Today’s Preview

1、US EIA crude oil inventories (to July 18) will be released today (previous: -3.859 million barrels).

2、Trump plans to issue an executive order to promote AI’s development, considering naming July 23 as “AI Action Day” with a speech scheduled on artificial intelligence.

3、SOON unlocks ~41.88 million tokens, about 22.41% of the current circulating supply.

4、Avail unlocks ~972 million tokens, about 38.23% of the current circulating supply.

Macro & Hot Topics

1、Trump: Rates Should Fall by 3% or More.

Trump said, “Powell is keeping rates far too high. The economy is strong. Rates should drop three percentage points or even more, and should stay at 1%.” He also highlighted how Powell’s policies are weighing on the housing market. US Treasury Secretary Besant echoed similar views, calling for the Fed to cut rates now, criticizing the Fed’s expanded mandate for sustaining high government spending.

2、ETF Issuers Push for Crypto ETF In-Kind Redemption as SEC Shifts to Positive Stance.

Several ETF issuers—including 21Shares, Fidelity, Franklin Templeton, Galaxy, VanEck, and WisdomTree—filed amendments with the SEC Tuesday to enable “in-kind” creation/redemption mechanisms for their Bitcoin and Ethereum ETFs. Bloomberg ETF analyst James Seyffart noted this signals a positive shift in SEC policy after months of hesitation. SEC Commissioner Hester Peirce had previously indicated that in-kind redemption for crypto ETFs is “coming soon.”

3、LetsBonk Grabs 64% of Solana Meme

Token

Launchpad Market.

LetsBonk has grown its market share among Solana meme launchpads from just 5% a month ago to 64%. By contrast, Pump.fun has tumbled from 90% to 24% in the same period. Last Friday, LetsBonk’s trading volume hit $179 million (vs. $52 million for Pump.fun). Just a month ago, LetsBonk averaged under $10M daily volume while Pump.fun pulled 15x that. The jump in volume has driven record fee income—over $8M in fees for LetsBonk last week, double Pump.fun’s haul.

4、Goldman Sachs: Fed to Hold Rates Next Week, Begin Cuts at Remaining 2025 Meetings.

Goldman Sachs expects the Fed to leave rates unchanged next week, but start cutting rates in the three meetings left in 2025, citing weakening job growth and stagnant consumer spending (flat for six straight months—a rarity outside recessions). Further cuts are projected in early 2026.

Market Updates

1、BTC and ETH trade in a tight range at highs; alts in broad rally; $470M in liquidations (mainly longs) over the last 24H.

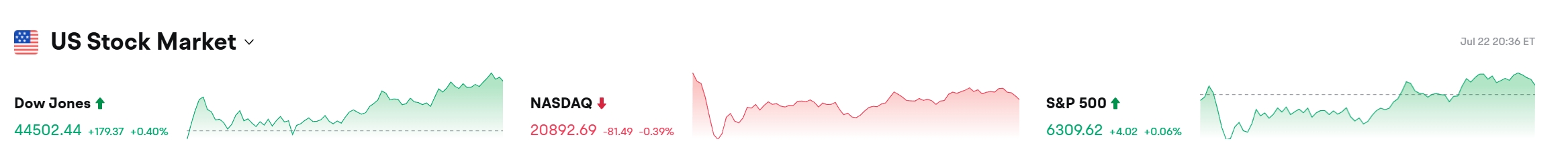

2、S&P 500 closes at another record high; tech stock rally pauses, weighing on Nasdaq; Medpace surges 55% post-earnings; gold rebounds above $3,400; domestic coking coal soars in night trading.

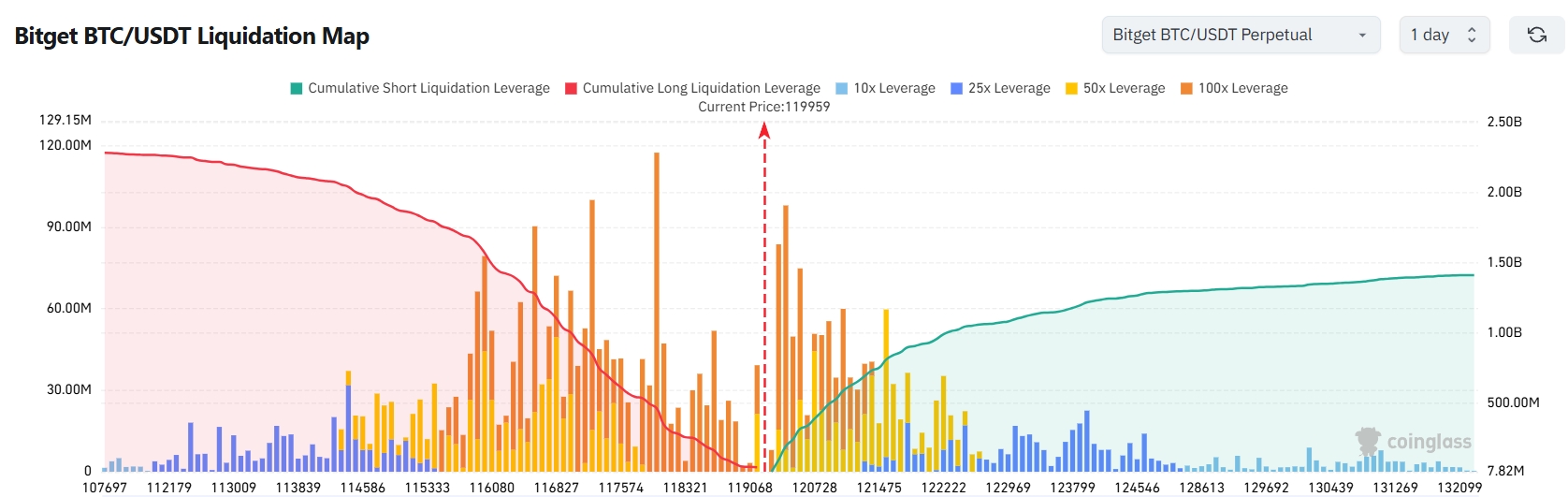

3、Bitget BTC/USDT liquidation map: At 119,948 USDT, a 2,000-point drop to 117,948 could trigger $460M in long liquidations; a 2,000-point rise to 121,948 could hit shorts with $897M in liquidations. Short-side risk currently dwarfs long, so manage leverage accordingly.

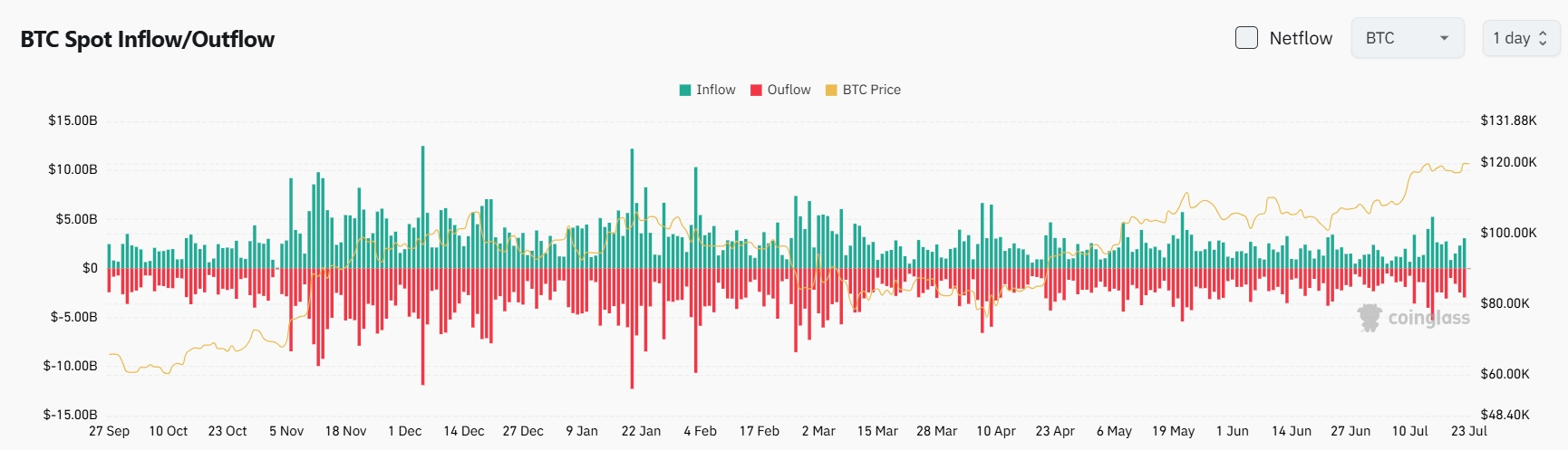

4、BTC spot flows in past 24H: $3.08B in, $2.95B out—net inflow $130M.

