- FG Nexus raises $200 million in funding

- Capital will support its Ethereum-focused treasury strategy

- Move reflects growing institutional confidence in $ETH

FG Nexus, a publicly traded company, has announced the successful raise of $200 million to back a bold Ethereum treasury strategy. This significant capital injection is aimed at strengthening the firm’s position in the crypto space, particularly through Ethereum ($ ETH ), the second-largest cryptocurrency by market cap.

This move places FG Nexus among the growing number of institutions treating Ethereum not just as an asset, but as a core part of their financial and strategic planning. As traditional markets continue to take note of crypto’s potential, large-scale investments like this demonstrate an evolving corporate mindset.

Ethereum Becomes a Treasury Asset

FG Nexus’s $200 million raise isn’t just a financial maneuver—it marks a deliberate shift in how public companies are viewing digital assets. By committing such a large amount to an Ethereum treasury strategy, the firm is indicating long-term belief in Ethereum’s future value and utility.

The strategy is likely to include both direct ETH holdings and potential exposure to Ethereum-based financial instruments or DeFi opportunities. This aligns with a broader trend of institutional Ethereum adoption, as ETH increasingly finds a place in corporate portfolios.

What This Means for the Market

This development adds to the bullish sentiment around Ethereum, especially at a time when institutions are exploring blockchain integration and decentralized technologies. Investors and crypto watchers will view FG Nexus’s decision as a milestone in mainstream ETH adoption.

With Ethereum poised for future upgrades and growing use cases—from smart contracts to NFTs and beyond—FG Nexus’s treasury strategy could inspire other companies to follow suit.

Read Also :

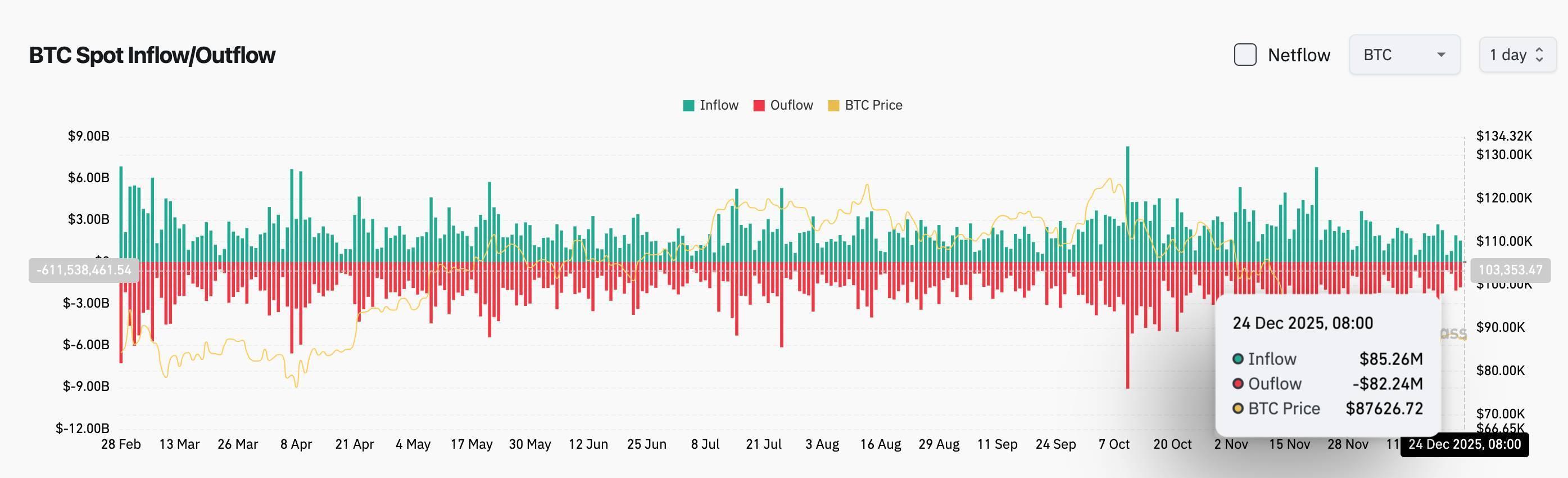

- Whales Sell as Institutional Bitcoin Demand Surges

- ETH Narrative Shift Boosts Institutional Adoption

- BTC Holders Sit on $1.4T in Unrealized Gains

- JASMY Eyes 1,650% Surge Toward $0.2785 Target

- FG Nexus Secures $200M for Ethereum Treasury Strategy