AI and Digital Payments Drive Cryptocurrency Adoption Boom in 2025

Cryptocurrency adoption has witnessed remarkable growth in 2025, with individuals and even large institutions pivoting towards digital asset ownership. Interestingly, data shows that the recent wave of crypto embrace is largely driven by digital payment and artificial intelligence.

In Brief

- About 37% of U.S. and UK respondents cite AI and digital payments as key forces behind growing crypto adoption.

- Another 34% use crypto for payments — more than for staking or farming — showing that utility is rising over passive DeFi activity.

- Cities like Cannes aim for 90% crypto adoption among merchants, as retail and food payments dominate usage.

- Younger users lead crypto ownership, with 51% of stablecoin holders aged 18–34, and Bitcoin still topping the list.

Digital Payments Surpass Staking and Farming as Leading Crypto Use Case

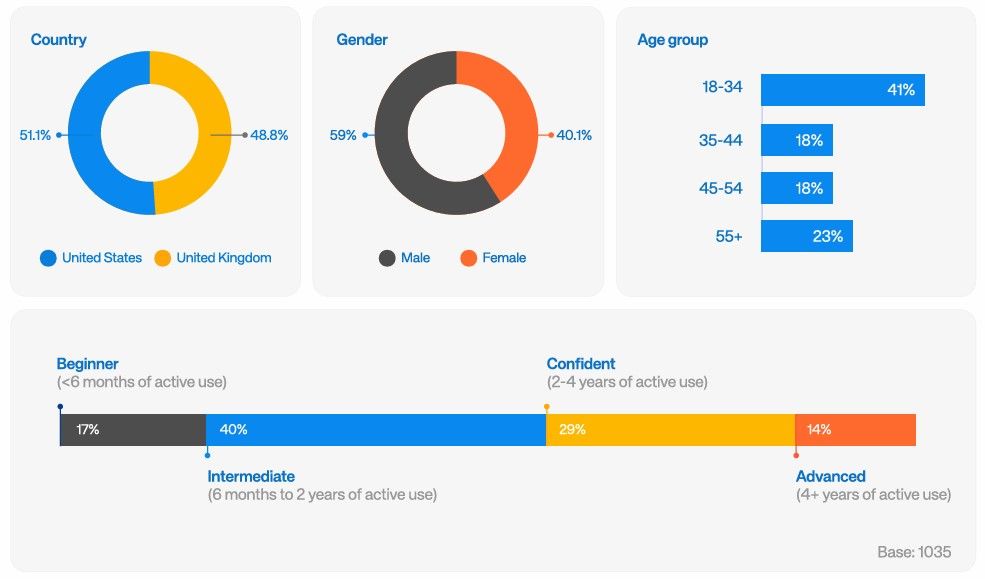

A reported 37% of the 1000 respondents surveyed across the U.S. and UK pointed to artificial intelligence and digital transactions as the pillars of the crypto revolution. According to the recent study jointly conducted by Reown and public opinion analytics company YouGov, 34% of the poll participants actively use cryptocurrency for payments.

Data from the study shows that this number is more than those involved in other DeFi activities like staking or farming, though trading remains more popular.

Meanwhile, another 27% of the respondents admitted that on-chain payments using digital assets will become a dominant trend within the next three to five years. This further reinforces the usefulness of crypto assets as a real-world problem-solving tool.

Cryptocurrency Payments and AI: Two Sides of the Same Coin

Offering a perspective on the recent research, Reown CEO Jess Houlgrave explained that AI and payments are together tackling a fundamental challenge of making crypto “useful, trusted, and intuitive.”

She added that both areas complement each other, with payments driving everyday crypto use and AI simplifying the process. In fact, Houlgrave dismissed notions that one sector will not displace the other. The Reown chief maintained that artificial intelligence helps advance customer experience and developer efficiency.

Houlgrave emphasized that AI enhances key aspects such as “personalization, fraud detection, and support.” It also accelerates processes, including “onboarding, auditing, and automation.”

Stablecoin issuer Tether is advancing in the AI-finance trend after detailing plans to unveil an AI-powered decentralized payment system that runs without an API.

According to the Reown CEO, the usability of digital payments is the underpinning driver of the increased adoption. She noted that real-world applications such as cross-border remittances and freelance payouts have transformed digital payments from a “crypto demo” to a “real-life infrastructure.”

Firms and Cities Embrace Digital Assets

Digital payments have become a global trend, with several firms integrating peer-to-peer settlement methods to boost productivity. Last month, online commerce platform Shopify added a USDC payment option to help streamline transactions.

