Ethereum ETF Black Monday: Historical Outflows Fail To Impact Price, Here’s Why

Ethereum's price has remained stable despite record ETF outflows. The dominance of long-term holders is keeping Ethereum's price in check, with consolidation expected in the coming days.

Ethereum’s price has seen some volatility in recent days, driven by broader market uncertainty. While August began on a bearish note, Ethereum managed to recover over the weekend.

However, Ethereum’s ETFs faced significant challenges during this period, especially with large outflows on Black Monday.

Ethereum ETF Outflows Peak

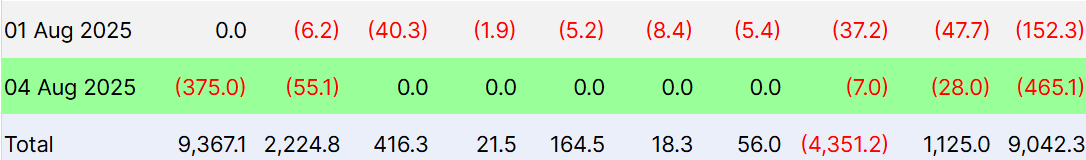

Ethereum ETFs experienced their largest single-day outflows since their inception more than a year ago. The “ETH ETF Black Monday” saw over $465 million in outflows, signaling a negative investor sentiment heading into August. This was compounded by an additional $152 million in outflows on Friday, bringing the total for the month to $617 million.

These outflows are the largest Ethereum ETFs have faced, highlighting a bearish outlook from investors.

It’s clear that investors are cautious, perhaps due to market conditions or uncertainties surrounding global events. However, the pressure caused by these large withdrawals does not appear to have had a significant long-term impact on Ethereum’s price.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum ETF Net Flows. Source:

Ethereum ETF Net Flows. Source:

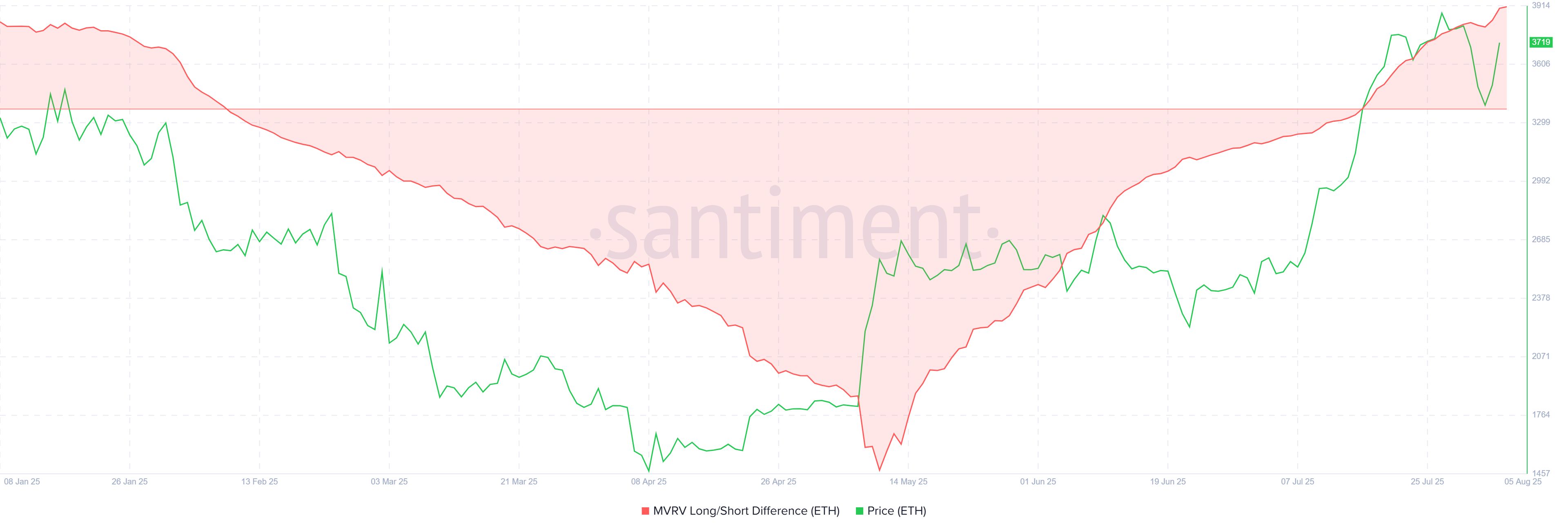

Despite the significant ETF outflows, Ethereum’s macro momentum shows positive indicators. The MVRV Long/Short Difference, which measures the profitability of long-term and short-term holders, is currently at a seven-month high. This suggests that long-term holders (LTHs) dominate Ethereum’s market, benefiting from their accumulated profits.

LTHs typically have a lower selling tendency and higher influence on the price, balancing out the negative effects of ETF outflows. This dominance by LTHs is likely helping to keep Ethereum’s price stable despite investor hesitation.

Ethereum MVRV Long/Short Difference. Source:

Ethereum MVRV Long/Short Difference. Source:

ETH Price To Likely Consolidate

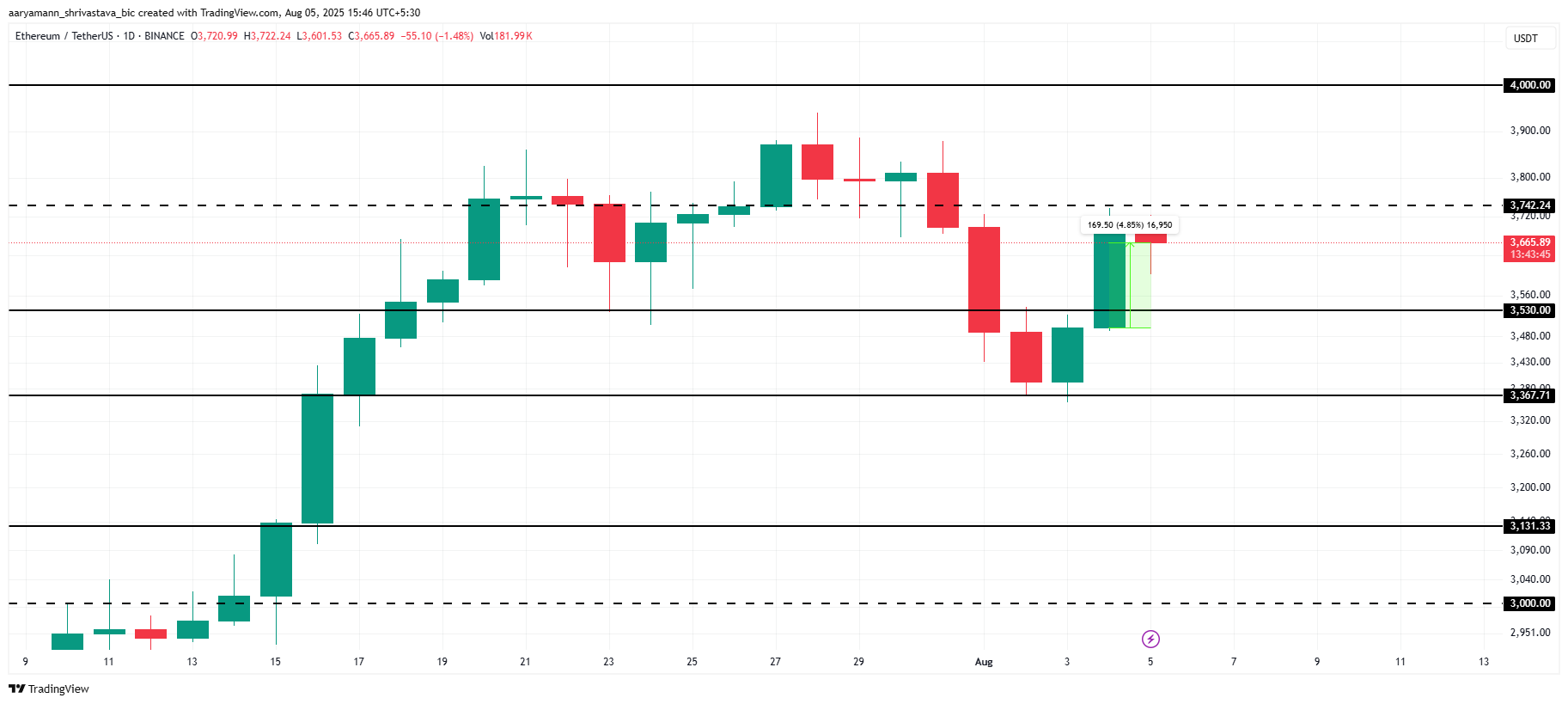

Ethereum’s price has risen by 4.85% over the last 24 hours, trading at $3,665 at the time of writing. Ethereum is currently facing resistance at $3,742, the last barrier before a potential move toward the $4,000 mark.

Given the factors mentioned, Ethereum is likely to hover sideways within the range of $3,742 and $3,530 in the coming days. This consolidation will give the altcoin a chance to find its next direction, whether upward or downward, depending on broader market cues.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

If Ethereum’s price faces continued selling pressure, or if ETF outflows persist, the cryptocurrency could dip below the support level of $3,530 and potentially fall to $3,367. This would invalidate the bullish outlook and suggest a larger market correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?