Institutions Submit Revised Solana Spot ETF Documents to SEC

- SEC filings from Franklin Templeton and others include direct staking.

- Ongoing regulatory dialogue signals potential approval progress.

- Increased institutional investment may impact Solana ecosystem liquidity.

Franklin Templeton and six other asset managers submitted revised S-1 filings for Solana spot ETFs to the SEC. These amendments reflect regulatory dialogues and incorporate staking, aiming to enhance transparency and yield for investors.

Franklin Templeton, Grayscale, and other asset managers submitted updated S-1 documents for Solana ETFs to the SEC in July 2025, reflecting regulatory dialogues.

Solana ETF filings are seen as a step towards regulatory approval, potentially encouraging significant capital inflow into Solana, reminiscent of Bitcoin ETF approvals.

The revised S-1 documents submitted by major asset managers, including Franklin Templeton and Grayscale, highlight the possibility of direct staking within Solana ETFs . This indicates ongoing compliance efforts to address SEC provisions. Industry leaders like Jito Labs back these filings by emphasizing Solana’s infrastructure.

The market impact could be substantial, drawing in institutional capital akin to prior Bitcoin and Ethereum ETF approvals . This might enhance Solana’s liquidity, and indirectly affect BTC and ETH, as market rebalancing occurs. Initial responses from market participants are cautiously optimistic.

The financial landscape is set to evolve as stakeable asset ETFs may enhance yield options for holders. These developments could influence staking participation and liquidity metrics, though detailed data remains pending. Historical trends from prior ETF approvals underline likely capital inflows and ecosystem growth potential. Investors and stakeholders now keenly await further SEC updates, with the prospect of rising institutional adoption for Solana causing industry speculation.

“These amendments reflect ongoing dialogue between the issuer and the SEC regarding improving the prospectus language, indicating that the approval process is progressing.” — Nate Geraci, President, The ETF Store

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

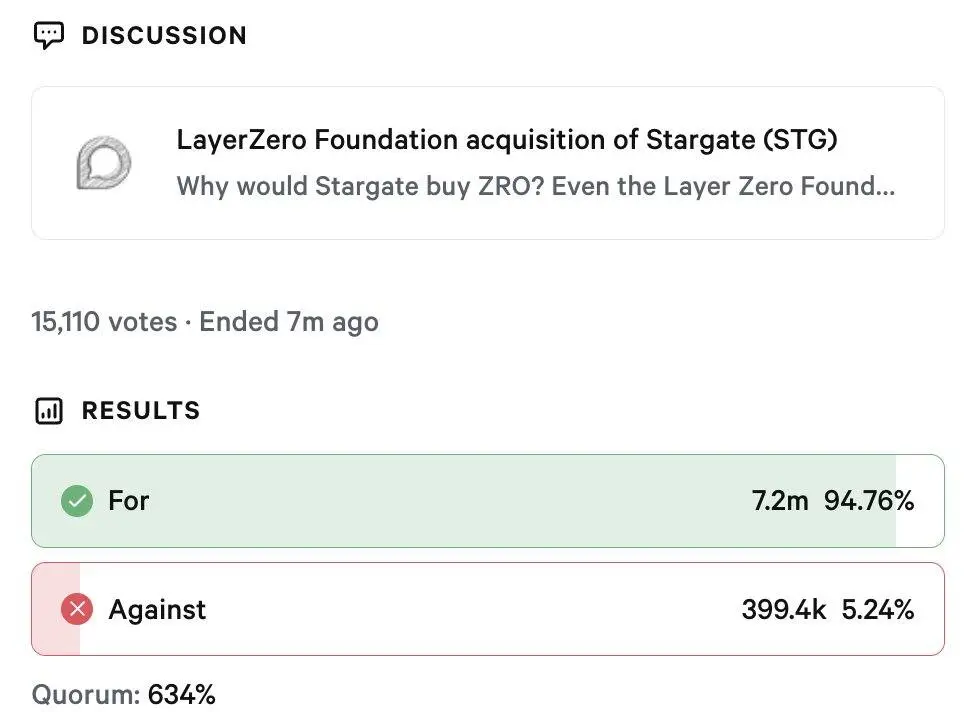

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated