PI Network Falls to New All-Time Low—Why the Token Could Slide Even Further

PI’s price drop to $0.39 is linked to a massive 150 million token unlock, and bearish indicators suggest the downtrend may continue unless demand surges.

PI’s price dropped to a new all-time low of $0.39 during the early hours of Friday’s Asian trading session, intensifying bearish concerns across the market.

Although it has rebounded slightly to trade at $0.40 at press time, the price dip reflects mounting sell pressure ahead of the 150 million PI token unlock, which will be conducted over the next 30 days.

150 Million PI Tokens Set to Test Market’s Breaking Point

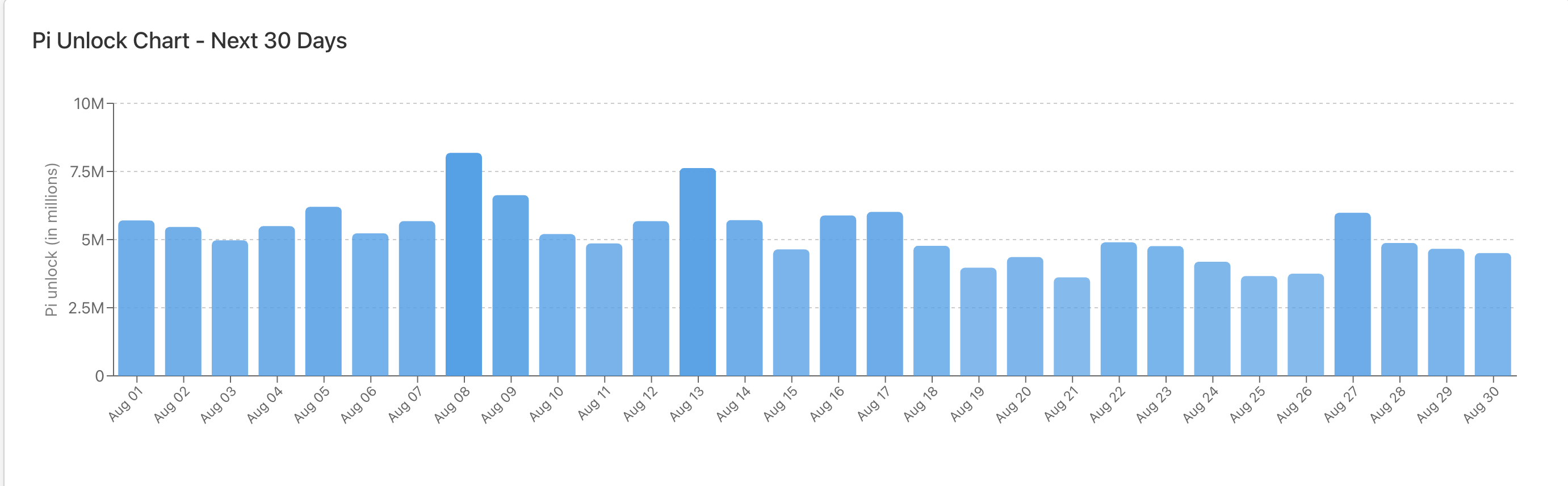

According to data from PiScan, 150 million tokens, valued at $64 million at current market prices, are scheduled to be unlocked over the next 30 days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

PI Unlock Chart. Source:

PiScan

PI Unlock Chart. Source:

PiScan

Large-scale token unlocks like this exert significant downward pressure on crypto asset prices, particularly in low-demand environments. Unless demand for PI sees a strong and sustained uptick, the altcoin’s downtrend may continue or even accelerate.

