Key Market Insights for July 18th, how much did you miss out on?

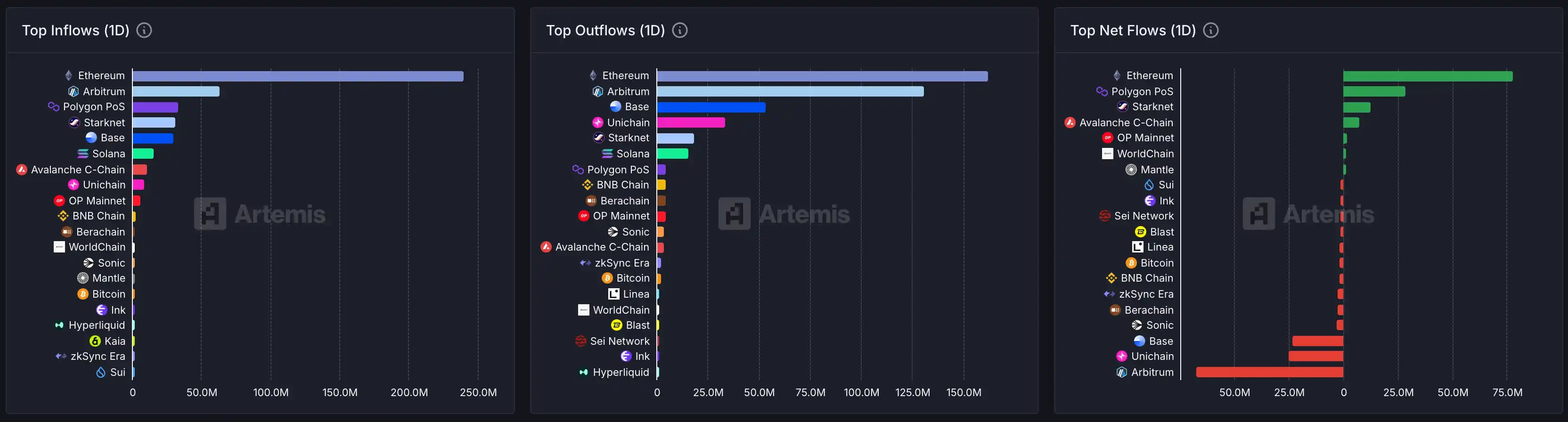

1. On-Chain Funds: $77.9M Flows Into Ethereum; $67.3M Flows Out of Arbitrum 2. Biggest Gainers and Losers: $ERA, $SUSHI, $PUMP 3. Top News: Total Stablecoin Market Cap Surpasses $260B, with a 1.43% Increase in Supply Issuance in the Past Week

Featured News

1.Stablecoin Total Market Cap Surpasses $260 Billion, 1.43% Increase in the Past Week

2.Arkham: BlackRock's ETF Currently Has Over 5x More Allocation to ETH Than BTC

3.US Stock Concept Stocks with ETH Reserves See Pre-Market Rally, BMNR Up Over 16%

4.Pudgy Penguins CEO: Seeking New Round of Funding for Abstract, Aiming to Involve the Community in Some Way

5.Animoca Research: Shitcoin Reserve Strategy Carries High Risk, But Could Be a Potential Catalyst for Driving Mass Adoption of Cryptocurrency

Featured Articles

1.《Amid the Soaring Rise of Crypto Reserves Companies, What Are Some Potential "Pitfalls"?》

This article outlines four key tools and representative cases behind this trend, attempting to answer a question: When traditional financial instruments meet crypto assets, how can a company evolve from simply "buying coins" to "playing the game"? And how can retail investors identify the risk signals in this capital game?

2.《The Received Stablecoin Regulation, and the Restless Wall Street Bankers》

Almost simultaneously, the three major financial regulatory giants, the Federal Reserve, FDIC, and OCC, jointly released guidance a few days ago, clearly stating that U.S. banks can provide cryptocurrency custody services to customers. Banks and institutions on Wall Street can no longer contain their excitement.

On-chain Data

On-chain Fund Flow on July 18

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x FOGO: Trade futures to share 1,000,000 FOGO!

Bitget Spot Cross Margin adds HYPE/USDT

Instant BGB airdrop: Complete fiat tasks to earn incentives

CandyBomb x SOL: Trade futures to share 160 SOL!