Bitcoin is currently testing a crucial resistance level near $113,900, influenced by a CME futures gap and balanced investor sentiment as indicated by SOPR data, signaling a healthy market without panic.

-

Bitcoin approaches $113,900 resistance amid CME futures gap, suggesting potential consolidation or bounce.

-

Short-term investors maintain balanced sentiment with SOPR near 1.03, indicating no panic selling.

-

Technical pullback reflects a healthy market pause, supported by steady ETF demand and stable macroeconomic conditions.

Bitcoin tests $113,900 resistance amid CME gap and balanced SOPR sentiment. Discover market insights and trading outlook with COINOTAG’s expert analysis.

-

Bitcoin tests key resistance near $113,900 amid CME gap tension while SOPR data reveals balanced sentiment and no signs of market panic.

-

Bitcoin hovers near $113,900 as CME gap zones attract intense trading interest, pointing to potential short-term consolidation or bounce.

-

Short-term investors show restraint as SOPR holds around 1.03, indicating a healthy and measured market sentiment unlike past euphoric peaks.

Bitcoin is entering a crucial phase this week as it tests key price levels near $113,900, triggering strong market reactions. Weekend volatility and CME futures trading gaps have created a technical pressure zone, with short-term holders also revealing more cautious behavior. This situation brings both warning signs and fresh opportunities, making traders and analysts alert.

Bitcoin was recently priced around $113,693, down slightly by $18. Analysts at Swissblock emphasize that this pullback is a normal, healthy pause rather than a market reversal. The current structure suggests a technical breather before a potential upward move. ETF demand remains steady, and macroeconomic indicators show no significant threats, supporting a stable outlook.

Source: CryptoRus

How Does the CME Gap Create Technical Pressure on Bitcoin?

The Chicago Mercantile Exchange (CME) futures chart reveals a significant price gap between $112,500 and $113,900 after reopening on Monday. This gap represents a zone where no traditional futures trades occurred over the weekend, creating a technical pressure area. Price action often gravitates towards filling such gaps, making this zone a focal point for traders.

Trading volume surged around the gap, with Bitcoin hovering near the upper boundary at $113,900. Historically, CME gaps tend to be “filled” as prices retrace, so market participants closely watch whether Bitcoin will sustain above $113,900 or retreat toward $112,500.

Source: Daan Crypto Trades

What Does SOPR Indicate About Short-Term Bitcoin Investors?