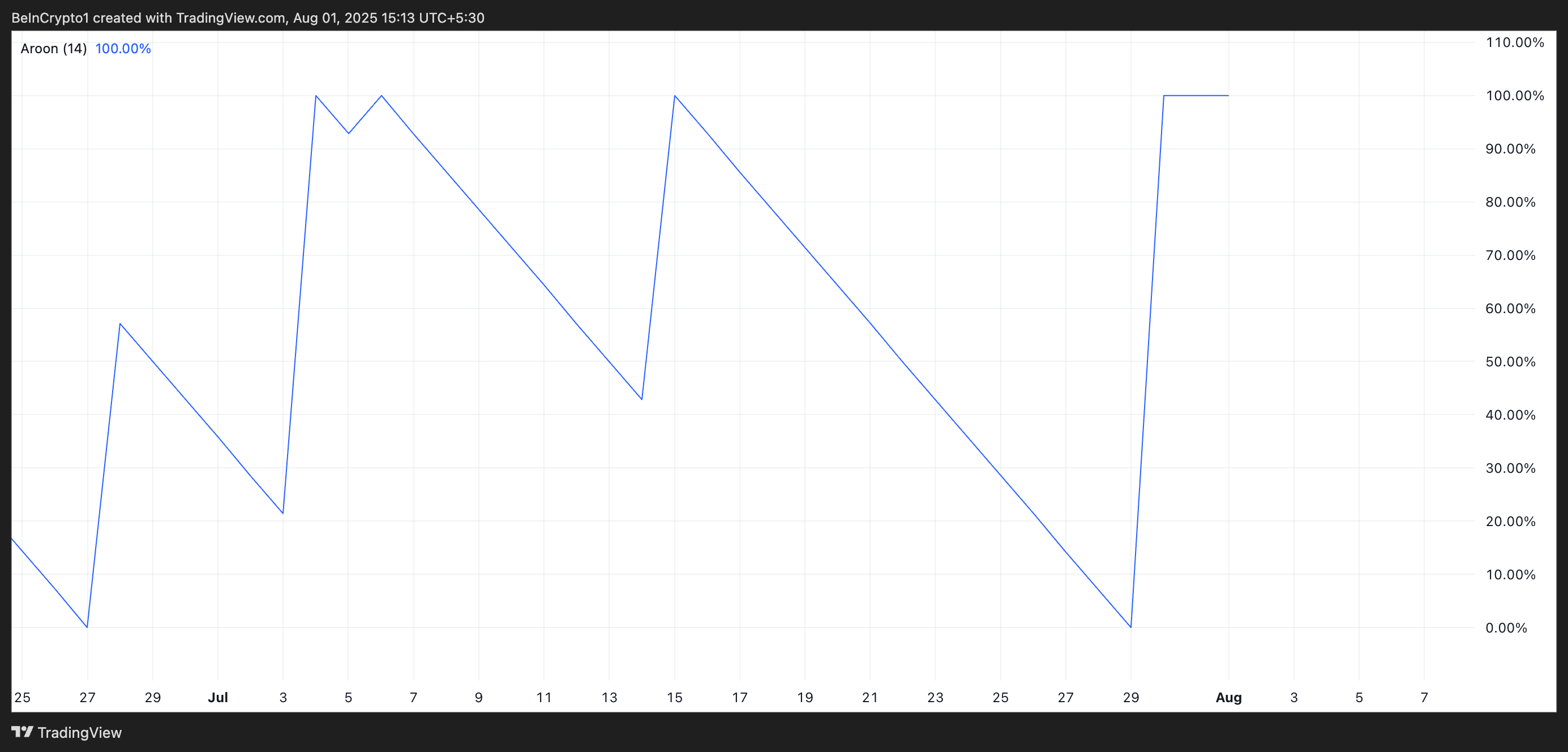

Technical indicators paint a similarly bleak picture. The Aroon Down Line, which measures the strength of recent downtrends, currently sits at 100% on PI’s daily chart. This signals that the decline is strong and sellers are firmly in control.

PI Aroon Down Line. Source:

TradingView

PI Aroon Down Line. Source:

