Pump.Fun’s 100% Revenue Buyback Strategy Examined

- Pump.Fun’s singular buyback event with daily revenue sparked debate.

- Token value fell after buyback, highlighting volatility.

- Community doubts sustainability without official leadership comments.

Pump.Fun used 100% of its daily revenue for token buybacks, differing from its usual 25% allocation. This action, identified by community analysts, raised questions about sustainability and liquidity risks, showing volatility in newly repurchased tokens.

Speculation surrounds Pump.Fun’s decision to allocate full daily revenue for token buybacks, highlighting substantial market and liquidity risks. Immediate reactions include significant asset volatility and increased scrutiny from community analysts.

Pump.Fun, usually allocating 25% of revenue for buybacks, dedicated 100% of its daily revenue for buybacks recently. This move was widely discussed on community platforms amid immediate drops in token prices following the action. Community insights indicate this might have been a temporary measure rather than a long-term strategy, as no official statements affirm a permanent policy change.

The decision affected the value of the PUMP token, which experienced sharp price fluctuations after the major buyback event. Traders and analysts highlighted the risks associated with such volatility, noting a stark decline in the token’s market value soon after the buyback. The liquidity volatility in the crypto market reflects the challenges faced when implementing significant buyback policies without robust utility or underlying stability.

“It appears that they did indeed conduct a 100% buyback within a single day.” – Dumpster DAO, Community Participant, Decentralized Project

Initial community reactions suggest skepticism regarding the strategy’s sustainability. Observers question whether such moves could maintain long-term token value. These events mirror trends in similar token buybacks, where short-lived value spikes can often precede declines without strong utility enhancements or market acceptance. The absence of official remarks from Pump.Fun’s leadership adds to the uncertainty surrounding future policy directions and potential economic implications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hong Kong Begins Six-Month Transition for New Stablecoin Rules

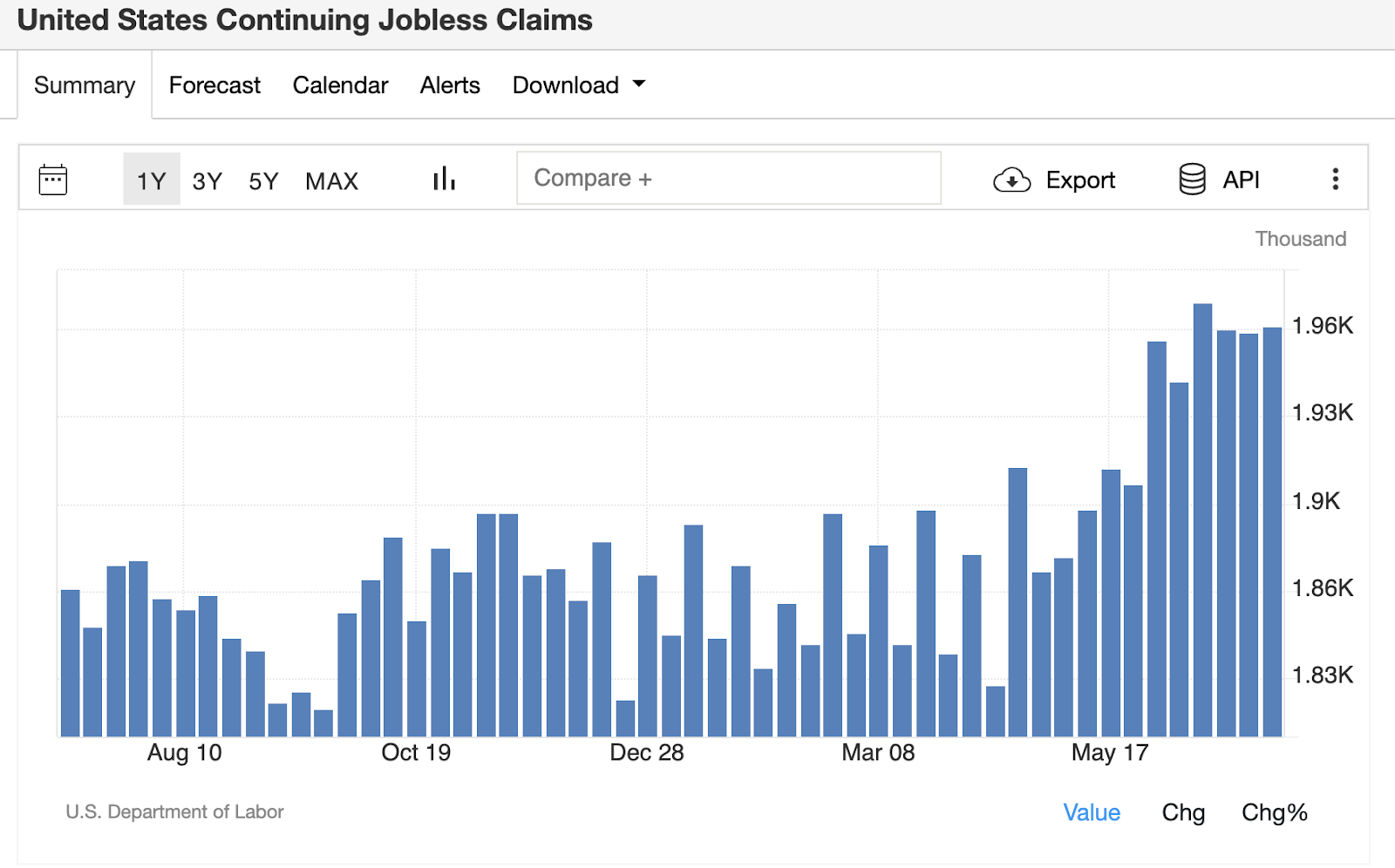

Recapping the latest US data: Philly Fed, retail sales and more

After a jittery few months, recent economic data is hinting at a resilient economy that is beginning to re-accelerate

Dogecoin Whales Acquire 130M DOGE Amid 15% Price Drop

Twenty One Capital Acquires 5,800 BTC, Becomes Third-Largest Holder