$1 Trillion Capital Is All It Takes for Bitcoin to Hit $1 Million | US Crypto News

Bitcoin's price could soar to $1 million due to the global money supply doubling and increasing liquidity, making it more sensitive to capital inflows. The surge in fiscal policies supports Bitcoin as a hedge against fiat debasement.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab your coffee and settle in because the numbers behind Bitcoin’s future are starting to get serious. As global liquidity surges and the pace of money creation accelerates, some investors believe we are entering a new phase for the pioneer crypto.

Crypto News of the Day: Bitcoin Hitting $1 Million Seen as Inevitable with Global Money Supply Set to Double

In a recent US Crypto News publication, Davinci Jeremie urged viewers to spend just a dollar to buy Bitcoin.

According to the Bitcoin maxi, BTC price could reach $500,000 per coin before 2030. Now, a growing number of analysts believe Bitcoin could go well beyond $500,000, ultimately reaching $1 million. This, they say, may be inevitable.

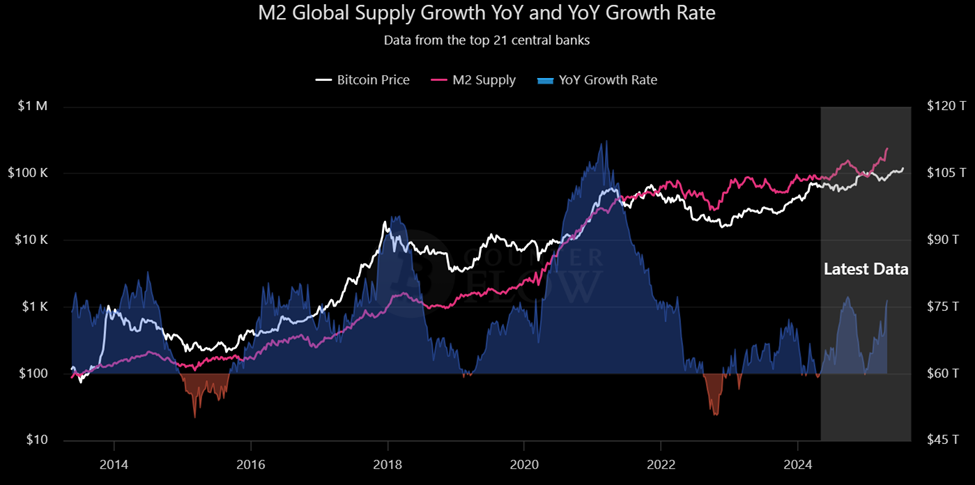

Analysts point to a macroeconomic backdrop that heavily favors Bitcoin, citing surging global liquidity and the money supply, which is on track to double in the next decade.

“It will take 1 trillion USD moving into Bitcoin to get to 1 million. Money supply alone is 100 trillion going to 2O0 trillion by 2035. Zero chance we don’t get there,” wrote Fred Krueger, an investor and Bitcoin maxi.

The sentiment echoes broader concerns about monetary debasement, especially as global central banks maintain loose fiscal policies and governments continue large-scale deficit spending.

In the past year, the money supply has grown at its fastest pace in recent history, adding credence to the Bitcoin bull case.

According to River, a Bitcoin-focused platform, anyone who has held Bitcoin since July 2024 has outperformed against money debasement tenfold.

We're seeing the fastest money supply growth in years.If you held bitcoin over the past year, you outperformed money debasement by 10x.

— River (@River) July 21, 2025

That outperformance reinforces Bitcoin’s positioning as a hedge against fiat dilution, particularly in an environment of rising global debt and systemic liquidity injections.

Further supporting the bullish thesis, global M2 money supply per Bitcoin has reached a 12-year high.

“Global liquidity relative to Bitcoin supply has reached a 12-year high, with ~$5.7 million in global M2 supply per Bitcoin in circulation,” wrote DeFi investor Christiaan.

This liquidity-to-scarcity ratio reflects just how little capital is needed, in relative terms, to send Bitcoin dramatically higher.

With only 21 million BTC coins ever existing, and significantly fewer in active circulation, Bitcoin’s fixed supply makes it increasingly responsive to institutional or sovereign capital inflows.

Chart of the Day

Global Money Supply. Source:

Bitcoin Counter Flow

Global Money Supply. Source:

Bitcoin Counter Flow

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- PI coin jumps 14% after Pi Network launches direct buy feature.

- Capital rush into NFT tokens puts PENGU’s rally at risk.

- Elon Musk’s SpaceX moves $153 million in Bitcoin ahead of Tesla earnings.

- Western Union joins the stablecoin race as legacy payments face disruption.

- JPMorgan eyes crypto-backed loans as US regulators ease rules.

- Between Rolex, Benner, and Buffett: What is the crypto market trying to tell us?

- Ark Invest cuts Coinbase holdings, channels $175 million into Bitmine.

- $7 billion in Dogecoin (DOGE) now on exchanges—A sell-off ahead?

- More public companies turn to Bitcoin this week as corporate adoption rises.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 21 | Pre-Market Overview |

| Strategy (MSTR) | $426.28 | $429.03 (+0.65%) |

| Coinbase Global (COIN) | $413.63 | $415.20 (+0.38%) |

| Galaxy Digital Holdings (GLXY) | $27.45 | $27.85 (+1.46%) |

| MARA Holdings (MARA) | $18.83 | $18.98 (+0.80%) |

| Riot Platforms (RIOT) | $14.02 | $14.26 (+1.71%) |

| Core Scientific (CORZ) | $13.27 | $13.35 (+0.60%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeepMind CEO says China’s AI is just months behind U.S. and closing the gap fast

Bitcoin Rally: Why the Surge to $100K May Signal a Cautious Rebound, Not a Bullish Reversal

Bitcoin ETFs Achieve Remarkable $104.1M Net Inflows for Fourth Straight Day

Citigroup: TSMC's Advanced Process Chip Supply May Remain Tight