Dogecoin Price Risks 30% Fall: Can Bulls Break the August Pattern?

Key Insights:

- Dogecoin price prediction shows risk of a 30% drop if key support fails.

- August curse is back; DOGE has dropped in August for 3 straight years.

- Bull-bear index and spot netflows show selling pressure building.

Dogecoin price has been trading sideways for weeks. Over the last 7 days, it has given up 10% of its recent gains, though the 3-month returns are still above 20%.

That said, this range-bound price action has left many traders guessing the next direction. Especially now, because August hasn’t been a lucky month for the DOGE price in the past. Is the August curse returning?

The August Curse Has Hit Dogecoin Price Before

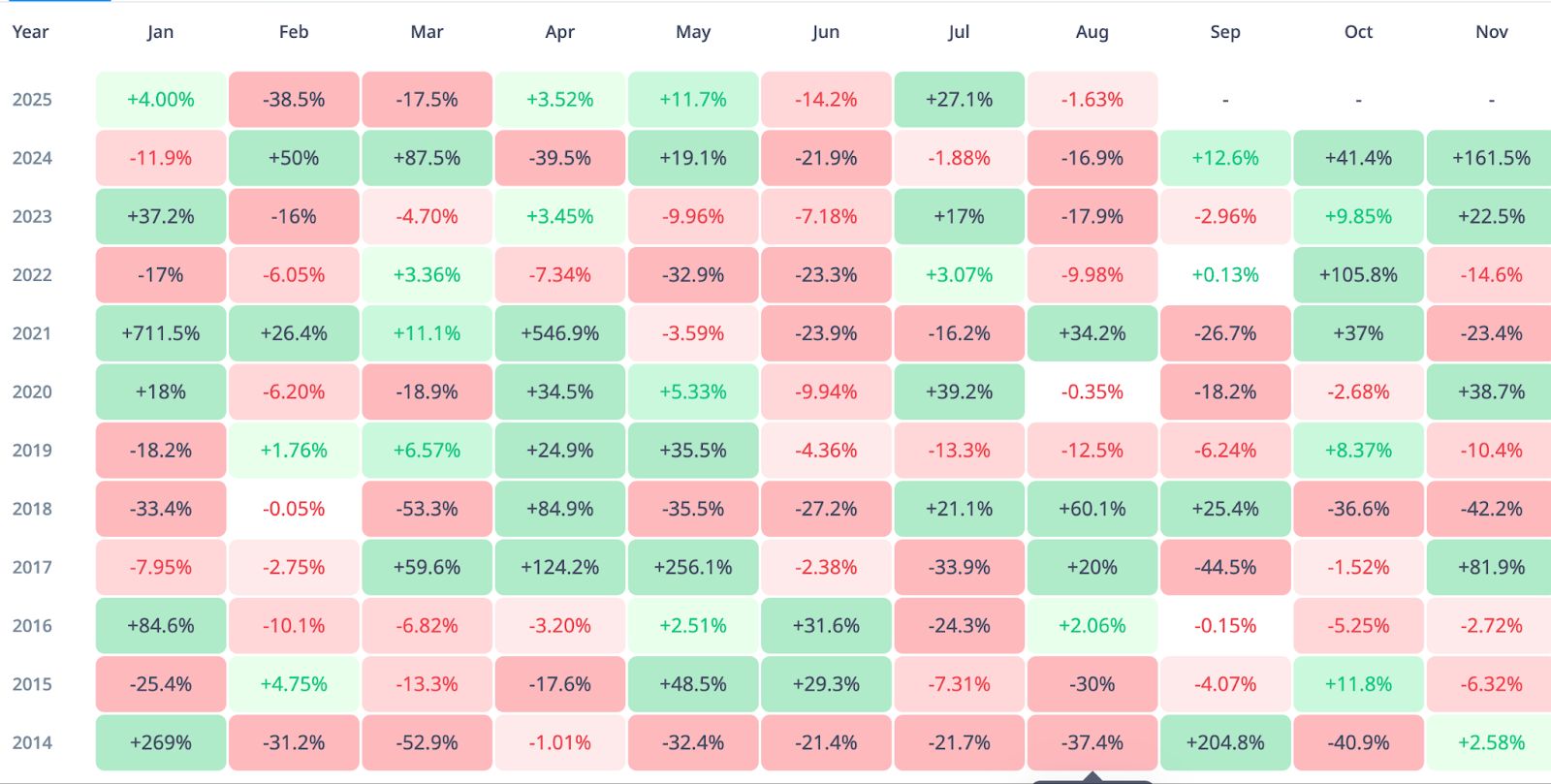

Looking at DOGE’s historical monthly performance, August has been one of the worst months for Dogecoin’s price.

