Russia and Saudi Arabia to Boost Oil Production Starting October

Saudi Arabia, Russia and their partners within OPEC+ announce a coordinated increase in oil production of 547,000 barrels per day. A strategic decision that disrupts the fragile balance of the global market and could reignite geopolitical tensions, as the standoff between Washington and Moscow intensifies.

In Brief

- OPEC+ increases its production by 547,000 barrels per day, or 0.6% of global consumption.

- Saudi Arabia and Russia lead this market share recovery initiative.

- Trump threatens new sanctions against Russia and its trading partners.

- India maintains its Russian imports despite American pressures.

Russia and Saudi Arabia want to regain control

On Sunday, August 3, eight producing countries gathered within OPEC+ officially agreed to increase their daily production by 547,000 barrels.

This decision, jointly led by Saudi Arabia and Russia , is part of a long-term strategy aimed at recovering market shares lost during previous restrictive policies.

This increase certainly represents a modest fraction of the 100 million barrels consumed daily worldwide. However, it signals a major paradigm shift. After years of drastic cuts aimed at keeping prices high, oil giants now prioritize volume over prices.

The immediate impact is already felt in the markets. Brent, the international benchmark, hovers around 70 dollars per barrel. A level that strongly contrasts with the peaks of 120 dollars reached in spring 2022, during the Russian invasion of Ukraine.

For French consumers, this stabilization could keep pump prices at their current levels: 1.62 euros per liter of diesel and 1.66 euros for gasoline.

The forward-looking vision of OPEC+ relies on growing demand until the middle of the century. This forecast directly contradicts the projections of the International Energy Agency, which expects stabilization by 2030, notably due to the widespread adoption of electric vehicles.

Geopolitical tensions redraw the energy chessboard

The OPEC+ announcement comes in a particularly volatile geopolitical context. Donald Trump recently hardened his tone towards Moscow, giving “ten days” to Russia to resolve the Ukrainian conflict.

This ultimatum comes with concrete threats: “We will impose tariffs and other things“, stated the American president.

Among the measures considered is an indirect surcharge of 100% on imports of Russian products, including hydrocarbons. This move targets India directly, which by 2025 became the world’s second largest importer of Russian oil, with 1.6 million barrels per day.

But New Delhi does not bow to pressure. The Indian government has clearly expressed its determination to maintain its energy relations with Moscow, asserting the primacy of its strategic interests over American injunctions.

This stance illustrates the growing fragmentation of the global trading system, marked by the emergence of rival economic blocs such as the BRICS and the erosion of Western unilateralism.

In this context of rapid recomposition, oil market outlooks are becoming increasingly opaque. Reversals in American trade policy, combined with persistent geopolitical instability, plunge the energy industry into a prolonged turbulence zone.

It is in this tense atmosphere that OPEC+ undertakes a major strategic shift. The production increase decided by the cartel goes beyond simple cyclical adjustment: it marks a political and economic offensive.

In this new game of influence, every barrel becomes a diplomatic lever, every energy alliance, a declaration of sovereignty.

In sum, Russia, Saudi Arabia and their allies want to preserve their central role in a shifting global energy order. For them, it is no longer just about regulating the market, but redefining the rules of power in a deeply multipolar world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Popeyes operator managing more than 130 restaurants files for bankruptcy protection

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

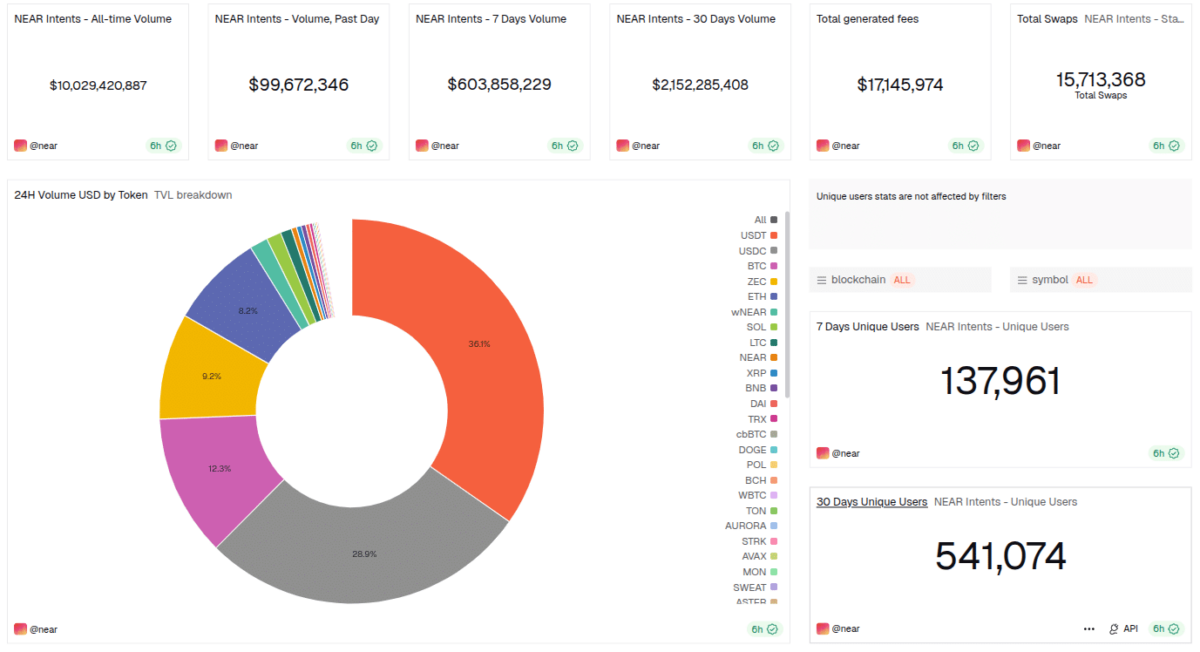

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow