Nigeria SEC welcomes stablecoin innovation while ensuring compliance

Nigeria’s Securities and Exchange Commission (SEC) has expressed support for stablecoin businesses that operate within the bounds of the country’s digital asset regulations.

During the Nigeria Stablecoin Summit held in Lagos, SEC Director-General Emomotimi Agama reportedly said the African country is ready to embrace blockchain-based payment innovations as long as they comply with existing laws.

He highlighted the growing relevance of stablecoins in Africa’s digital economy, where volatile local currencies have pushed many toward dollar-backed assets for stability.

Agama described Nigeria’s digital landscape as “dynamic, young, and increasingly decentralized,” pointing to how stablecoins are becoming integral to daily transactions.

Considering this, the financial regulatory chief said:

“I stand before you as both a regulator and an advocate for responsible innovation. My message today is clear: Nigeria is open for stablecoin business, but on terms that protect our markets and empower Nigerians.”

Nigeria ranks as one of the top countries for crypto adoption globally. According to data from Chainalysis, the country sits second in the world, driven by the practical use of digital currencies for remittances, commerce, and cross-border payments.

For many, stablecoins like USDT and USDC have filled a critical gap left by unreliable access to foreign currency and rising inflation.

Commenting on the SEC’s new stance, Nathaniel Luz, President of the Africa Stablecoin Network, told CryptoSlate that the announcement provides clarity that has long been needed in the emerging industry.

According to him:

“It’s a square peg in a square hole. It’s the right endorsement for the industry at this point. Up until now, so many crypto companies have treaded in the Nigerian market with great caution. Having such clarification from the DG of the SEC brings a high sigh of relief, while opening the door to foreign players.”

Meanwhile, this shift follows Nigeria’s crackdown on crypto firms last year, which included the arrest of Binance executive Tigran Gambaryan.

Since then, the authorities have moved toward structured regulation, including exploring a tax framework for crypto transactions to support national revenue efforts.

The post Nigeria SEC welcomes stablecoin innovation while ensuring compliance appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

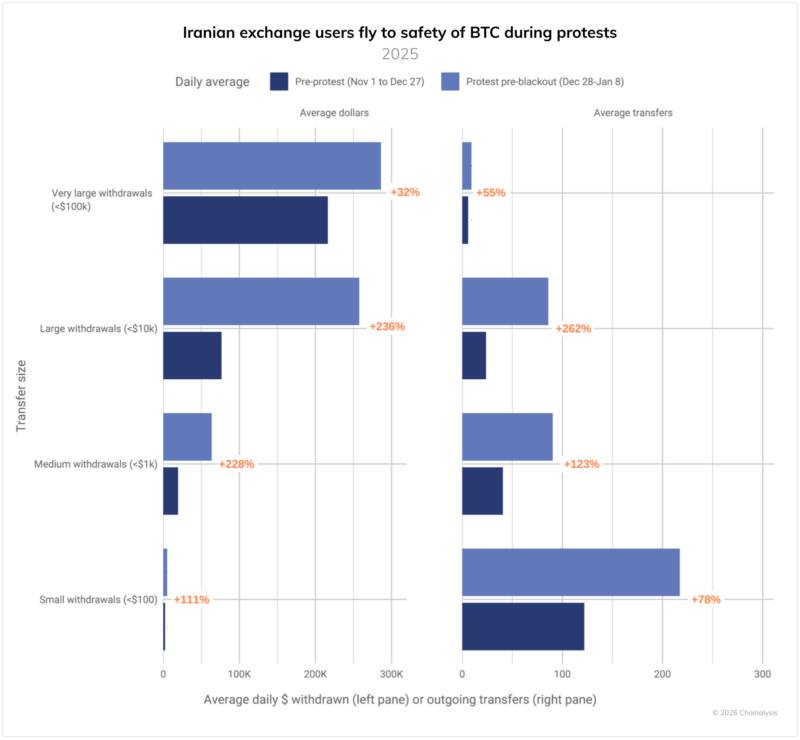

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?

Product Update: New Options Metrics Suite