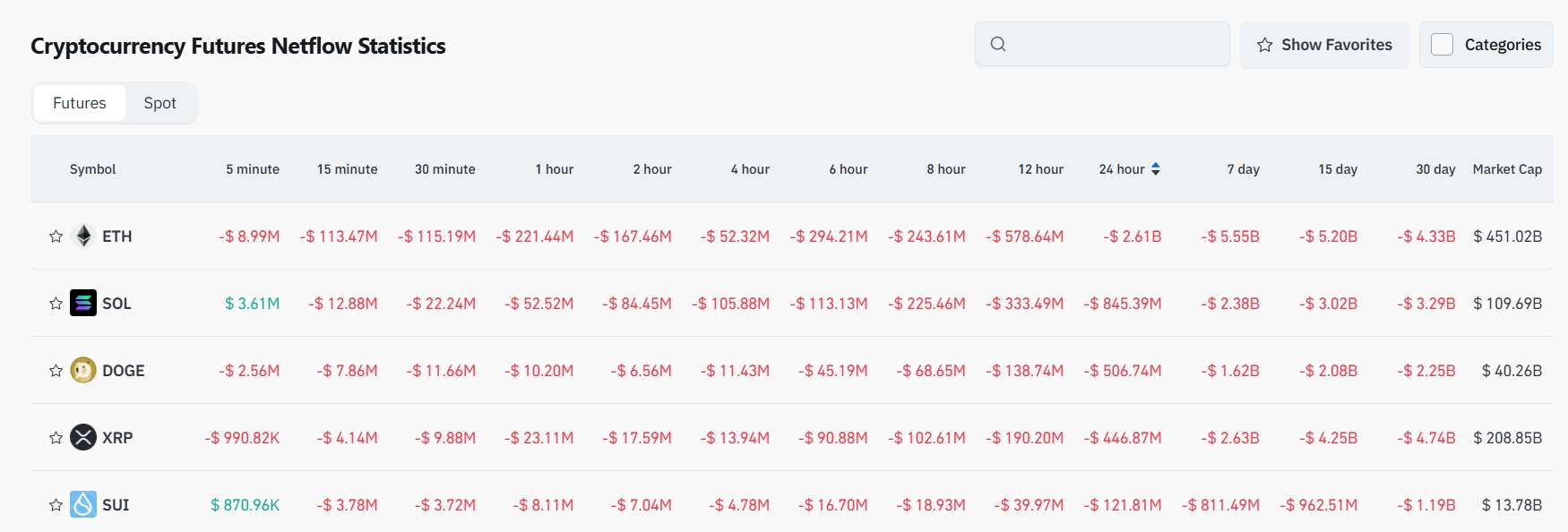

5、Contracts with highest 24H net outflows: $ETH, $SOL, $DOGE, $XRP, $SUI—potential trading opportunities.

Institutional Views

-

Matrixport: Wall Street’s crypto IPO boom could extend the current Bitcoin bull market cycle.

Source

-

TD Cowen: Strategy’s premium is justified; expects Bitcoin holdings to approach 900,000 BTC by 2027.

Source

News Updates

1、US Justice Department drops probe into Kraken co-founder Jesse Powell.

2、Trump: Will enter trade talks with the EU on Wednesday.

3、Trump: Rates should be cut by 3% or more.

4、Several US Senate Banking Committee members release a draft on crypto market structure.

5、South Korea to propose “short-selling” regulation for digital assets, aiming at stock market-level oversight.

Project Developments

1、SEC approves Bitwise crypto index fund conversion, then freezes the review process.

2、21Shares files S-1 for ONDO ETF with the SEC.

3、Telegram crypto wallet now officially available for 87 million US users.

4、Sonic launches its first airdrop, users can now claim 25%.

5、JP Morgan gears up for crypto-collateralized lending, possibly launching as early as next year.

6、Bitget Wallet becomes the first to integrate Plasma public chain, enabling stablecoin payments.

7、Mexico’s Grupo Murano to invest $1B in Bitcoin, plans $10B BTC treasury in 5 years.

8、LetsBonk’s market share reaches 64% among Solana meme coin launchpads.

9、Nano Labs boosts BNB strategic reserves to $90M, plans to upgrade reserve strategy.

10、BNB Chain Foundation spent 25,000 USDT on TAG token purchases.

X Highlights

1. Lao Bai: Diamond Hand’s Next Level—Core Beta Bets Beyond BTC

Wrapping up his “Diamond Hands” series, Lao Bai argues it’s better to focus on “Beta”—BTC, ETH, SOL, BNB as blue-chip foundational holdings—than chase Alpha and get repeatedly wrecked. For strong alt picks: AAVE leads DeFi for its record TVL and regulatory compatibility; Pendle dominates RWA and stablecoin yield stratification (call it the ‘Bond King’); Hyperliquid is now the king of perp chains for UX and liquidity; Bittensor fuses AI+crypto with sound tokenomics. Some look pricey now, so enter wisely, but for the next cycle these “diamond hand” assets could outperform BTC and anchor lasting wealth through any market.

Link

2. Yuyue: Pump Breaks Support Again—Use Rebounds to Exit, Not Bottom Fish

Pump fell through key support again—price and volume fading, and defense now left to only the “hopeful.” Better to let washouts finish and signals confirm before re-entering; scooping “bottoms” now is like picking up pennies in front of a steamroller. Even if a short-term bounce comes from a Binance listing or partial recovery, it’s just a chance to exit. In a bull, allocating to strong movers like DOGE (up 20% in 2 days) is far better than getting trapped in persistent laggards.

Link

3. memekiller: Buying Tokens is Betting on the Whales—Don’t Get Brainwashed by ’Community Faith’

At its core, buying a token is giving a vote of confidence to its backers, not just “community hype.” What matters is the resources, patience, and execution of whales behind the project, not retail buzz. Retail has to spot whale footprints through price action, volume, wallets, funding, and team—don’t just be a “community cult” bagholder tricked by narratives, endlessly losing money. Know the real game to avoid becoming exit liquidity.

Link

4. Bruce J: Spotting a Real Bull—Apathy Means the Run Isn’t Over

Peak bulls are when “everyone is numb”—new highs daily, Discords full of memes and banter, everyone aping in, gains feel automatic. Now, sentiment is still hesitating, taking profits, and “just waiting”—far from euphoria. The true bull could be just starting, with rotation and main moves yet to come. The sidelines still have plenty of time to play catch-up.

Link