SYRUP Gains Whale Attention — 3 Real World Assets (RWA) Altcoins to Watch in August

Even in a red market, RWA tokens are flashing bullish signs. Maple Finance, Zebec, and Keeta have held strong and may lead the next leg in August.

The broader crypto market has dropped over 5% this week, but the Real World Asset (RWA) sector is showing signs of resilience. While most altcoins struggle, the RWA market cap remains relatively stable at around $49.8 billion, indicating steady interest despite broader market weakness.

Amid this backdrop, a few RWA tokens have not only held their ground but also posted solid gains, attracting both whale activity and on-chain attention. We’ve picked three standout RWA tokens that are showing strong momentum as August approaches. Read on to learn which coins are gaining traction, what’s driving their rally, and why they should be on your radar.

Maple Finance (SYRUP)

Maple Finance is a DeFi lending protocol that lets trusted firms borrow crypto without collateral. It’s built for real-world use, and interest is rising as more institutional players tap into on-chain credit.

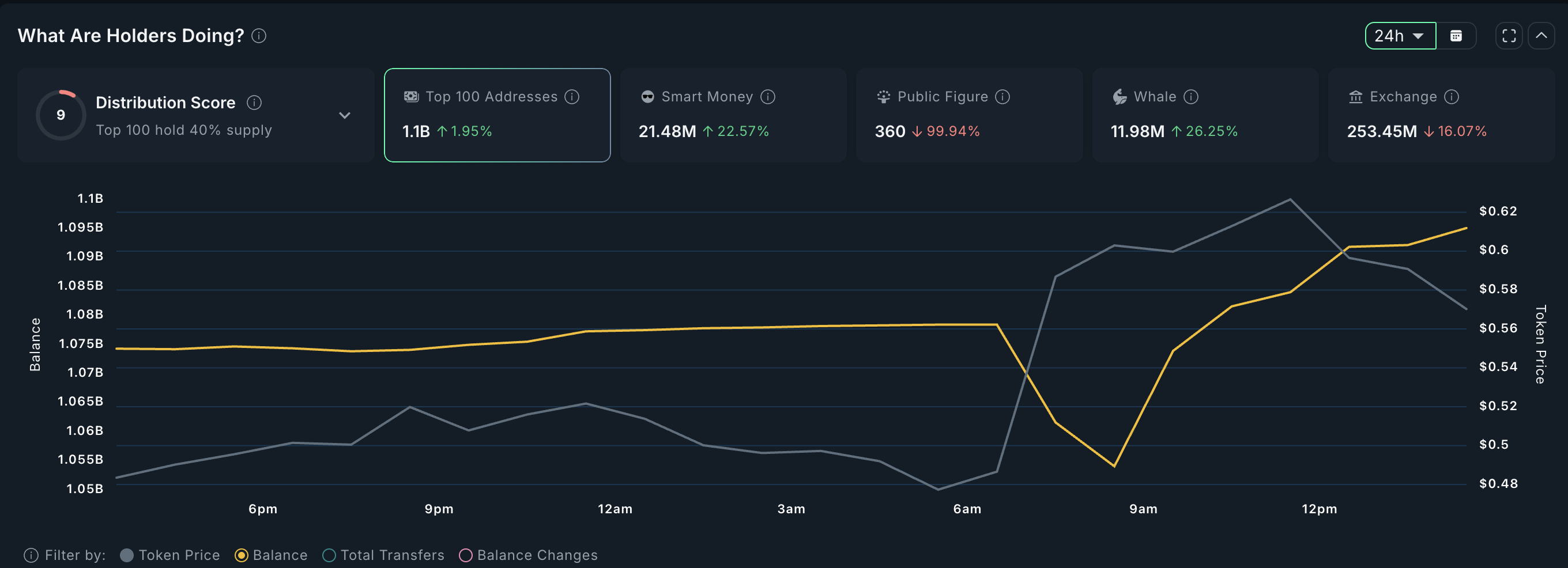

SYRUP, Maple’s RWA token, is flashing strength. It’s up 31% over the past week and 25% in just 24 hours. The move is backed by strong on-chain action. Whale holdings have surged 26.25% in a day, now totaling 11.98 million SYRUP.

Smart money wallets are also up 22.57% in the same period. Exchange balances fell by 16%, suggesting lower selling pressure.

Maple Finance, as the top RWA altcoin for August:

Maple Finance, as the top RWA altcoin for August:

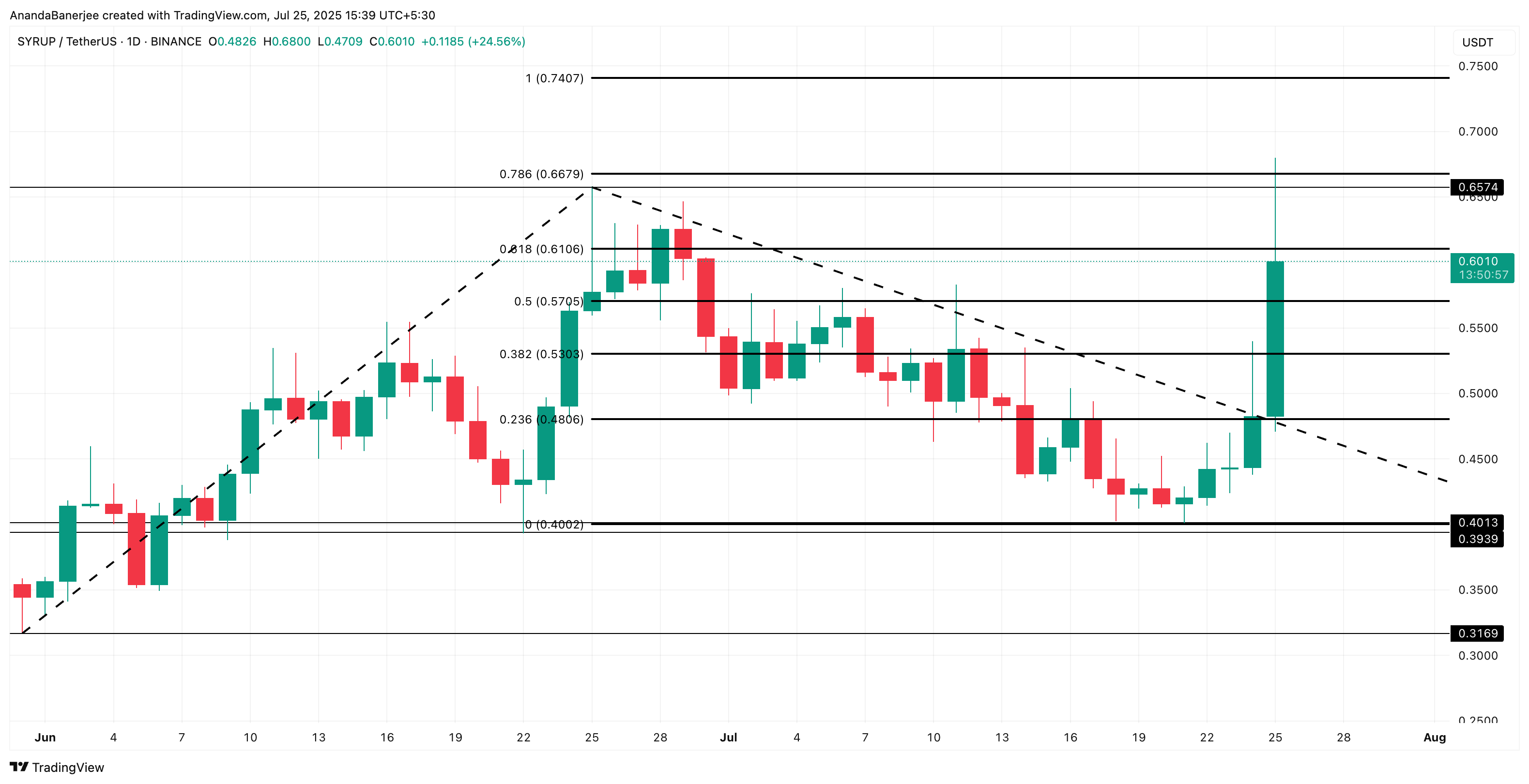

From a technical view, SYRUP has broken past a key Fibonacci resistance at $0.57, which marks the 0.5 Fib extension level. It’s now trading near $0.60, with the next key resistance at $0.65 (previous swing high). If that breaks, the full extension could push the price toward $0.7407.

Note that this RWA token managed to break through multiple resistance levels with a single rising candle, but the sellers quickly pushed the prices down.

SYRUP price analysis:

SYRUP price analysis:

If price breaks back below $0.55 and exchange balances reverse, the upside case weakens. But for now, bulls seem in control.

Zebec Network (ZBCN)

Zebec Network is a Solana-based real-world asset (RWA) payments platform focused on programmable cash flows. It allows users and institutions to stream payments in real-time, making it useful for payroll and subscriptions. Its use case is gaining attention as RWA protocols grow in demand.

ZBCN, the RWA token, has jumped 44.3% over the past week and is up 11.5% in the last 24 hours. This surge comes alongside a steady uptick in whale and smart money interest, making it one of the strongest altcoin performers during the broader market dip.

Zebec Network whale accumulation trends:

Zebec Network whale accumulation trends:

From Nansen’s dashboard, whale holdings have risen 1.52% over the past 7 days to 487.98 million ZBCN, while smart money holdings are up 7.84% to 50.51 million. These inflows suggest quiet accumulation by deep-pocketed investors. Public figure wallets also rose 4.61%. Meanwhile, exchange balances have dropped slightly to 21.14 billion, which hints at reduced sell pressure.

Zebec Network price analysis:

Zebec Network price analysis:

The price has broken past the downtrend resistance and has flipped the $0.0038 into a strong support zone. It now sits around the $0.0042 level. If it clears the $0.00478 Fibonacci resistance next, a move toward $0.0055 or even $0.0063 could follow.

However, if it fails to hold $0.0038, a short-term correction toward $0.0023 may be possible.

OriginTrail (TRAC)

OriginTrail is a Web3 data and AI project focused on supply chain transparency and real-world asset integration. It helps verify and track physical items on-chain, from pharmaceuticals to luxury goods. With RWA demand rising, OriginTrail is gaining attention.

TRAC price is up 2.1% today, bucking the broader market’s weakness. In the last 7 days, whale holdings are up 323%, signaling rising big-player interest. Nansen data shows top 100 holders increased their stash by 2.03%, while exchange balances dropped 4.24%, suggesting less selling pressure ahead.

Even though the exact token numbers aren’t high, whale interest cannot be undermined.

TRAC whale movement:

TRAC whale movement:

On the price chart, TRAC recently broke above the $0.48 resistance and is now hovering around $0.50. If it clears $0.53 (a level rejected earlier), the Fibonacci extension chart points to upside targets at $0.69 (the 1.618 Fib extension).

TRAC price analysis:

TRAC price analysis:

If the price falls below $0.48, the rally may pause and test the support at $0.44 or even $0.41. But with whales stacking and exchange supply dropping, the bullish momentum looks intact, and TRAC may have more upside as RWA narratives heat up.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Performance Food Group (NYSE:PFGC) Surpasses Q3 CY2025 Projections

Baidu's ERNIE 5 AI Model Rises Up the Rankings—A Math Wiz That Beats OpenAI's GPT 5.1

Fed Leaders Support Holding Off on Rate Cuts Amid Ongoing Inflation Worries