Mercuryo CEO Petr Kozyakov recently mentioned that more firms are turning to cryptocurrencies for salary payments. And with this trend growing at a fast rate, people are actively looking for ways to spend their digital assets directly.

Companies in the financial space have helped facilitate cryptocurrency usage, with card issuer Mastercard offering stablecoin payment through recent partnerships. Countries are also positioning for this financial shift. Cannes, a city in France, has set a 90% crypto payment adoption target among its merchants by the summer of 2025.

This move is strategic as retail use of crypto assets continues to gain ground. Digital asset payment network Oobit disclosed that 70% of crypto-related payments on the platform went to retail, food, and beverages.

Cryptocurrency Trading Tops the List of Favorite Onchain Activities

According to reports from the study, cryptocurrency trading stands out as the most popular on-chain activity.

Here’s what the data shows:

- About 36% of respondents enjoy crypto trading the most as their on-chain activity.

- Another 10% of survey participants prefer making payments as their favorite on-chain use.

- Plus, 14% of participants look forward to using on-chain payments the most in the future.

Houlgrave stated that on-chain payments are becoming mainstream, citing the real-world applications in payments and everyday finance. She added that the technology is finally measuring up to what originally drew people to crypto.

The Reown CEO emphasized that the original idea for crypto assets was global, borderless, and trustless payments as laid out in the Bitcoin white paper.

Survey Shows Stablecoins Outpace Solana Adoption

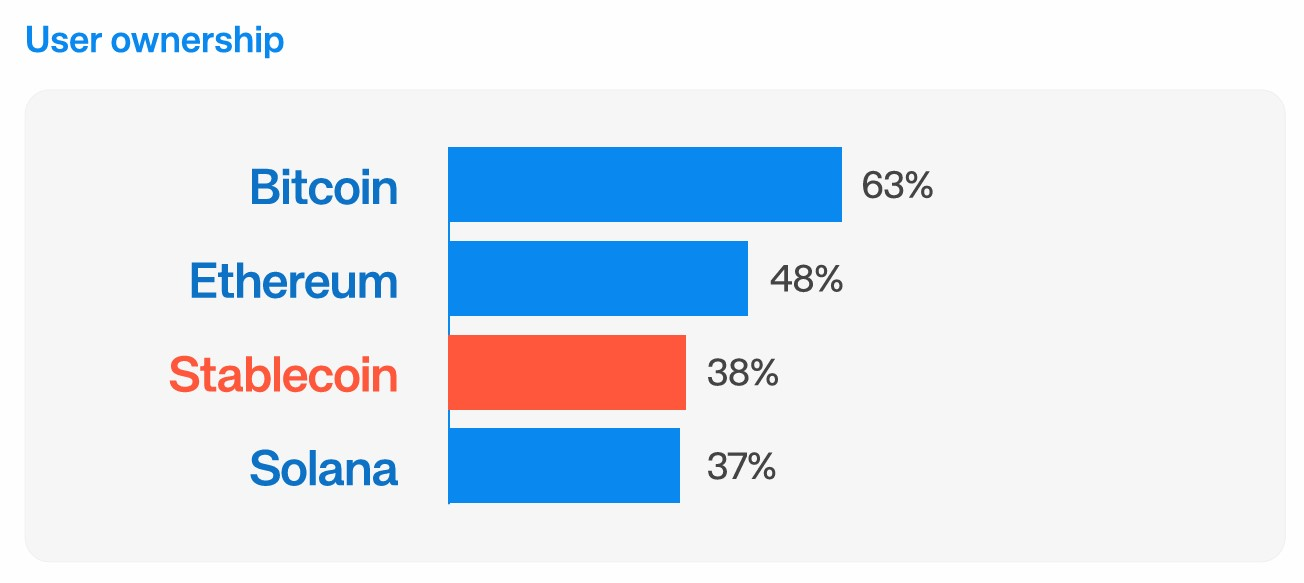

Looking at crypto ownership, the study showed that 63% of respondents owned Bitcoin, while 48% held Ethereum. It was also found that 38% of poll participants owned stablecoins, placing it above Solana at 37%.

Among the stablecoin owners, 51% are aged 18 to 34. However, the adoption rate among users older than 45 decreased significantly.

Reown’s report highlights the significant shift in cryptocurrency adoption, driven by real-world use cases like digital payments and AI integration. With growing support from companies and governments, crypto is moving from speculation to practical utility—especially as an everyday financial infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BP’s Significant Write-Down Indicates Tough Times Ahead for Net-Zero Investments

Cathie Wood Is Reducing Her Palantir Holdings Once More. What’s the Best Approach to PLTR for January 2026?

GBP/AUD breaks through crucial support even as GDP beats expectations