Steller (XLM) Price Faces Challenge Amid Mounting Outflows

Stellar struggles to breach $0.50 amidst outflows and weakening momentum. A further drop is possible unless inflows recover, which could drive a price reversal.

Stellar (XLM) experienced a strong rally recently, pushing the altcoin’s price to higher levels. However, over the past week, the price has faced considerable consolidation. Signs of a potential reversal are becoming more apparent as the altcoin struggles to break the crucial $0.50 resistance level.

XLM has seen notable volatility over the last 24 hours, suggesting that the price may continue to face downward pressure in the near future.

Stellar Investors Are Pulling Back

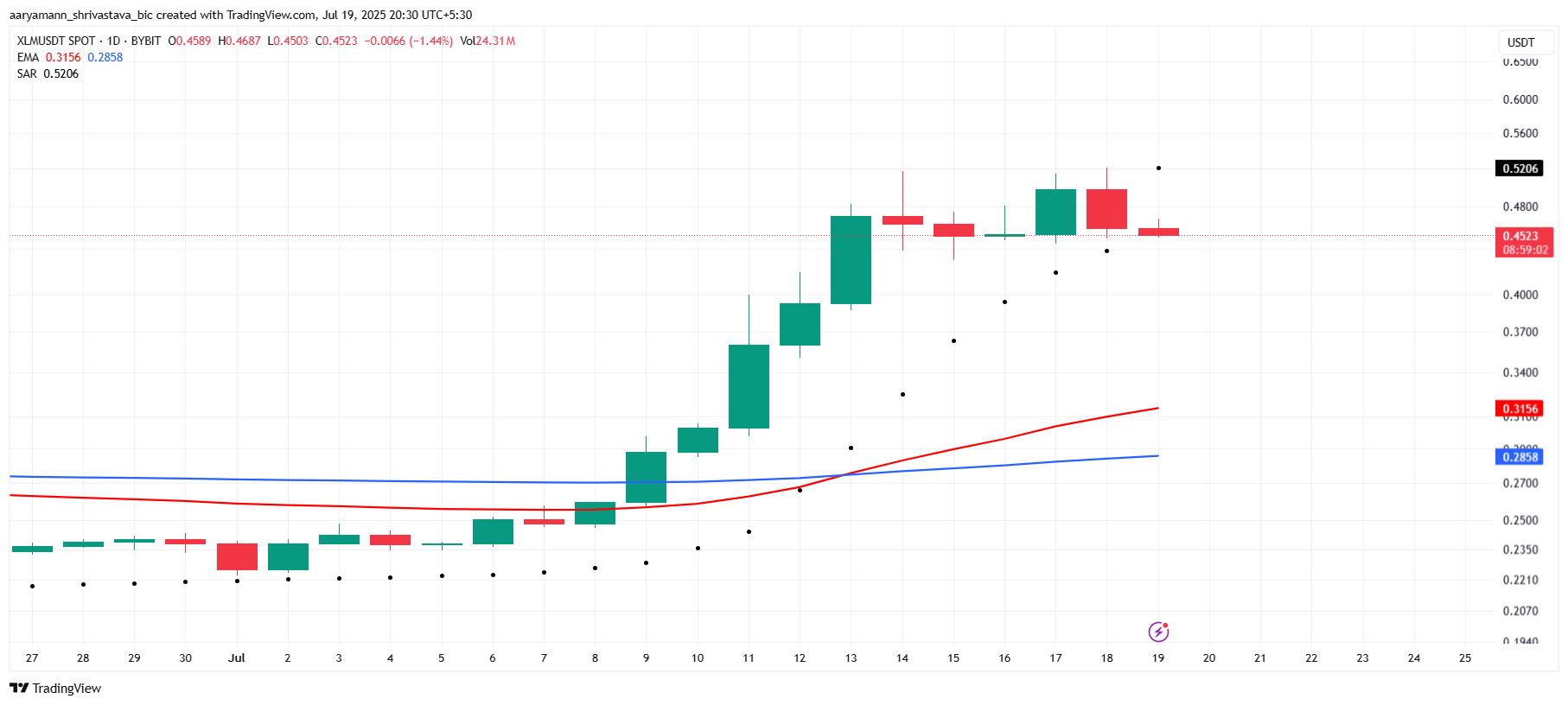

The Parabolic SAR, which sits above the candlesticks, indicates that the downtrend for XLM is beginning to gain strength. This technical signal suggests that bearish momentum is taking hold, making it difficult for the altcoin to push beyond the $0.50 resistance.

