Ripple’s XRP Eyes Double Bottom Reversal Pattern

- XRP forms potential double bottom around $3.10, indicating reversal.

- Ali Martinez notes five-wave bounce signals bullish trend.

- Positive funding rates and wallet growth support market optimism.

Ripple’s XRP is forming a potential double bottom around $3.05–$3.10, suggesting a bullish reversal if buying persistency pushes past key resistance levels, according to crypto analysts on July 31, 2025.

The potential XRP rebound indicates a shift in market sentiment, supported by on-chain data, positive funding rates, and analyst forecasts, though executive comments are still absent.

XRP is forming a potential double bottom around $3.05–$3.10, suggesting a bullish reversal. This development comes as traders closely monitor key resistance zones.

Main Content

Crypto analyst Ali Martinez highlighted the setup via Twitter, observing a higher low pattern with a subtle five-wave bounce. Ripple executives have not commented on this potential chart formation yet.

On-chain activity shows unique wallet numbers near 7.3 million, signaling increased user participation. Exchange balances are declining as coins move off exchanges, interpreted as long-term holding. Market sentiment remains cautiously optimistic. Despite recent liquidations, funding rates are positive, supporting a bullish outlook. Derivatives markets also trade at a premium, bolstering confidence.

Speculation surrounds potential ETF approval, though no official announcements have been made. Related altcoins, like Litecoin and Solana, might benefit from positive spillover if such approvals occur. Crypto WZRD discusses latest blockchain innovations

Historical data suggests that double bottoms often precede significant rallies, provided breakouts are confirmed. This pattern holds significance for XRP, contingent on a breakout above $3.25–$3.30.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

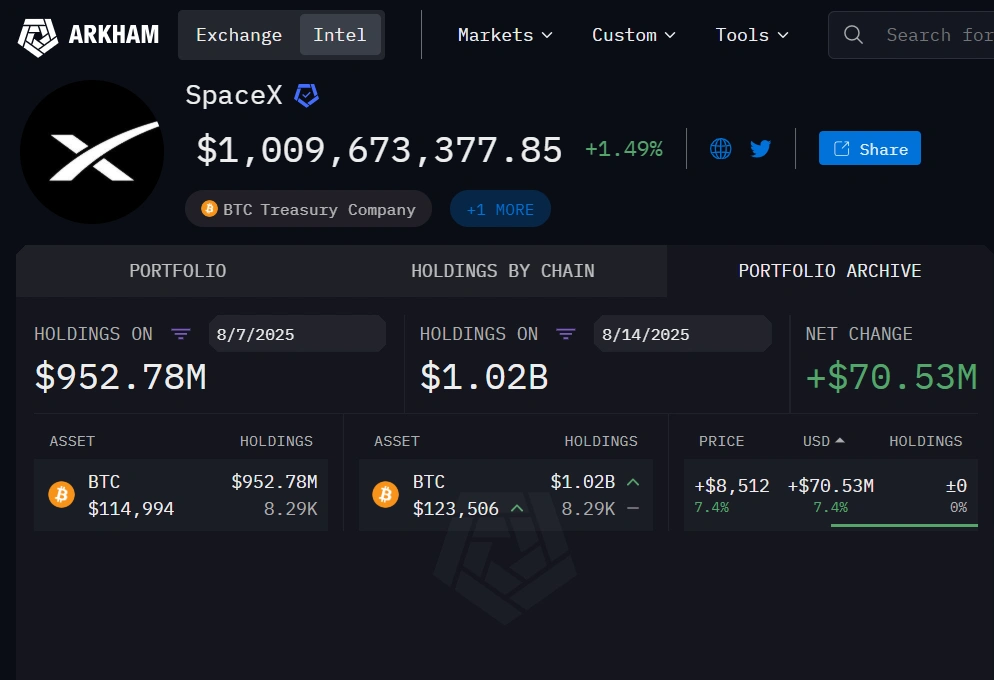

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.