In 2023, DOGE dropped nearly 18%, in 2022 it lost around 10%, and in 2021, during its meme coin prime, it still fell 16.2%.

Even this year, Dogecoin is already down over 1.6% in August. These consistent losses point to what traders are calling the “Dogecoin August Curse.”

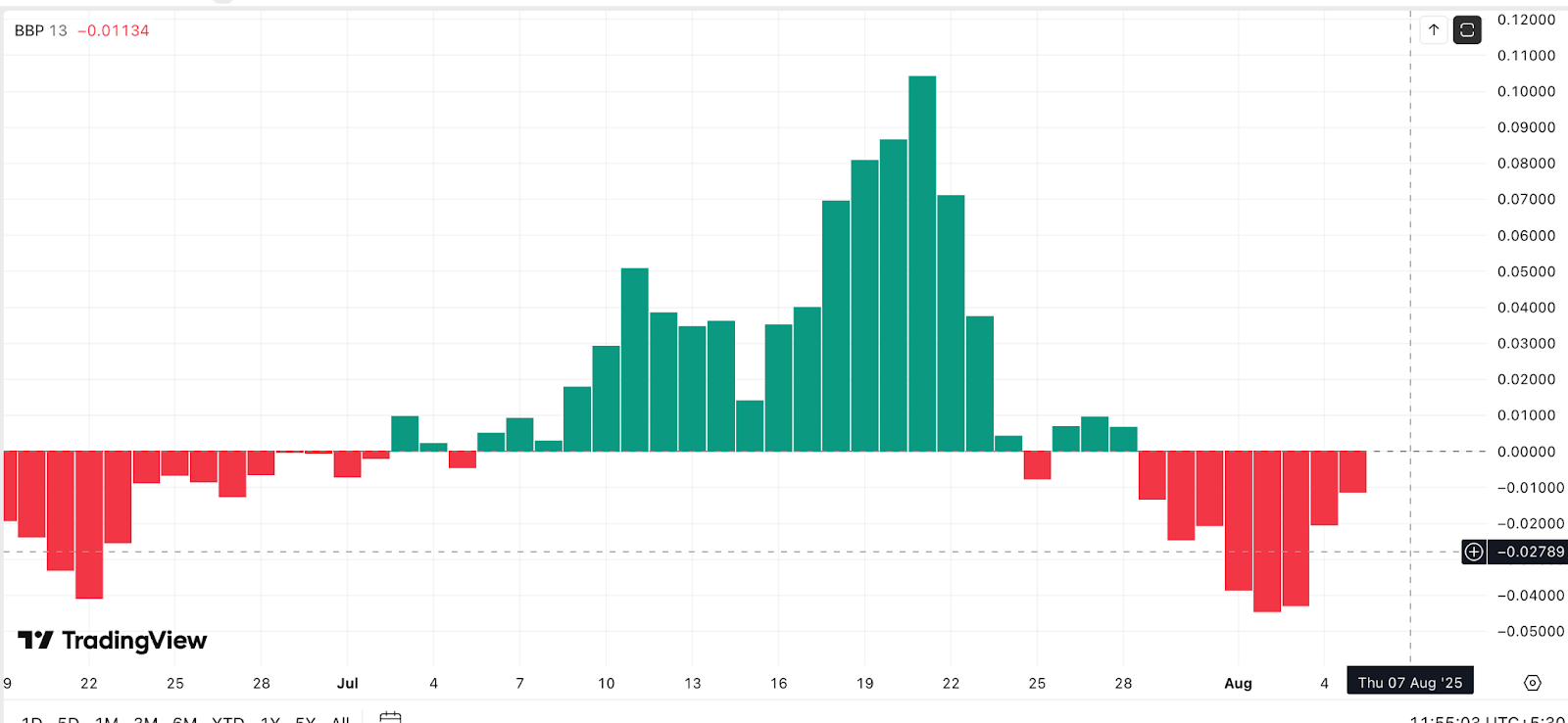

To make things worse, the pressure is still visible in sentiment data. The bull-bear power index, which shows who is dominating between buyers and sellers, continues to remain in the red.

This means bearish pressure is still outweighing the bulls, which is not helping the case for a quick recovery in Dogecoin price.