TradingView

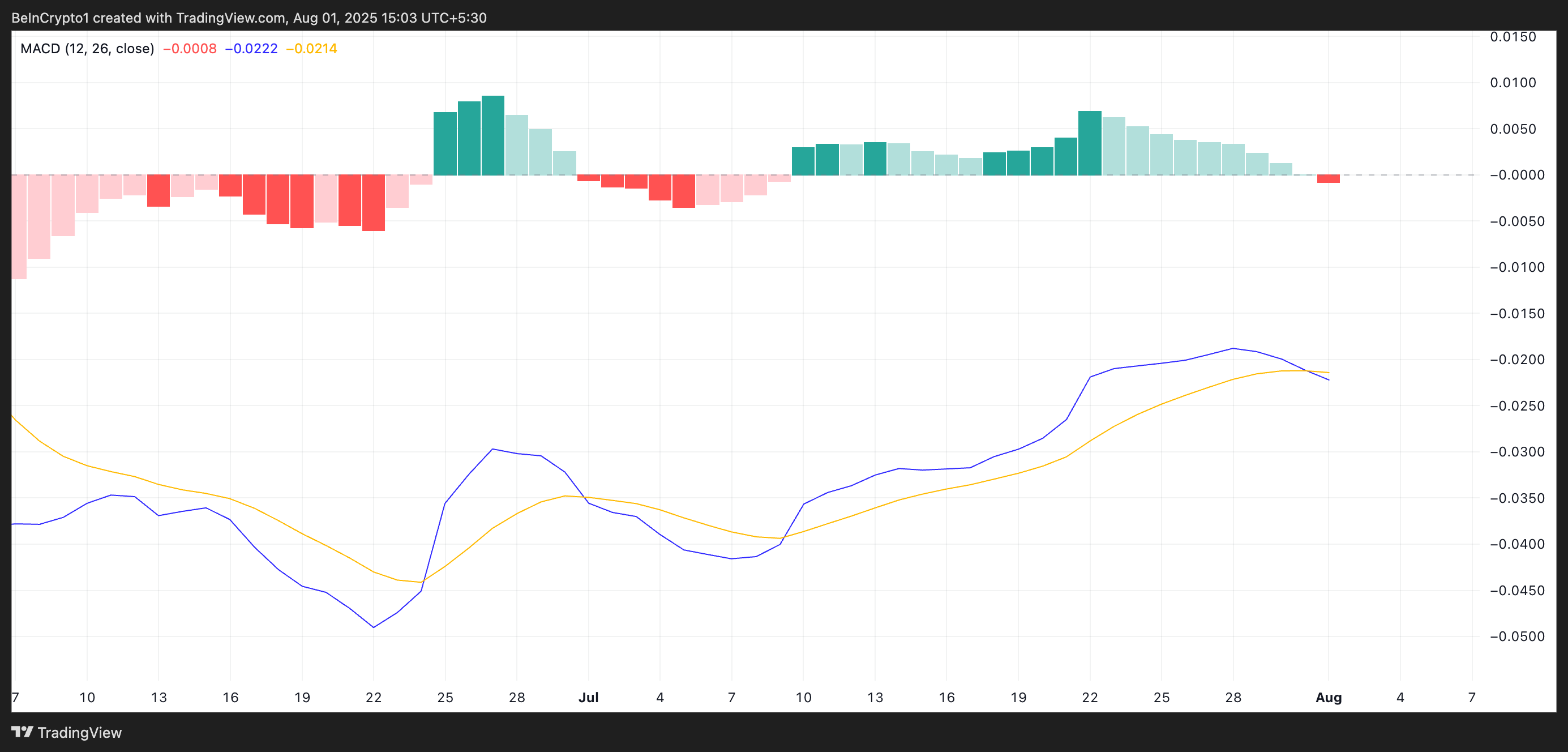

Further compounding the bearish outlook is the recent crossover observed on PI’s Moving Average Convergence Divergence (MACD) indicator. Readings from the PI/USD one-day chart show that the MACD line (blue) has crossed below the signal line (orange) during today’s session.

PI MACD. Source:

TradingView

PI MACD. Source:

TradingView

This crossover is a classic confirmation of shifting momentum in favor of the bears, suggesting that selling pressure has decisively overtaken any lingering bullish sentiment.

Pi Slides, But Oversold RSI May Offer Short-Term Reprieve

With a massive token release imminent, PI may struggle to regain footing unless sentiment improves and demand surges to absorb the incoming supply. If demand remains low, PI could revisit its $0.39 all-time low and decline further.

However, there is a catch. PI’s Relative Strength Index (RSI) rests at 32.02, shy of the 30-mark that indicates oversold conditions.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

PI RSI. Source:

TradingView

PI RSI. Source:

TradingView

While this suggests bearish momentum remains dominant, a short-term rebound could be on the cards if buyers step in to defend the current price level. In that case, PI’s price could climb toward $0.46.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?