Joe Lubin-backed SharpLink Gaming moves to sell $5 billion more worth of common stock to fund ETH purchases

Quick Take SharpLink updated its prospectus with the SEC to drastically increase the amount of stock eligible for sale from the $1 billion initially proposed on May 30. The firm is looking to issue a total of $6 billion worth of common stock to fund ETH treasury purchases.

SharpLink Gaming (ticker SBET), a Minnesota-based affiliate marketing firm and largest corporate holder of ETH, increased the total amount of sellable stock to $6 billion on Thursday.

The move, indicated as a "prospectus supplement" with the U.S. Securities and Exchange Commission, drastically increases the amount of its equity the firm is looking to issue from $1 billion initially proposed on May 30 to $6 billion in total to fund additional ETH purchases.

"We are filing this Prospectus Supplement to amend the Prior Prospectus to update the amount of shares of Common Stock we are eligible to sell pursuant to such prospectus," the firm wrote in the July 17 updated prospectus. "With this Prospectus Supplement, we are increasing the total amount of Common Stock that may be sold under the Sales Agreement to $6 billion, comprising of up to $1 billion under the Prior Prospectus and an additional $5 billion under this Prospectus Supplement."

The firm notes it has made "gross sales" of approximately $721 million worth of stock sold pursuant to the "prior prospectus." It notes it "may sell an additional $279,166,115 of Common Stock under the Prior Prospectus" as well as an additional $5 billion under its prospectus supplement submitted on Thursday.

The Block reached out to SharpLink Gaming for comment.

SharpLink Gaming is the largest corporate holder of Ethereum, owning over 321,000 ETH valued at around $1.1 billion as of July 16. The firm aggressively pivoted toward an ETH accumulation strategy after obtaining a $425 million private placement led by the crypto infrastructure firm Consensys in early June. Consensys CEO and Ethereum co-founder Joseph Lubin also joined SharpLink as chairman of its board of directors, The Block previously reported.

ETH is trading at $3,412 at press time, having seen $42.9 billion in trading volume in the past 24 hours, The Block's ETH Price Page shows .

SharpLink Gaming shares traded at $35.91 as of 4:56 p.m. ET (20:57 UTC), falling 2.15% in the past 24 hours, Nasdaq data shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Future Contracts Tap into Altcoin Potential at CME Group

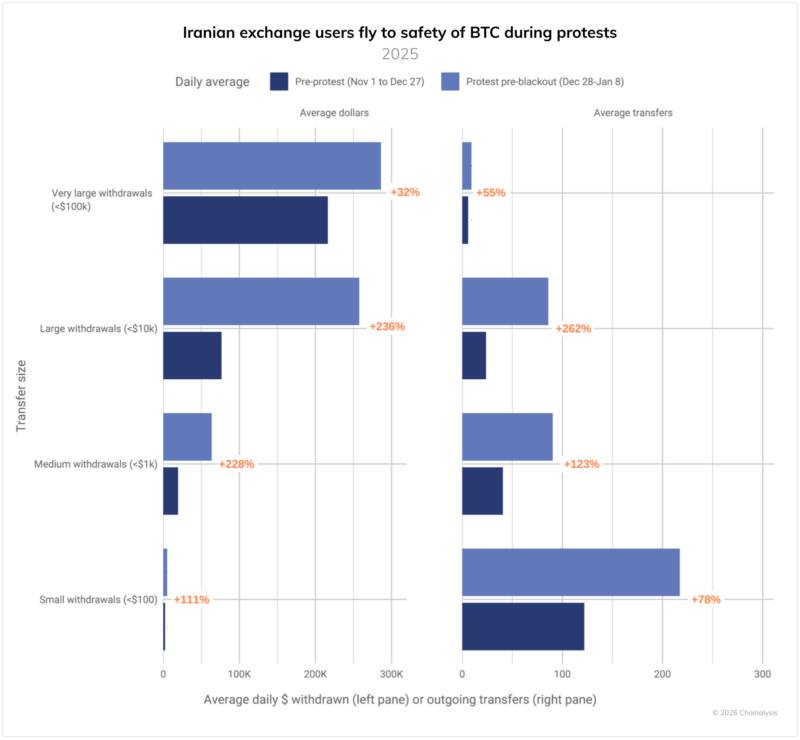

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?