However, the active Golden Cross, which is currently present, has the potential to neutralize the effects of the downtrend. The Golden Cross is a bullish indicator that typically signals long-term upward movement.

Despite the recent bearish signals, it may provide the support needed to slow the decline in XLM’s price.

XLM Golden Cross. Source:

XLM Golden Cross. Source:

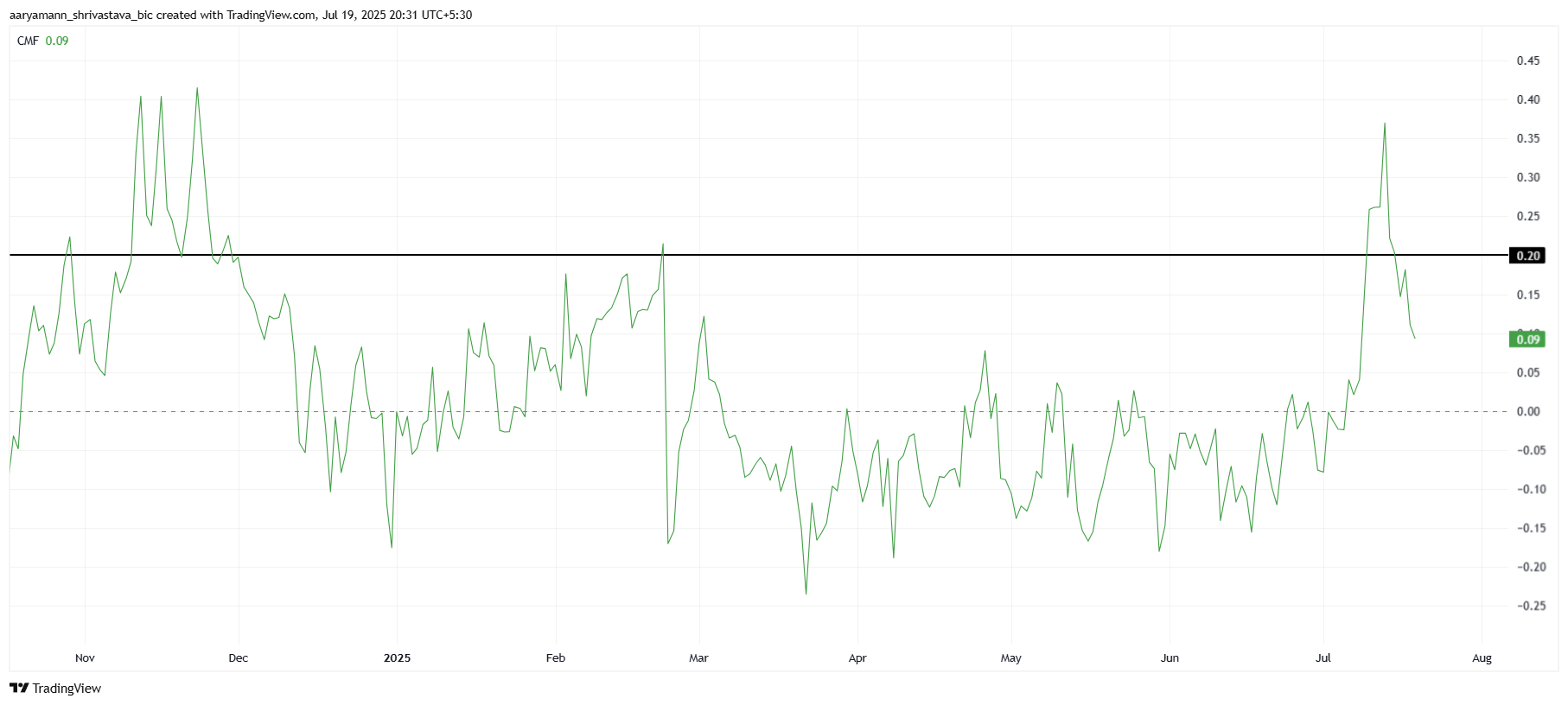

The overall macro momentum for XLM shows mixed signals, as reflected in the Chaikin Money Flow (CMF) indicator. Last week, the CMF reached an eight-month high, signaling strong inflows and bullish sentiment.

However, the indicator has since begun to decline, suggesting that the buying pressure is weakening. Despite this, the CMF remains above the zero line, indicating that inflows are still outpacing outflows.

Should the CMF slip below the zero line, it would indicate that outflows are dominating, which would be a negative signal for XLM. A further decline in the CMF would likely put additional downward pressure on the price, confirming the bearish outlook for the altcoin.

XLM CMF. Source:

XLM CMF. Source:

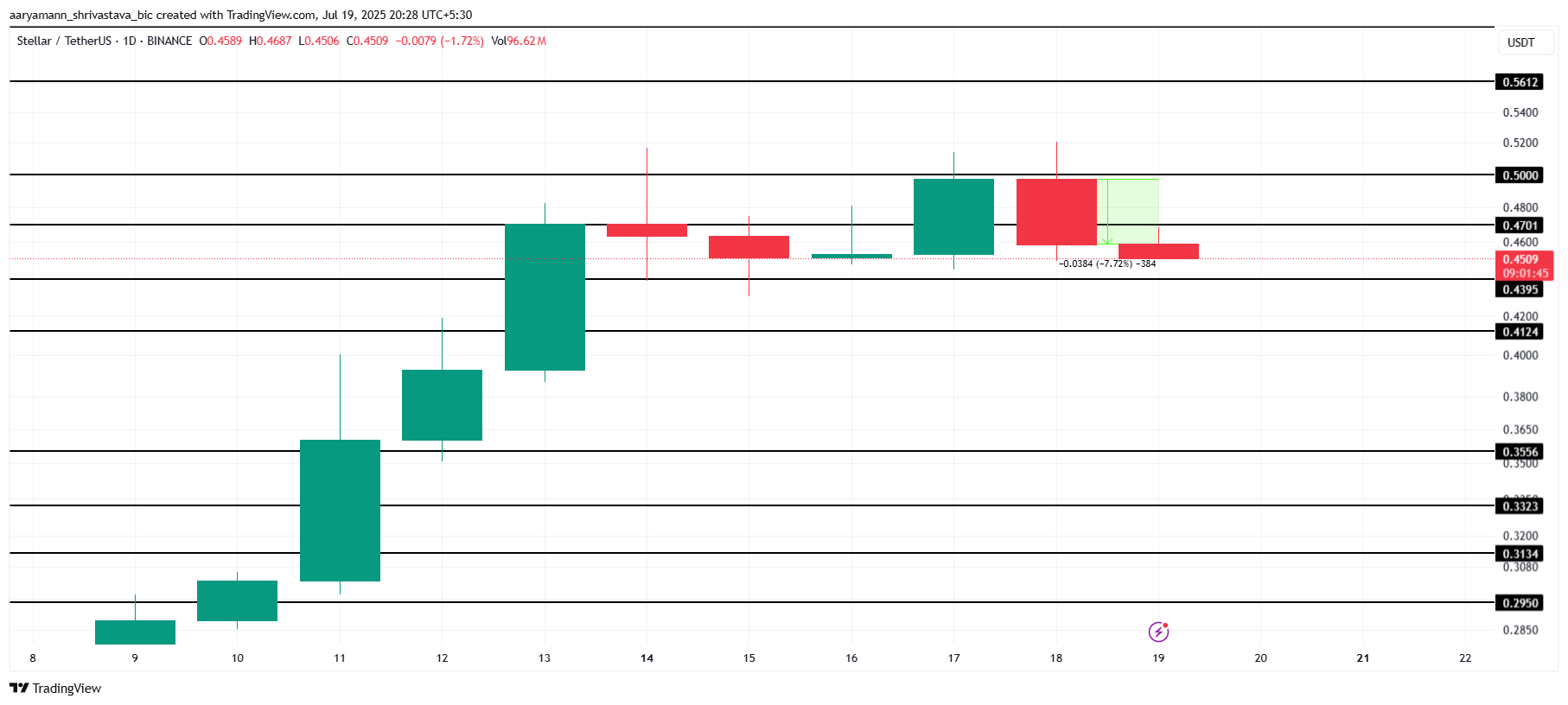

XLM Price Can Bounce Back

XLM’s price has fallen 7% over the past 24 hours and is currently trading at $0.45. The altcoin has been consolidating under the $0.50 resistance for the past week, struggling to make significant gains.

If the outflows continue to dominate, the price could see further downside pressure. Failing to breach this resistance level, coupled with the weakening momentum indicators, could push XLM below its support levels of $0.43 and $0.41.

This would make the altcoin vulnerable to a deeper correction, potentially falling to $0.35 in the coming days.

XLM Price Analysis. Source:

XLM Price Analysis. Source:

However, if the inflows recover and the bearish trend is neutralized, XLM could find support and make another attempt at breaching the $0.50 resistance.

A successful breach would invalidate the current bearish thesis, with XLM targeting a price of $0.56, signaling a reversal of the recent downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.