Avalanche (AVAX) Breakout Imminent? $36 Target If $27 Cracks

TL;DR

- AVAX is testing key resistance at $27; a breakout may open the path toward the $33–$36 upside zone.

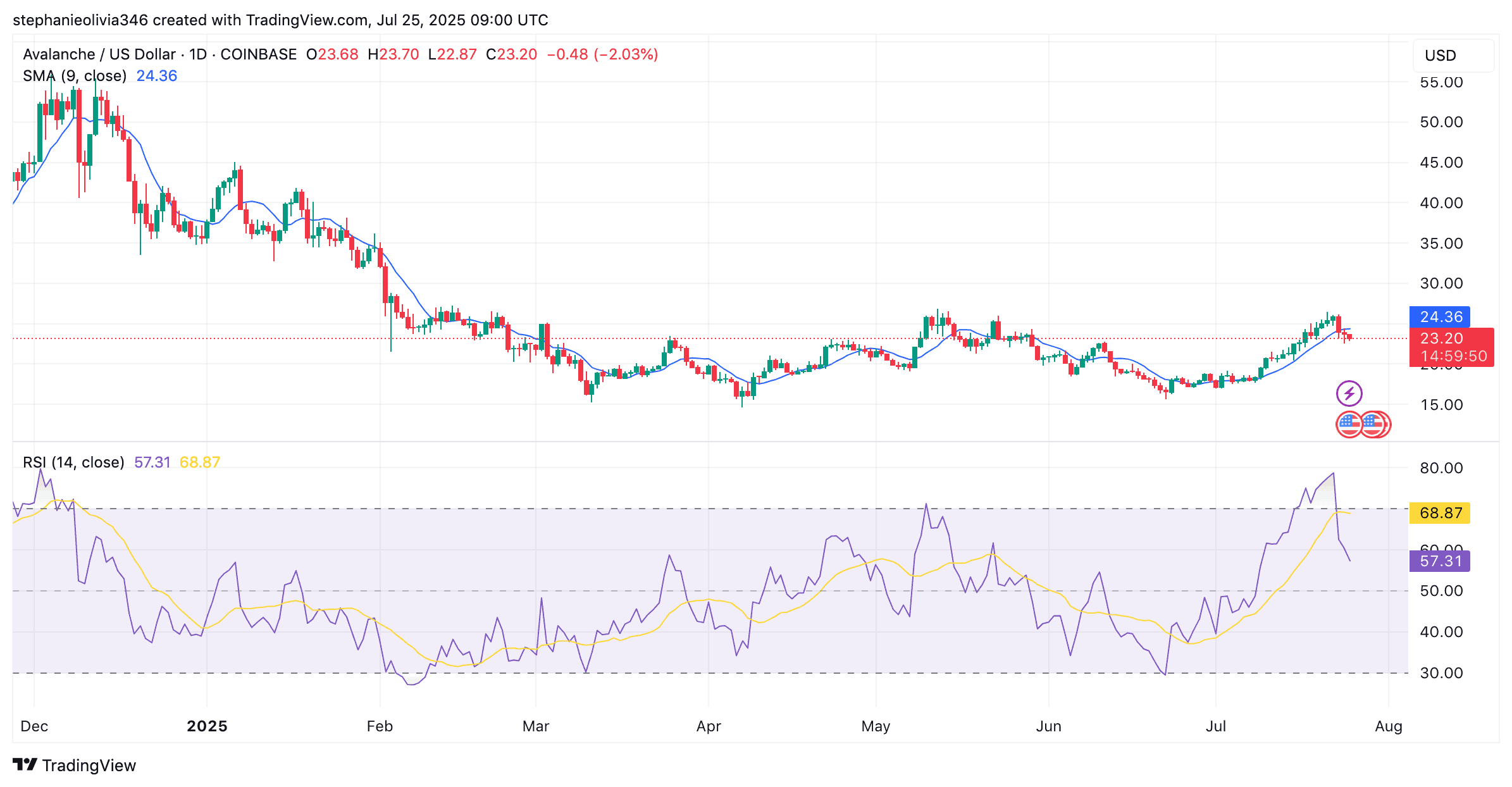

- The price dipped below the 9-day SMA; the RSI, retreating from near-overbought levels, suggests possible buyer exhaustion.

- FIFA’s Layer-1 project on Avalanche adds long-term ecosystem value and broader institutional visibility.

AVAX Tests Major Resistance Around $27

Avalanche (AVAX) is back near a price level that has stopped rallies before. The $27 mark has acted as a cap in past trading, with the most recent rejection happening in March. If the current move breaks above that level, the next area on the chart sits near $36. Analyst Ali Martinez pointed this out on social media, saying a clean break could lead to a quick push higher.

If Avalanche $AVAX breaks above $27, it could quickly climb toward the next key target at $36! pic.twitter.com/qBP2sUUR7q

— Ali (@ali_charts) July 25, 2025

AVAX was trading at $23 at press time. It has dropped about 1% in the last 24 hours and is down around 4.7% over the past week.

Still, the broader trend since July has been strong. The price climbed more than 65% from lows near $15.50, forming a steady series of higher lows and highs before losing some momentum near $26.

Short-Term Weakness Below 9-Day SMA

The recent pullback has taken the price below the 9-day simple moving average, which now sits at $24.35. This short-term trend line is easily utilized to test momentum. Slowing strength may be a hint of trade at it unless the price rebounds soon.

Meanwhile, the RSI reading is 56.80. Earlier this week, it touched 68.84 but has since reversed. This decline in momentum reveals that it is possible that buyers are pulling back. If the RSI slips below 50, it could suggest more weakness ahead.

Watch $33–$36 Range if Breakout Holds

According to trader CW, the last dip found support at the 0.618 Fibonacci level. They now see $33.30 as the next upside zone, based on the 1.618 extension. This range lines up with the $36 resistance zone that was active during late 2023. Many traders will watch these levels if AVAX breaks above $27.

If the breakout fails, the price may revisit support zones near $23.50 or $20.50. Both levels acted as resistance earlier and may now draw demand.

Earlier this year, FIFA announced it would build its blockchain network on Avalanche. Called FIFA Blockchain, the project is designed to power digital collectibles and new fan experiences. The platform will run as a Layer-1 chain and aims to reach global audiences through its use in sports and media.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...