Short Bias and Exchange Flows Add to Bearish Signs

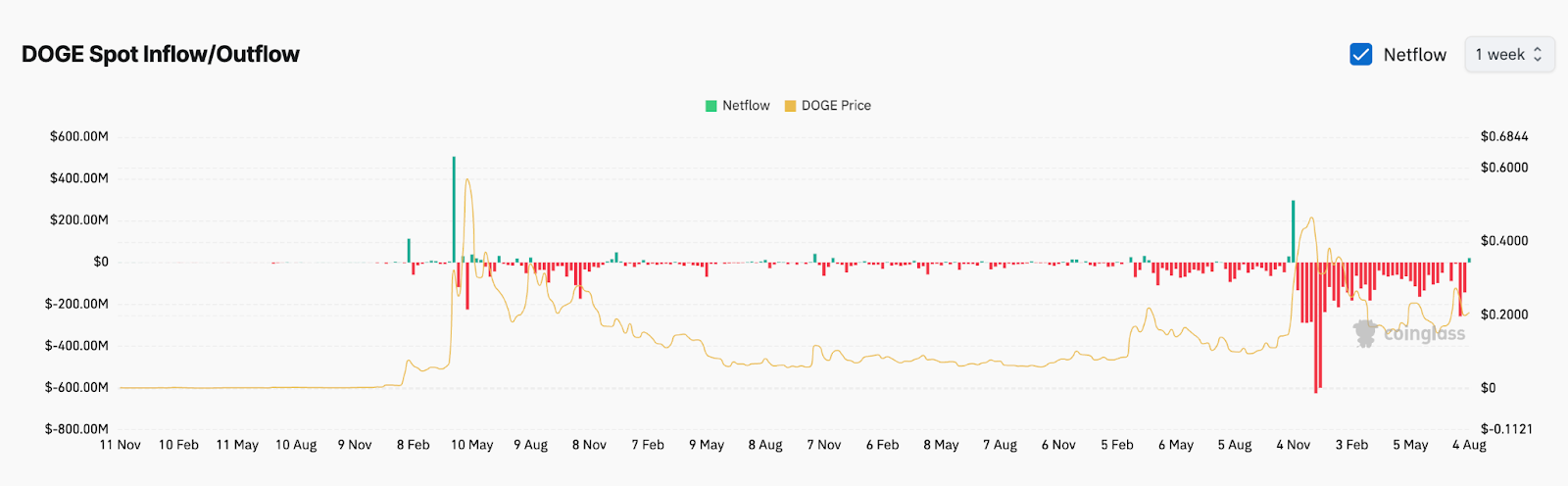

On-chain data from Coinglass shows that DOGE spot flows have turned green again. This means more DOGE is moving to exchanges, often a sign of incoming sell pressure. The netflows just turned positive after a brief red period.

