Solana Price Pullback Might Continue as Traders Bet $1.2 Billion on a Dip

Solana price has pulled back 6% this week as SOPR dips and short bets rise. Key support at $175 could decide whether bulls regain control or the dip deepens.

Solana’s rally seems to have cooled off. Despite posting over 22% gains in the past month, the last seven days have been sluggish. The token has dropped nearly 6%, now trading around the $184 mark, well below the recent high.

While this might look like just a healthy cooldown, some on-chain and sentiment metrics suggest that the correction might drag on longer than expected.

SOPR and Liquidations Hint at Bearish Pressure

One of the key signs of potential further correction comes from the SOPR, or Spent Output Profit Ratio. This metric tracks whether holders are selling their tokens at a profit or loss.

Solana’s SOPR has dropped from 1.04 to nearly 1.00 over the past week, meaning wallets that are selling now are barely breaking even.

In simple terms, fewer people are cashing out in profit, which usually happens when confidence starts dipping. This often signals market hesitation or early signs of panic, more so when the metric drops along with the price.

Solana price and falling SOPR:

Glassnode

Solana price and falling SOPR:

Glassnode

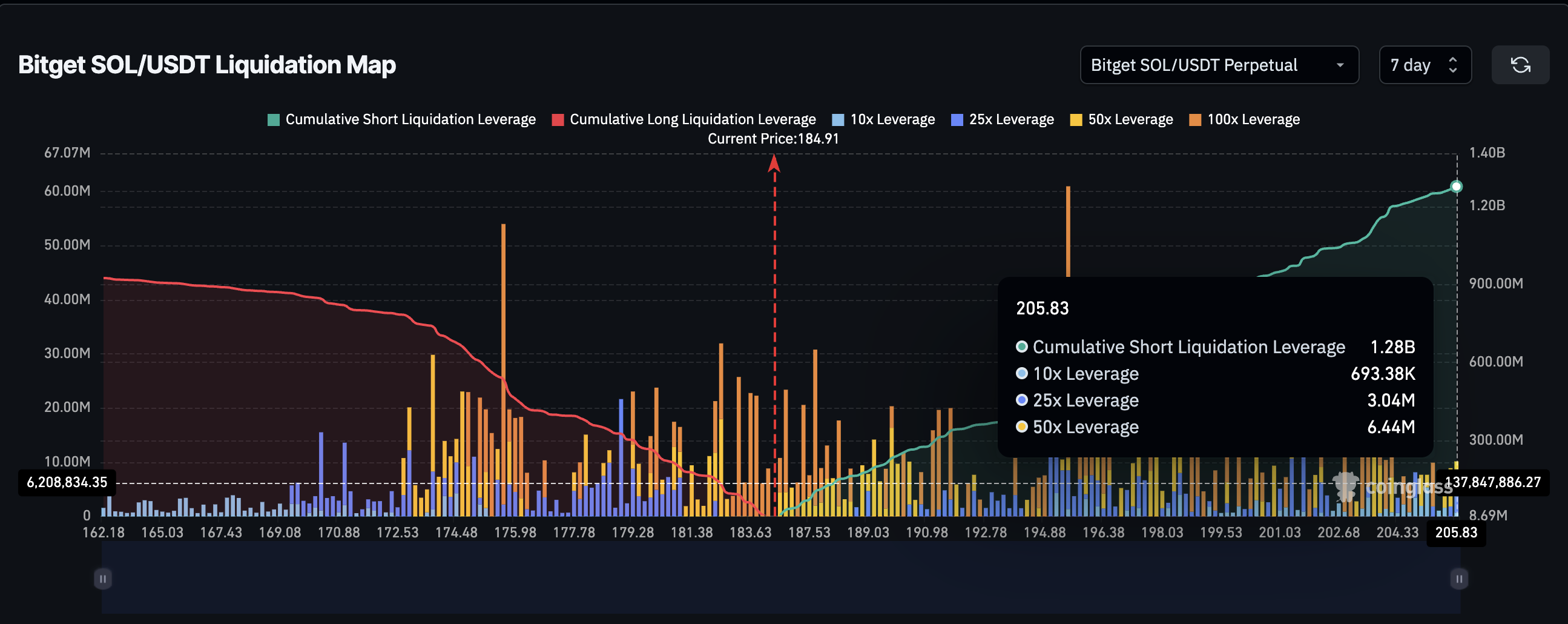

Validating this weakness is the liquidation data. In the 7-day window, short positions on Solana total $1.28 billion, compared to $924 million in long positions.

Solana liquidation map:

Coinglass

Solana liquidation map:

Coinglass

That means traders are placing bigger bets on Solana’s price falling further. This short bias lines up with the SOPR reset and shows that traders are no longer positioning for upside, at least in the short term.

