BitMine’s Ethereum Holdings Surpass $2 Billion Mark

- BitMine reached $2 billion in ETH holdings.

- 566,776 ETH was acquired and staked.

- Focused on 5% of global ETH supply.

This development indicates BitMine’s dedication to bolstering its position in the Ethereum market, influencing both the company’s financial outlook and broader industry dynamics.

The announcement by BitMine Immersion Technologies details the company’s acquisition of 566,776 ETH, now worth over $2 billion. This follows a strategic financial operation, closing a $250 million private placement earlier in July. Under CEO Jonathan Bates, the firm has focused on asset-light treasury management, with Ethereum as a core investment. “We are committed to supporting the broader Ethereum ecosystem through our growing holdings and staking activities,” Bates stated. The leadership involves Chairman Tom Lee , who shapes the firm’s treasury strategy.

With a significant accumulation of Ethereum, BitMine may influence market liquidity and staking ratios. The BMNR stock surged following the news, reflecting investor confidence. Historically, similar actions have led to increased awareness and potential price appreciation.

BitMine’s ambitious goal to own 5% of Ethereum’s global supply establishes a new benchmark for public companies. This high-profile acquisition could reduce circulating supply, echoing past impacts seen with other cryptocurrencies, like MicroStrategy’s Bitcoin strategy.

Experts continue analyzing potential regulatory implications as BitMine’s actions may prompt increased market scrutiny. Historical trends suggest such movements can drive innovations in financial and technological sectors. The crypto community keenly follows potential shifts in ETH-related assets and liquidity, with updates available on BitMine’s Twitter account .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

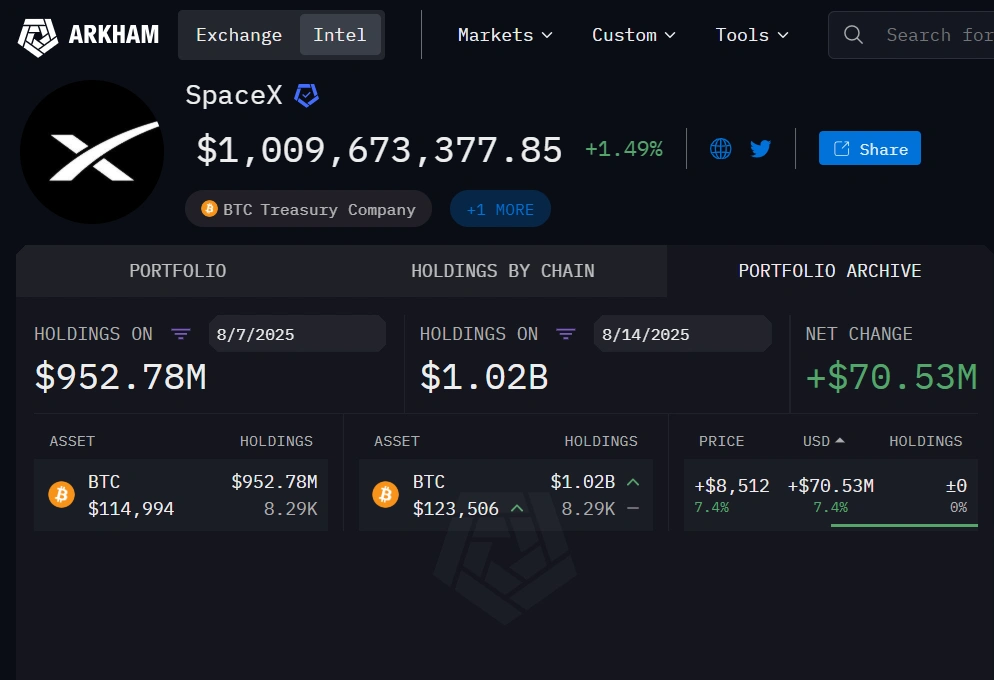

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.