public key on-chain could be compromised. This includes those tied to Satoshi Nakamoto.

Today we publish a Bitcoin Improvement Proposal addressing incentive & safety issues for migrating the ecosystem to post quantum cryptography.BIP timeframes are relative to a future point at which quantum computers are deemed a significant threat.

— Jameson Lopp (@lopp) July 15, 2025

The plan introduces three key phases.

Phase A would prohibit new transactions from being sent to quantum-vulnerable addresses. This step would encourage users to migrate to post-quantum (P2QRH) addresses.

Phase B is more aggressive. It would make all transactions using legacy cryptography invalid at a predetermined block height. This means effectively freezing funds in vulnerable wallets if not upgraded.

Phase C, still under research, could provide a recovery mechanism for users who miss the migration deadline. This would use zero-knowledge proofs to verify control of a wallet’s seed phrase.

The Quantum Threat to Bitcoin Is Real

According to the proposal, over 4.9 million BTC—worth nearly $593 billion at current prices—are exposed due to legacy address formats. These include early formats like Pay-to-Public-Key (P2PK) and reused keys.

Satoshi Nakamoto’s wallet, holding about 1 million BTC, would be among the affected if the proposal is adopted and no migration occurs.

The authors say this plan creates a clear incentive for users and institutions to act. “Fail to upgrade and you will certainly lose access to your funds,” the draft states.

The motivation is clear. If a quantum attacker gains access to exposed public keys, they could steal coins covertly and undermine trust in the network.

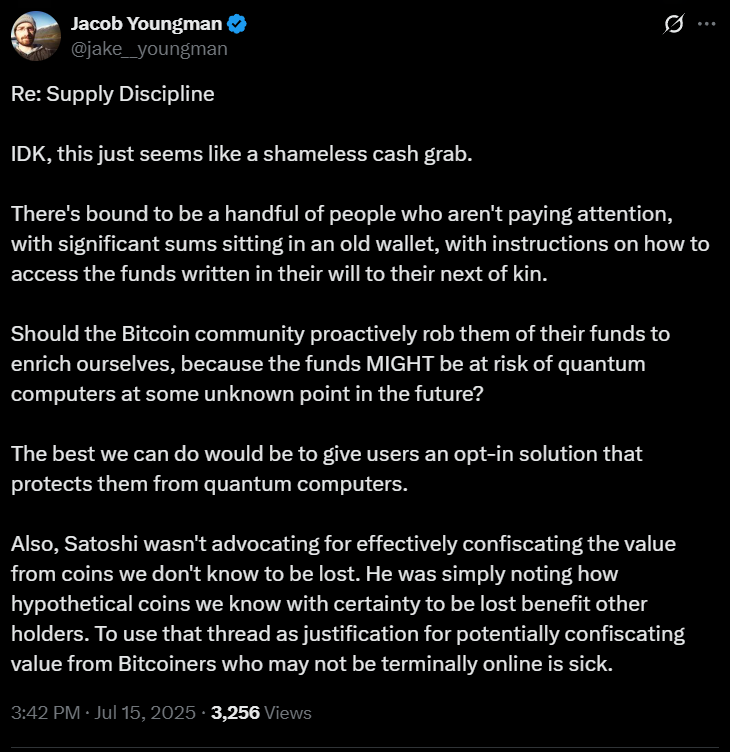

Some Community Members Criticze the Developers’ Proposal

Some Community Members Criticze the Developers’ Proposal

The developers warn that by the time such an attack is visible on-chain, the damage could be irreversible.

They also cite recent advances in quantum algorithms and post-quantum cryptography, including NIST’s ratification of PQ signature schemes in 2024.

Hardware may still lag, but algorithmic progress is narrowing the threat window.

Bitcoin has historically been slow to adopt upgrades. This proposal aims to accelerate migration by setting a five-year timeline, aligning stakeholders around a defined flag day.

Meanwhile, the proposal is still in draft form and would require broad community consensus to move forward.

However, it marks the most serious and coordinated effort yet to preempt a quantum threat to Bitcoin.

If implemented, it would also be the first time in Bitcoin’s history that unspent coins could be permanently disabled for failing to meet new security standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes