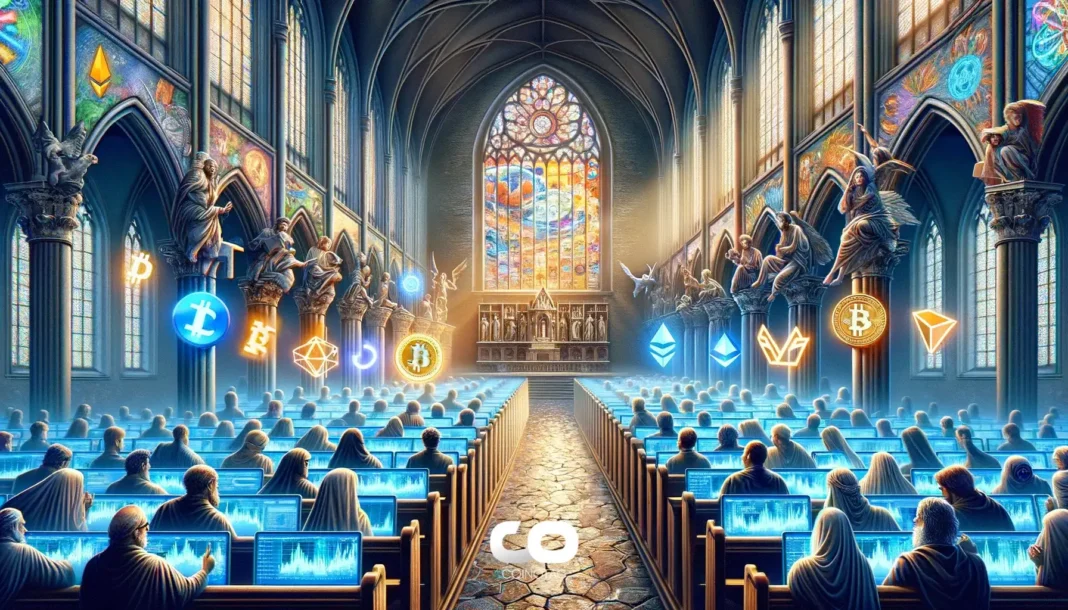

Ethereum Breaks $3,600 Amid Increased Institutional Engagement

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Ethereum broke past $3,600.

- Institutional actions and legislation favor cryptocurrency markets.

Ethereum surged to over $3,600 as institutional entities like BlackRock and legislative updates in the U.S. drive momentum.

Ethereum’s rise to $3,600 signifies growing institutional confidence and legislative endorsement, affecting market dynamics.

BlackRock’s filing to include Ethereum staking in its ETF and Peter Thiel’s investment signals strong institutional support for Ethereum. The record ETF inflows further underline this trend, while U.S. legislative actions contribute to the positive environment.

Ethereum’s surge highlights the increasing intersection of traditional finance with cryptocurrency. BlackRock’s proposal and Thiel’s participation reflect a notable shift in institutional sentiment. Cory Klippsten, CEO of Swan Bitcoin, said, “These decisions may catalyze Ethereum’s position in mainstream finance.”

The growing institutional interest and legislative support have bolstered investor confidence. ETH’s rally benefits the entire altcoin market, with Layer 2 and DeFi projects also gaining traction. The $726.74 million influx into ETH-focused ETFs is pivotal to this momentum.

“Thiel’s involvement gives credence to Ether’s status as a legitimate long-term investment, which many are calling the currency of the digital economy.”

This institutional momentum is likely to persist, potentially pushing Ethereum closer to $4,000 in the near term. Historical parallels with Bitcoin ETF launches suggest that Ethereum’s rally may continue, supported by robust staking and network activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Alena Vranova Launches GLOK for Bitcoin Security

Trump-Endorsed World Liberty Ethereum Tokens Launch

Glassnode Altseason Indicator Activates as Bitcoin Dominance Declines and Ethereum Gains Strength

U.S. Congress Moves Forward on Blockchain Regulation