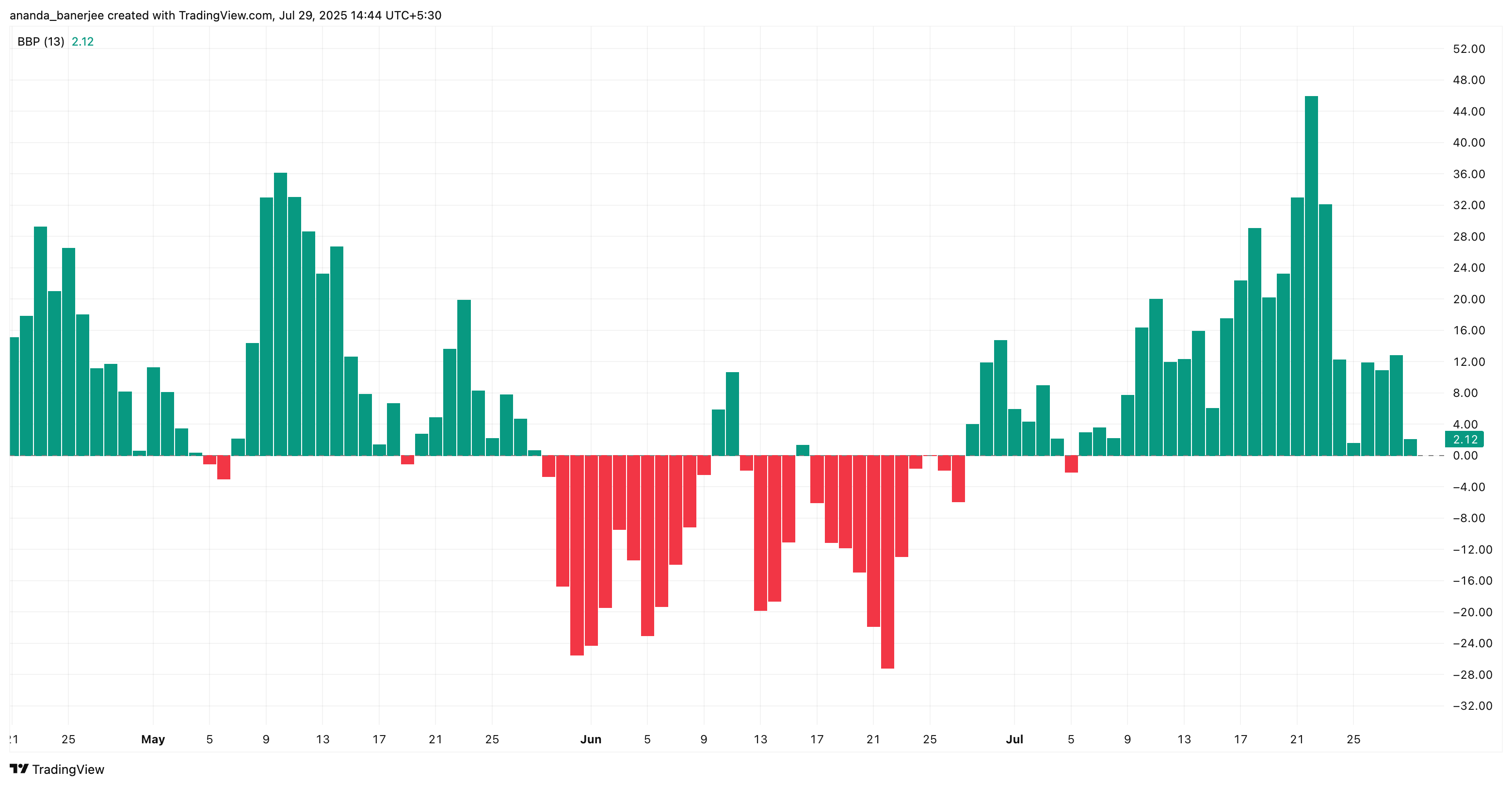

Bullish Momentum is Losing Steam

Another red flag comes from the Bull-Bear Power Index. This indicator, which measures the strength of buyers versus sellers, has been trending downward. It shows that buyers are slowly losing control as the correction deepens.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A fading bull power reading means fewer aggressive buys are happening during dips, reducing the chance of a quick bounce-back.

Solana bulls are losing momentum:

TradingView

Solana bulls are losing momentum:

TradingView

This kind of cooling off doesn’t necessarily mean Solana’s long-term trend is broken, but it does imply that bulls are taking a breather.

Without a fresh wave of buying interest, the price could stay soft or grind lower before any meaningful recovery.

Key Solana Price Levels to Watch: $175 as Make-or-Break Support

From a price action standpoint, Solana has pulled back from its local top at $206 and is now hovering around $184. Based on a Fibonacci retracement from the recent $125 low to the $206 high, the key support level to watch is $175. This is a classic 38.2% retracement zone, often seen as the first “serious” support in a healthy uptrend.

Solana price analysis:

TradingView

Solana price analysis:

TradingView

If Solana holds this level, it might trade in a range before trying another leg up. However, a break past $187, a key resistance ( a level where the SOL prices have been rejected earlier), can quickly flip the short-term bearish narrative bullish.

But if $175 breaks, it could open the door for a deeper correction. That would confirm the bearish signals flashing from SOPR, liquidations, and weakening bull power.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Rising Stars to Market Giants: 4 Top-Rated Cryptos in 2026 Revealed

X cuts down InfoFi projects with AI-generated content

Why Calavo (CVGW) Shares Are Rising Today

Why Vertiv (VRT) Shares Are Rising Today