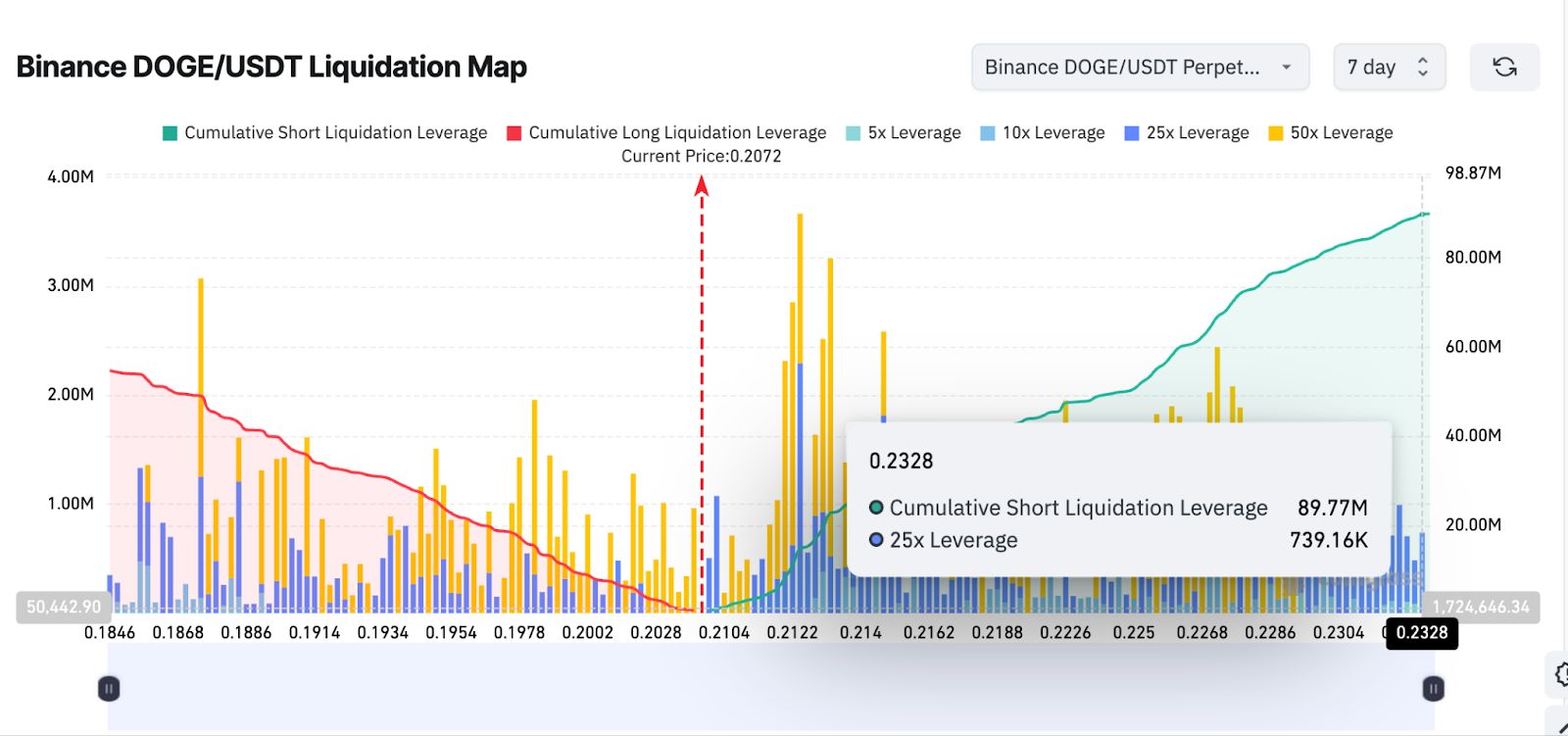

On top of that, liquidation data from Binance shows a large cluster of short positions around the $0.23 to $0.24 level. These shorts haven’t been liquidated yet, and Dogecoin price is still far below that level, sitting around $0.207. This tells us that the market is still betting against Dogecoin, and there’s not enough upside pressure to liquidate those bears.

So, the setup is clearly biased toward the downside, unless buyers step in with strength. And if the price breaks the key $0.18 level, the existing long positions (even if they are few) would liquidate. That would push the Dogecoin price lower, as part of the liquidation cascade.

Key Levels To Watch for Dogecoin Price

Looking at the chart, Dogecoin price recently broke below the key support at $0.222, which lined up with the 0.236 Fibonacci level. It’s now hovering just above $0.207, which is another short-term trendline support.

The problem is, this level has been tested multiple times, and each bounce is getting weaker. If DOGE breaks below $0.188, the next major support lies around $0.14. That would mean a 30% correction from current levels, which lines up with the kind of drops we’ve seen in past Augusts.

Yes, there is a real risk of a drop toward $0.14, especially if the August pattern continues and the Dogecoin price fails to bounce strongly this week.

Breakout Retest, or Breakdown? Meme Coin Narratives Still Matter

On the other side of the trade, some traders believe the retest of a larger breakout trendline has already happened. They point to the long-term downtrend break followed by a clean retest; technically, a bullish pattern. This view is supported by tweets from traders like GalaxyBTC, who think DOGE is getting ready to move.

There’s also a growing sentiment on Twitter that older meme coins like DOGE may get more attention if newer launches underperform. As one trader said, many pros have shifted to mid/high-cap meme tokens and aren’t touching 2025 launches anymore. That could bring fresh attention back to Dogecoin.

But all of this comes down to one thing: the bulls need to step in fast.

If DOGE closes a daily candle below $0.188, it could trigger panic and validate the 30% drop scenario. Until then, the fight continues between short-term bounces and long-term bearish patterns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SignalPlus Macro Analysis Special Edition: Is Work Resuming Soon?

Macro assets faced a tough week, with the Nasdaq Index experiencing its worst weekly decline since the "Liberation Day" in April, mainly due to concerns over an artificial intelligence bubble...

487 new BTC for Strategy, Saylor's appetite does not wane

XRP Price Prediction: Is $6 the Next Big Target?