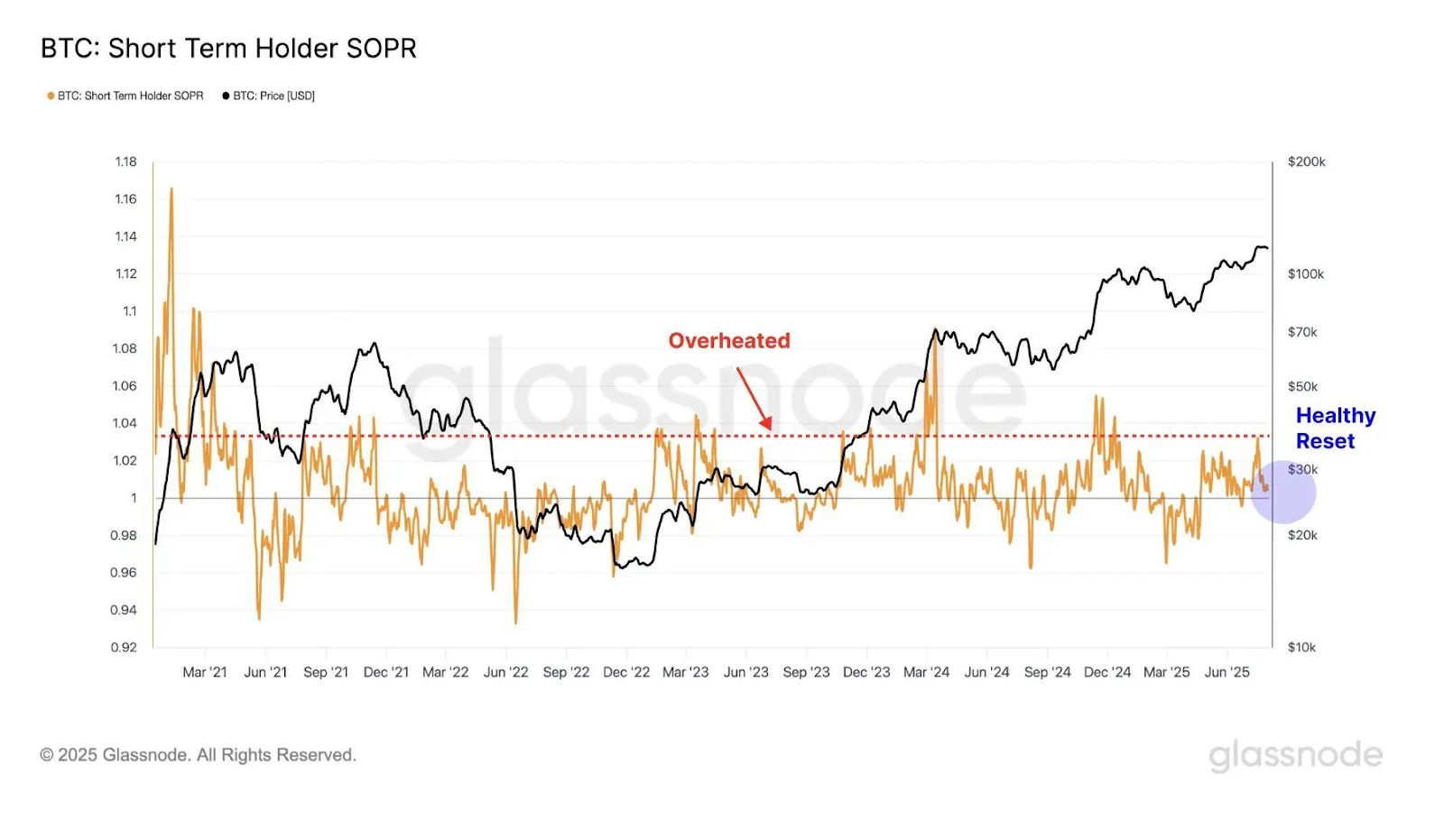

The Spent Output Profit Ratio (SOPR) currently stands near 1.03, signaling a balanced market sentiment among short-term investors. This metric measures whether recent buyers are selling at a profit or loss. A SOPR close to 1 indicates a “healthy reset,” with no excessive profit-taking or panic selling.

In contrast, during previous bull runs, SOPR peaked around 1.16-1.17 when Bitcoin reached $70,000 and later surpassed $100,000. These elevated levels reflected overheated market conditions. The current moderate SOPR suggests measured investor behavior and a stable market environment.

Frequently Asked Questions

Why is Bitcoin testing resistance near $113,900?

Bitcoin is testing resistance near $113,900 due to a CME futures gap creating a technical pressure zone. This level acts as a magnet for price action and traders watch closely for a breakout or retracement.

What does a SOPR value of 1.03 mean for Bitcoin traders?

A SOPR value of 1.03 means traders are selling close to their purchase price, indicating balanced market sentiment without panic or euphoric selling, which supports price stability.

Key Takeaways

- Bitcoin tests $113,900 resistance: CME futures gap creates a key technical pressure zone.

- SOPR indicates balanced sentiment: Short-term investors show no signs of panic or euphoric selling.

- Market outlook remains stable: ETF demand steady and macroeconomic factors show no major risks.

Conclusion

Bitcoin’s current test of resistance near $113,900 amid the CME gap and balanced SOPR sentiment reflects a healthy market pause rather than a breakdown. With steady ETF demand and stable macroeconomic conditions, traders should watch these technical signals closely for potential upward momentum. COINOTAG will continue to provide timely updates on this evolving situation.